Hormel Foods is More than Just Spam

Pre-packaged global food and snacks brand Hormel Foods (NYSE: HRL) has seen its top and bottom lines surge from the pandemic as consumer stockpiled

This story originally appeared on MarketBeat

Pre-packaged global food and snacks brand Hormel Foods (NYSE: HRL) has seen its top and bottom lines surge from the pandemic as consumers stockpiled endless amounts of its products, especially Spam. Spam has earned a not-so-flattering meaning as in sending out unsolicited and unwanted e-mails or digital communications in bulk. People may hate electronic spam, but they sure love the real Spam. This is evidenced by over seven straight years of record sales growth, obviously accelerated by the COVID-19 pandemic. Hormel has evolved from a one-trick pony into a global food and snack brand beyond just Spam. It’s diverse portfolio of popular brands also includes Skippy, Jennie-O, Dinty Moore, Chi-Chi’s, Corn Nuts, Lloyd’s Barbecue Co., Wholly Guacamole, Columbus Craft Meats and recently Planters. It competes with portfolios owned by brands like Conagra (NYSE: CAG), Campbell (NYSE: CPB), J.M. Smucker (NYSE: SJM), and Kraft Heinz (NYSE: KHC). Hormel’s brands hold the #1 and #2 market share spots in over 40 categories sold in over 80 countries. While globalization has helped increase its reach and scale, it has also caused pain from inflationary pressures, logistics costs and a strong U.S. dollar. These headwinds have caused the Company to lower its earnings estimates, but Hormel is seeing some stabilization emerge.

History of the Mystery Meat

Spam was created by George Hormel and made its debut as a cheap, portable, and non-perishable canned cooked pork meal sent to soldiers during World War 2. In fact, over 100 million pounds of Spam was shipped to feed U.S. soldiers during the war by Uncle Spam. It was a staple for soldiers (often against their wishes) and consumers throughout the Great Depression. The name Spam was concocted by combining the words “spice” and “ham” and was marketed as a ready-to-eat food to complement any meal from breakfast Spam and eggs and Spam and pancakes to Spam-wiches as it was dubbed the “miracle meat” in early ad campaigns. The 85-year old canned meat is considered essential survival food with its “indefinite” shelf life. Although, there is an “enjoy by” date on each can, it’s freshness is best when consumed within two to seven years. Spam consists of pork shoulder and chopped ham as well as potato starch to bind everything together, water, sodium nitrate as a preservative, and sugar canned at high heat.

The Contagion

American soldiers introduced Spam to Asian countries during wars and rebuilding efforts. Spam represented a piece of American culture and became phenomenally popular in Asian nations like South Korea, Guam, the Philippines, and Japan. It’s most popular in Hawaii where its per person consumption is the highest in the states. In Hawaii, Spam is considered the “Hawaiian Steak” as Hawaiians eat an average of five cans per year. Guam citizens consume an average of a whopping 16 cans be year making it the Spam capital country of the world. It’s limited edition pumpkin spice Spam sold for over $100 per can on eBay (NASDAQ: EBAY) as recently as September 2022. It’s attracted a new generation of consumer with younger “foodies”. There is a Spam museum in Austin, Minnesota that received over 100,000 tourists annually. Spam has become trendy as Asian chefs have reintroduced it as an ingredient in culinary creations and menu items. Spam is back and more popular than ever.

Headwinds Make Impact

On Sept. 1, 2022, Hormel released its fiscal third-quarter 2022 results for the quarter ending July 2022. The Company reported an adjusted earnings-per-share (EPS) profit of $0.40 excluding non-recurring items missing consensus analyst estimates for a $0.41 by (-$0.01). Revenues grew by 6% year-over-year (YOY) to $3.03 billion beating analyst estimates for $3 billion. Hormel CEO Jim Snee commented, “We delivered another quarter of record sales and double-digit operating income growth. In the current environment, delivering seven straight quarters of record sales and four consecutive quarters of earnings growth is a notable achievement and speaks to the effectiveness of our strategy and the importance of our brands in uncertain times.”

Downside Guidance

Hormel issued downside guidance for fiscal full-year 2022 EPS of $1.78 to $1.85 versus $1.88 consensus analyst estimates. Fiscal full-year 2022 revenues are expected between $12.2 billion to $12.8 billion versus $12.41 billion analyst estimates. CEO Snee added, “We expect elevated cost inflation to persist, primarily related to operations, logistics, and raw material inputs. As a result, we are revising our full-year earnings guidance range. We view the majority of the escalated cost pressures we are currently absorbing as transient and likely to subside over the coming quarters.”

Here’s What the Charts Say

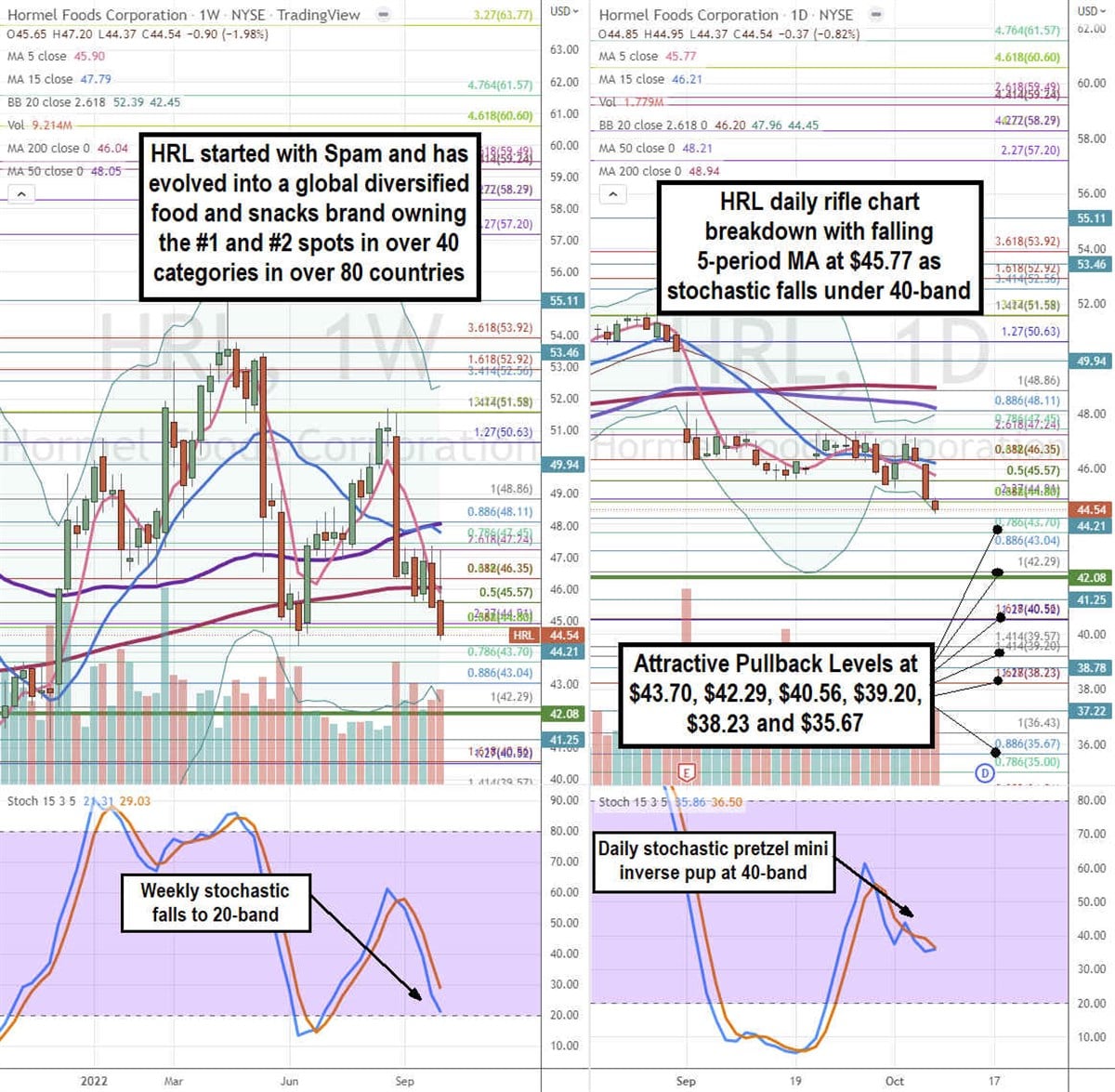

Using the rifle charts on the weekly and daily time frames provides a precise view of the landscape for HRL stock. The weekly rifle chart peaked and reversed off the $51.58 Fibonacci (fib) level. The weekly downtrend is led by the falling 5-period moving average (MA) at $45.90 followed by the 15-period MA at $47.79. Shares collapsed through the weekly 50-period MA at $48.05 and the weekly 200-period MA at $46.04. The weekly lower Bollinger Bands (BBs) sit at $42.45 as the weekly stochastic falls to the 20-band. The weekly market structure low (MSL) buy triggered on the breakout through $42.08. The daily rifle chart triggered another breakdown led by the falling 5-period MA at $46.21 followed by the 15-period MA at $45.77. The daily lower BBs sit at $44.45 as the stochastic formed a pretzel mini inverse pup at the 40-band. The daily BBs are expanding after a compression period which bodes more downside to come. Attractive pullback levels sit at the $43.70 fib, $42.29 fib, $40.56 fib, $39.20 fib, $38.23 fib, and the $35.67 fib level.

Pre-packaged global food and snacks brand Hormel Foods (NYSE: HRL) has seen its top and bottom lines surge from the pandemic as consumers stockpiled endless amounts of its products, especially Spam. Spam has earned a not-so-flattering meaning as in sending out unsolicited and unwanted e-mails or digital communications in bulk. People may hate electronic spam, but they sure love the real Spam. This is evidenced by over seven straight years of record sales growth, obviously accelerated by the COVID-19 pandemic. Hormel has evolved from a one-trick pony into a global food and snack brand beyond just Spam. It’s diverse portfolio of popular brands also includes Skippy, Jennie-O, Dinty Moore, Chi-Chi’s, Corn Nuts, Lloyd’s Barbecue Co., Wholly Guacamole, Columbus Craft Meats and recently Planters. It competes with portfolios owned by brands like Conagra (NYSE: CAG), Campbell (NYSE: CPB), J.M. Smucker (NYSE: SJM), and Kraft Heinz (NYSE: KHC). Hormel’s brands hold the #1 and #2 market share spots in over 40 categories sold in over 80 countries. While globalization has helped increase its reach and scale, it has also caused pain from inflationary pressures, logistics costs and a strong U.S. dollar. These headwinds have caused the Company to lower its earnings estimates, but Hormel is seeing some stabilization emerge.

History of the Mystery Meat

Spam was created by George Hormel and made its debut as a cheap, portable, and non-perishable canned cooked pork meal sent to soldiers during World War 2. In fact, over 100 million pounds of Spam was shipped to feed U.S. soldiers during the war by Uncle Spam. It was a staple for soldiers (often against their wishes) and consumers throughout the Great Depression. The name Spam was concocted by combining the words “spice” and “ham” and was marketed as a ready-to-eat food to complement any meal from breakfast Spam and eggs and Spam and pancakes to Spam-wiches as it was dubbed the “miracle meat” in early ad campaigns. The 85-year old canned meat is considered essential survival food with its “indefinite” shelf life. Although, there is an “enjoy by” date on each can, it’s freshness is best when consumed within two to seven years. Spam consists of pork shoulder and chopped ham as well as potato starch to bind everything together, water, sodium nitrate as a preservative, and sugar canned at high heat.

The Contagion

American soldiers introduced Spam to Asian countries during wars and rebuilding efforts. Spam represented a piece of American culture and became phenomenally popular in Asian nations like South Korea, Guam, the Philippines, and Japan. It’s most popular in Hawaii where its per person consumption is the highest in the states. In Hawaii, Spam is considered the “Hawaiian Steak” as Hawaiians eat an average of five cans per year. Guam citizens consume an average of a whopping 16 cans be year making it the Spam capital country of the world. It’s limited edition pumpkin spice Spam sold for over $100 per can on eBay (NASDAQ: EBAY) as recently as September 2022. It’s attracted a new generation of consumer with younger “foodies”. There is a Spam museum in Austin, Minnesota that received over 100,000 tourists annually. Spam has become trendy as Asian chefs have reintroduced it as an ingredient in culinary creations and menu items. Spam is back and more popular than ever.