Fastenal Is At A Critical Turning Point

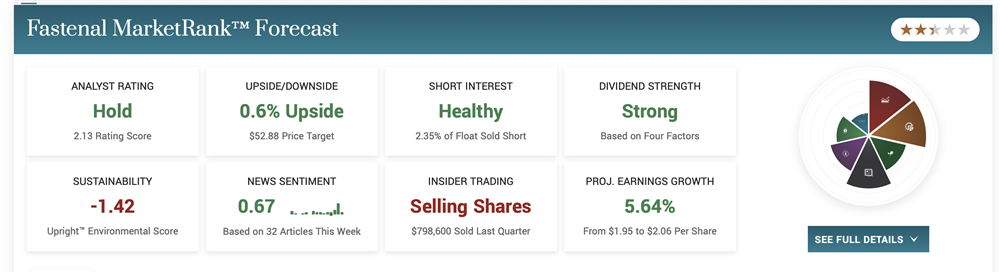

Fastenal reported a solid quarter but did not inspire the market to move higher. The dividend is safe, but valuation may cap gains in 2023.

This story originally appeared on MarketBeat

Fastenal’s (NASDAQ: FAST) Q1 report is lackluster, but investors should take the report’s details to heart. The company made several mentions of the supply chain that included words like stable, stabilizing and stability which we have not heard in quite some time. What this means for the company is easing cost pressures, although there are still headwinds to overcome, and improving margin.

The takeaway for investors is that Fastenal’s diversified product mix and multi-channel sales network are sustaining growth, margins are improving, and cash flow is robust. That means the 2.66% dividend is safe, and the distribution is expected to grow.

“The combination of good demand, more stable cost trends, and our long supply chain for imported fasteners and certain non-fastener products produced stable price levels for our products,” said the company in the press release.

The only thing that may hold this stock back in 2023 is the valuation. Trading at 26X its earnings, it is a highly-valued stock among S&P 500 (NYSEARCA: SPY) members. The offsetting factors include growth; the company is still growing earnings at a high-single-digit pace, and the yield, which is a full 100 basis points better than the S&P 500 average.

Fastenal Pulls Back To Support On Tepid Results

Fastenal reported a solid quarter, but the results are mixed regarding the analysts’ expectations. The $1.86 billion in revenue is up 9.1% compared to last year, but it missed the consensus by 50 basis points. The gain was driven by a 9.1% increase in average daily sales, supported by an increase in unit volume and 290 to 320 basis points of price increases. Internally, growth was driven by industrial customers and was offset by a decline in construction demand. Fasteners grew by 7% on a segment basement, Safety grew by 5.7%, and Other grew by 12.4%.

The margin news is also mixed. The company’s gross profit increased by 7.2% due to a 90 basis point decline in gross margin. The SG&A expense also increased about 5%, but that gain lagged revenue growth and left the margin down 90 bps to more than offset the gross margin weakness. That left operating income up 9.8%, EBIT up 9.6%, and GAAP EPS up 10.4% with share repurchases. The company does not give formal guidance, but the outlook is stable.

“The combination of good demand, more stable cost trends, and our long supply chain for imported fasteners and certain non-fastener products produced stable price levels for our products.”

Fastenal added 89 new Onsite locations during the quarter bringing the YOY gain to 16%. That is compounded by a 10.8% increase in FastStock signings and a 10.9% increase in FastStock installations. Daily sales in those units at up 20% and 19.3%, respectively and are expected to continue leading the company’s growth in 2023.

The Technical Outlook: Fastenal Is At Critical Support

The price action in Fastenal pulled back to the critical $51 level in premarket trading. This level is just below the 150-day moving average and is the mid-point of the current trading range. If the market can not find support at this level, it could drift to the bottom of the range near $45. If it does confirm support at this level, upward bias is expected, but range-bound conditions may persist until there is more clarity in the broad economy.

Fastenal’s (NASDAQ: FAST) Q1 report is lackluster, but investors should take the report’s details to heart. The company made several mentions of the supply chain that included words like stable, stabilizing and stability which we have not heard in quite some time. What this means for the company is easing cost pressures, although there are still headwinds to overcome, and improving margin.

The takeaway for investors is that Fastenal’s diversified product mix and multi-channel sales network are sustaining growth, margins are improving, and cash flow is robust. That means the 2.66% dividend is safe, and the distribution is expected to grow.