It’s Rally-On! For PVH Corp. But How High Can It Go?

PVH Corp. reported a stunning quarter, with analysts raising their targets and driving the stock upward. The question is how high can it go?

This story originally appeared on MarketBeat

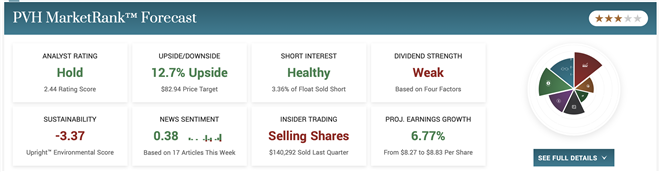

PVH Corp. (NYSE: PVH) stock is on fire after releasing a solid Q4 report with upbeat guidance for 2023. The takeaway from the report is the combination of brand, direct-to-consumer, and a lean into digital channels is a recipe for success. The only downside is that PVH Corp is not what you would call a high-yield stock, but other qualities make it an attractive play. The guidance points to margin improvement and ongoing share repurchases that could top $200 million. If so, that’s a return of 4.2% relative to the pre-release market cap, and the analysts are noting.

Analyst Christopher Nardone of Bank of America (NYSE: BAC) called PVH Corp. a standout in the apparel industry. He reiterated the firm’s Buy rating and gave a price target of $100 compared to the consensus of $83. That figure implied a 13% upside going into the report, but the premarket action has the stock at Fair Value relative to it now. The upshot is the most recent targets, including Bank of America, are above the consensus and have this stock breaking to new highs.

“We think continued momentum in international markets (particularly Europe) and improved visibility into further margin expansion opportunities will help drive higher estimate revisions and a rerating in the stock’s multiple,” wrote Nardone.

PVH Corp. Rockets Higher On Margin Gains

PVH Corp had a great quarter, with results outperforming guidance and the Marketbeat.com consensus figures at all levels. The company’s revenue of $2.49 billion is up 2.5% YOY compared to an expectation for decline and beat the consensus by 55o basis points. The strength was driven by strength in both core brands, Tommy Hilfiger and Calvin Klein, with DTC sales up 4% and wholesale flat on an as-reported basis. On an FX-neutral basis, sales are up 10% in DTC channels and 6% wholesale, with Digital down only 2% compared to last year’s robust increase.

“We are well positioned to achieve double-digit EPS growth in 2023 and have a multi-year opportunity ahead of us to drive meaningful top and bottom-line growth … and we are doubling down on the PVH+ Plan growth drivers and focusing on what is within our control to drive sustainable and profitable growth, generate strong cash flows, and deliver attractive returns for our shareholders,” said Zac Coughlin, Chief Financial Officer.

The margin contracted versus last year, but gross and operating margins are well ahead of expectation. The adjusted EPS came in at $2.38, beating the consensus by 4200 basis points and with favorable margin guidance for the year. The company expects revenue to increase by 3% to 4% in F2023 with an operating margin near 10%. That’s about 140 basis points better than Q4 and is expected to drive earnings of $10.00 compared to the $9.20 consensus figure.

The Bias In PVH Corp. Shares Is Upward

Institutions are another force that may help drive this stock higher. The institutional activity has been mixed over the past year but bullish on balance, with net holdings rising. Institutions hold about 94% of the stock, so it is a tightly held issue capable of multiple expansion.

The chart shows PVH stock moving up within a long-term trading range. The post-release action has the stock up more than 10% and confirms support at the 150-day moving average. The caveat is that price action appears to be capped by near-term resistance consistent with the analysts’ consensus target. This stock may remain range bound this year if this level cannot be overcome.

PVH Corp. (NYSE: PVH) stock is on fire after releasing a solid Q4 report with upbeat guidance for 2023. The takeaway from the report is the combination of brand, direct-to-consumer, and a lean into digital channels is a recipe for success. The only downside is that PVH Corp is not what you would call a high-yield stock, but other qualities make it an attractive play. The guidance points to margin improvement and ongoing share repurchases that could top $200 million. If so, that’s a return of 4.2% relative to the pre-release market cap, and the analysts are noting.

Analyst Christopher Nardone of Bank of America (NYSE: BAC) called PVH Corp. a standout in the apparel industry. He reiterated the firm’s Buy rating and gave a price target of $100 compared to the consensus of $83. That figure implied a 13% upside going into the report, but the premarket action has the stock at Fair Value relative to it now. The upshot is the most recent targets, including Bank of America, are above the consensus and have this stock breaking to new highs.