How Lower Volatility and Oil Production Cuts Could Impact the Market… I'm pleased with how the portfolio has shaped up over the last couple weeks. Of our 8 current positions, 6 are winners, one is breaking even, and one is a...

By Jay Soloff

This story originally appeared on StockNews

I'm pleased with how the portfolio has shaped up over the last couple weeks. Of our 8 current positions, 6 are winners, one is breaking even, and one is a small loser. Several of the stocks have been in an uptrend as well. For the time being, we're going to (likely) focus on smaller changes such as trimming or adding to positions. We're at about 70% allocation of our cash, which I think is reasonable in this environment. Things can change in a hurry of course, but I'm content with the mix of stocks we have in the portfolio at this time. Let's take a look at what's going on in the S&P 500 (SPY) week. Read on for more….

(Please enjoy this updated version of my weekly commentary originally published June 8th in the POWR Stocks Under $10 newsletter).

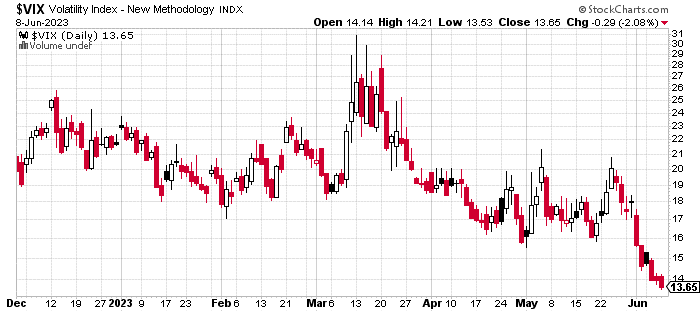

Market volatility has really come crashing down since the debt ceiling scare ended with hardly a whimper. We're seemingly experiencing the summer trading doldrums, where not much happens in the stock market from a macro perspective.

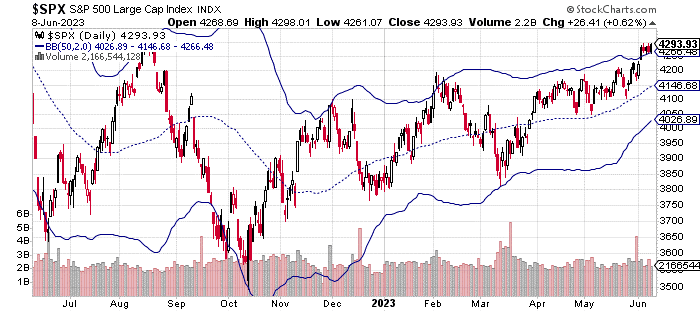

You can see in the chart above, the SPX (S&P 500 index) has breached the two-standard deviation upper barrier.

That doesn't necessarily mean stocks are going to sell off as the bands are quite narrow due to a lower volatility environment. However, mean reversion is a definitely possibility in the coming days (just due to the law of averages).

Whether the market remains in this low volatility environment will mostly be determined by what the Fed says and does at the June and July FOMC meetings.

We have the June meeting coming next week and then it won't be a shock to see a whole lot of nothing in the markets until after Independence Day.

The market continues to predict a pause in rate hikes for June. The futures market shows a 72.5% chance of the Fed doing nothing to rates next week.

Economic data has been mixed to the point where the Fed can likely justify not increasing rates (directly). Of course, they can accomplish some of their goals by jawboning (e.g. talking down the market).

In July, futures are showing a roughly 65% chance of a rate increase. That tracks with the mainstream narrative.

It has become apparent that the Fed isn't done raising rates. However, at this stage, they aren't in as much of a hurry to hike.

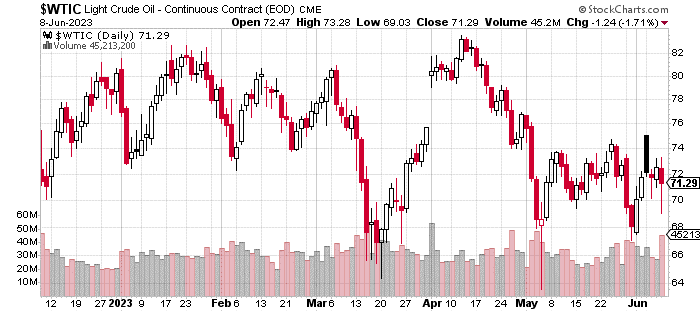

Moving on to oil, West Texas crude has been a bit volatile lately. Saudi Arabia announced production cuts, and the price of crude briefly spiked. However, it's come back down to around $70 per barrel.

Keep an eye on oil as it could be a leading indicator for the economy (and thus, stocks). A price too high or too low is generally not good for stocks (for different reasons). However, where we are now in terms of price is pretty much a non-factor.

As mentioned earlier, volatility, as seen in the VIX chart below, has come crashing down in recent days. The price is now firmly below 15, which is often considered a low-volatility regime.

While we could see a short-term spike based on the news cycle or the Fed, I expect volatility to remain relatively low.

The summer months tend to be slower in terms of realized volatility (the actual movement of stocks). Thus, implied volatility (forward looking) tends to come down as well. That's at least part of why the VIX is so low right now.

Let's take a look at the portfolio.

What To Do Next?

The above commentary will help you appreciate where the market is going. But if you want to know the best stocks to buy now, then please check out my new special report:

What gives these stocks the right stuff to become big winners, even in this challenging stock market?

First, because they are all low priced companies with the most upside potential in today's volatile markets.

But even more important, is that they are all top Buy rated stocks according to our coveted POWR Ratings system and they excel in key areas of growth, sentiment and momentum.

Click below now to see these 3 exciting stocks which could double or more in the year ahead.

All the Best!

Jay Soloff

Chief Growth Strategist, StockNews

Editor, POWR Stocks Under $10 Newsletter

SPY shares rose $0.19 (+0.04%) in after-hours trading Friday. Year-to-date, SPY has gained 12.84%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Jay Soloff

Jay is the lead Options Portfolio Manager at Investors Alley. He is the editor of Options Floor Trader PRO, an investment advisory bringing you professional options trading strategies. Jay was formerly a professional options market maker on the floor of the CBOE and has been trading options for over two decades.

The post How Lower Volatility and Oil Production Cuts Could Impact the Market… appeared first on StockNews.com