Is the New Bull Market at Hand?

There are signs that the S&P 500 (SPY) may finally be ready to break out above 4,200 and claim the start of the new bull market. Unfortunately, the bears have…

This story originally appeared on StockNews

There are signs that the S&P 500 (SPY) may finally be ready to break out above 4,200 and claim the start of the new bull market. Unfortunately, the bears have reason to believe that the worst is not yet behind us with early May economic reports looming large in investor decision making. Get Steve Reitmeister’s take with trading plan and top picks in the commentary below.

4,200 for the S&P 500 (SPY) is a vital level for the market. Above it lies a new bull market. Below it the bears can still claim victory.

Indeed, stocks were running up to that battle line once again this week.

Why? And what does that mean for the final bull/bear outcome for the market?

That will be the focus of this week’s commentary.

Market Commentary

On Thursday we found out that Q1 GDP was much lower than expected at only +1.1% growth when 2.3% was expected. The primary reason was that things slowed down considerably in March.

On top of that the Fed’s preferred inflation measure, Personal Consumption Expenditures (PCE), was higher than feared at +4.2% versus the previous reading of +3.7%. This should obviously have investors worried about the Fed’s “higher rates for longer” stance as we roll into their next announcement on Wednesday 5/3.

In fact, the combination of slower growth and higher inflation on Thursday had more commentators talking about Stagflation. That was an economic disease in the 1970’s that was part of a long secular bear market that did not really take off until 1982 when inflation started to come down and the economy got healthy once again.

Sounds like this would all equate to another Risk Off day. NOPE…think again!

The result was a shocking +2% rally on Thursday with tech leading the way thanks to the recent earnings success for Microsoft and Meta (Facebook). And then nearly another 1% was tacked on Friday to close at the highest level since early February.

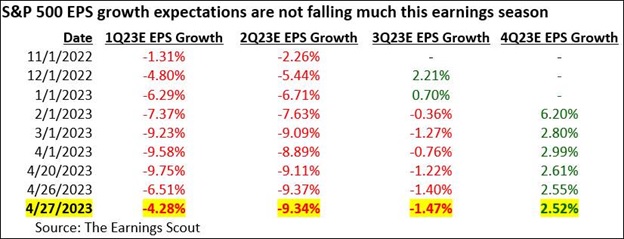

Gladly it is not just tech showing promise this earnings season.As the graphic below shows that just a week back on 4/20 Wall Street expected Q1 earnings to be down -9.75% year over year. And yet now with half of the companies in S&P 500 reporting that has been more than halved to only -4.28%.

Before you start getting too bullish on this positive earnings trend, unfortunately the bad news shows up in the next 2 columns. That being where estimates are getting slightly worse for the next 2 quarters. This coincides with the GDP report which shows that softness started end of Q1 and may be accelerating.

That is why estimates are still poor and why it may not necessarily be time to celebrate the end of the bear market. So at this stage the impetus from earnings season may have a touch more upside up to the line at 4,200.

To get a decided bullish break above 4,200 or to retreat back into bearish territory is awaiting the next round of catalysts. Like some of the key economic reports on the docket for next week:

5/1 ISM Manufacturing

5/3 ISM Services, Fed Rate Decision

5/5 Government Employment Situation

Note that the Chicago PMI report from Friday is considered the best leading indicator of where ISM Manufacturing will land. In that case it was still in contraction territory at 48.6. However, on the bright side that is the highest reading since September 2022.

So directionally it could be read that things are improving. We’ll know if that is also the case for ISM Manufacturing on Monday.

The point is that we are coming up to a moment of truth. Do bulls have the necessary fuel to break above 4,200 and claim victory? Or does the threat of recession still loom large enough to stay under that key level?

It is possible that we have our answer by the end of next week given the 3 key reports noted above.

Unfortunately, we may just have enough information to stay confused and in a limbo under 4,200 a while longer.

The trading plan remains balanced near 50% invested. If break bullish, then keeping adding attractive Risk On positions to get up closer to 100% invested.

If break bearish, then reduce amount invested with a very conservative mix of Risk Off stocks.

So let the chips fall where they may and we will trade accordingly.

What To Do Next?

Discover my balanced portfolio approach for uncertain times. The same approach that has beaten the S&P 500 by a wide margin so far in April.

This strategy was constructed based upon over 40 years of investing experience to appreciate the unique nature of the current market environment.

Right now, it is neither bullish or bearish. Rather it is confused…volatile…uncertain.

Yet, even in this unattractive setting we can still chart a course to outperformance. Just click the link below to start getting on the right side of the action:

Steve Reitmeister’s Trading Plan & Top Picks >

Wishing you a world of investment success!

Steve Reitmeister…but everyone calls me Reity (pronounced “Righty”)

CEO, StockNews.com and Editor, Reitmeister Total Return

SPY shares fell $0.20 (-0.05%) in after-hours trading Friday. Year-to-date, SPY has gained 9.17%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Steve Reitmeister

Steve is better known to the StockNews audience as “Reity”. Not only is he the CEO of the firm, but he also shares his 40 years of investment experience in the Reitmeister Total Return portfolio. Learn more about Reity’s background, along with links to his most recent articles and stock picks.

The post Is the New Bull Market at Hand? appeared first on StockNews.com

There are signs that the S&P 500 (SPY) may finally be ready to break out above 4,200 and claim the start of the new bull market. Unfortunately, the bears have reason to believe that the worst is not yet behind us with early May economic reports looming large in investor decision making. Get Steve Reitmeister’s take with trading plan and top picks in the commentary below.

4,200 for the S&P 500 (SPY) is a vital level for the market. Above it lies a new bull market. Below it the bears can still claim victory.

Indeed, stocks were running up to that battle line once again this week.