NVIDIA (NVDA): Is This Chip Stock a Worthy Buy?

Although the shares of leading chip maker NVIDIA (NVDA) have been soaring, its deteriorating financials could indicate trouble ahead. Is the chip stock a worthy buy? Let’s analyze its financial…

This story originally appeared on StockNews

Although the shares of leading chip maker NVIDIA (NVDA) have been soaring, its deteriorating financials could indicate trouble ahead. Is the chip stock a worthy buy? Let’s analyze its financial metrics to know more.

While prominent chip maker NVIDIA Corporation’s (NVDA) shares have seen a significant gain this year mainly due to the AI boom, the company reported disappointing results for the fiscal 2024 first quarter, which raises concerns about the company’s near future growth prospects.

In addition, considering the anticipated macroeconomic difficulties including supply chain disruptions in the semiconductor industry, high borrowing costs, and decreased consumer spending due to inflation and recession, it would be prudent to wait for a better opportunity to invest in this stock.

NVDA’s fiscal first-quarter financial report paints a worrisome picture. Its revenue declined 13.2% year-over-year to $7.19 billion. Its gross profit decreased 14.4% from the previous-year quarter to $4.65 billion.

While its non-GAAP operating expenses rose 8.8% year-over-year to $1.75 billion, non-GAAP operating income declined 22.8% year-over-year to $3.05 billion. The company’s non-GAAP net income amounted to $2.71 billion and $1.09 per share, falling 21.2% and 19.9% year-over-year.

Now, let’s look at the trends of some of its key financial metrics to better understand the situation.

Analyzing NVIDIA’s Financial Growth: Net Income, Revenue, P/S Ratio, and Asset Turnover Ratio (2018-2023)

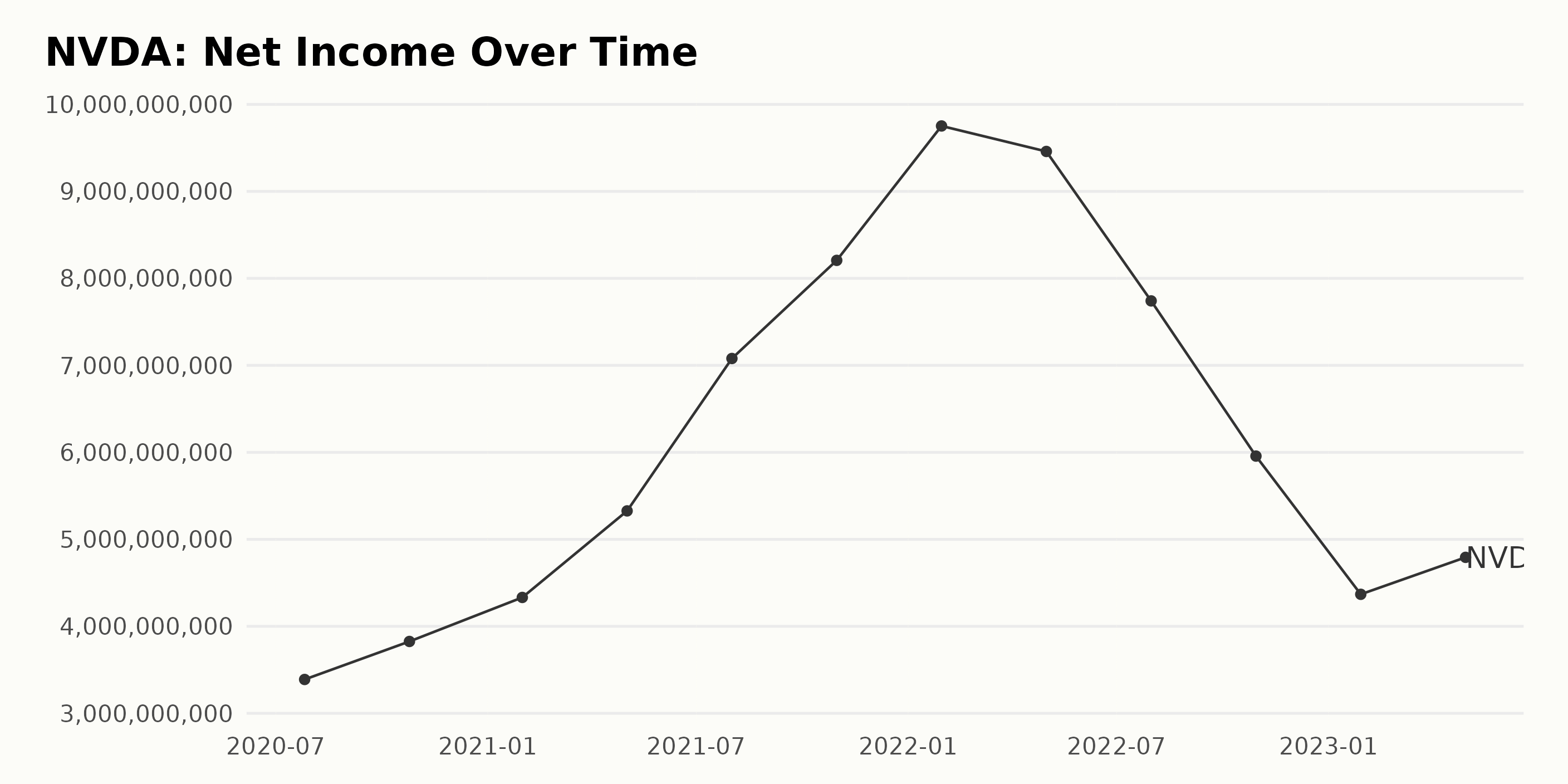

The trend and fluctuations in NVDA’s trailing-12-month net income can be summarized as follows: –

From January 2018 to October 2018, there was a consistent growth in net income, with an increase from $3.05 billion to $4.69 billion. A decline in net income was observed from January 2019 ($4.14 billion) to October 2019 ($2.41 billion). The net income started to recover in January 2020 ($2.80 billion) and continued to increase until May 2021 ($5.33 billion).

Moreover, while significant growth was noticed between May 2021 and January 2022, where the net income peaked at $9.75 billion, the net income declined between January 2022 ($9.75 billion) and October 2022 ($5.96 billion). From October 2022 to April 2023, net income increased, reaching $4.79 billion in April 2023.

Notably, recent data (from January 2022 to April 2023) indicates alternating decreases and increases in the net income, with a positive rise seen in the last value of the series.

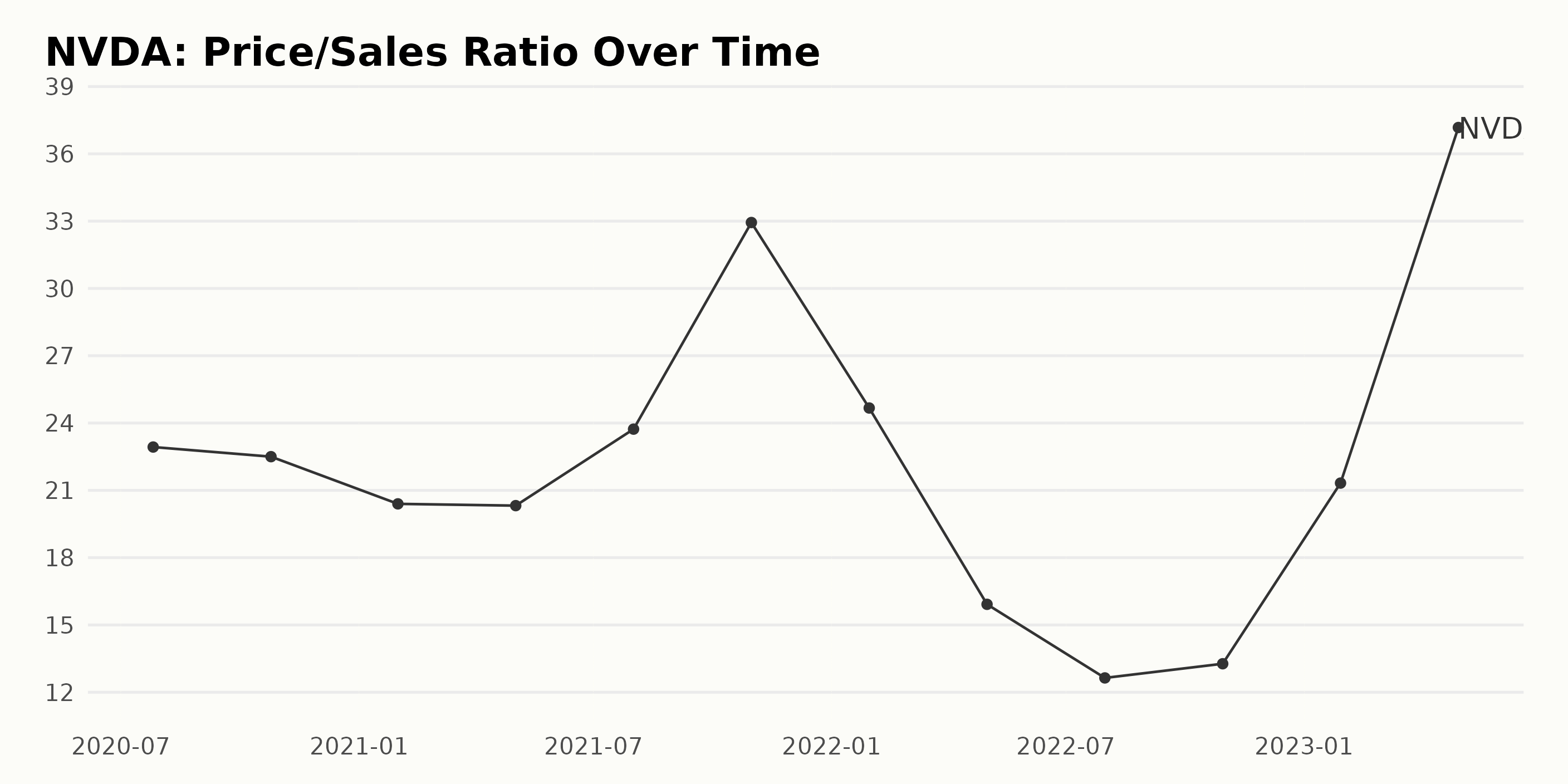

NVDA’s Price/Sales ratio has experienced both upward and downward fluctuations over the years. A summary of the significant events in the data series is provided below:

- January 2018: NVDA started with a P/S of 15.07.

- October 2018: The P/S reached its lowest value up to that point at 9.94, exhibiting a decrease from the starting value.

- January 2020: The P/S climbed to 17.30, surpassing the initial value in 2018.

- July 2020: NVDA saw a significant increase in its P/S, reaching 22.93.

- October 2021: The P/S hit an all-time high of 32.94 before experiencing a decline.

- January 2023: The P/S recovered to 21.32 after fluctuating between highs and lows in the preceding years.

- April 2023: The most recent data point shows the P/S at its peak value of 37.17.

Overall, the growth rate for NVDA’s P/S Ratio from January 2018 to April 2023 is approximately 146.28%. Although there have been periods of decline, the general trend has been an increase in the P/S ratio, with greater emphasis on the most recent data, which suggests a significant positive trend.

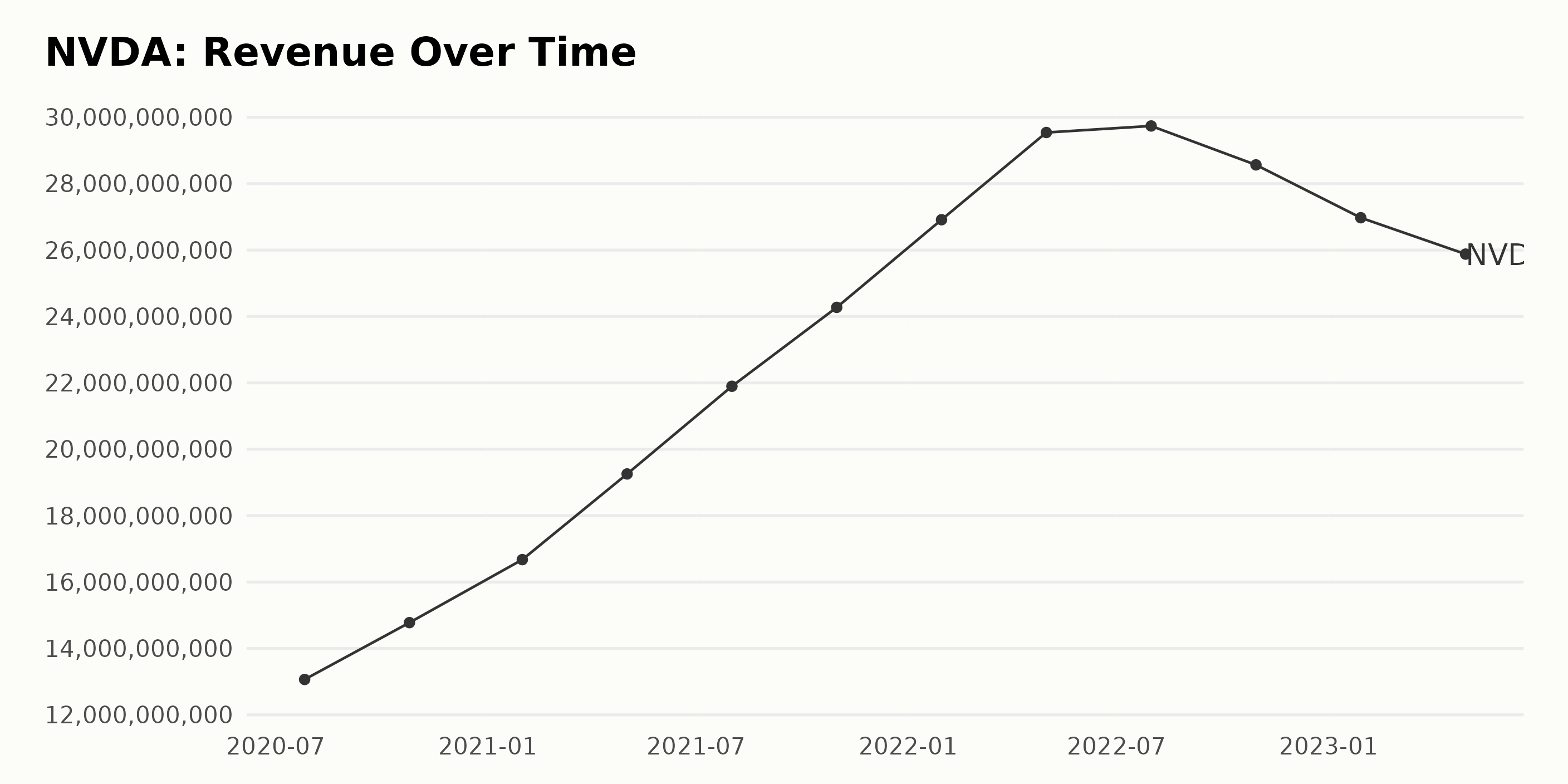

NVDA’s trailing-12-month revenue from January 28, 2018, to April 30, 2023. The following is a summary of the trends and fluctuations:

On January 28, 2018, NVDA’s revenue was $9.71 billion. The revenue generally increased with several fluctuations until reaching its highest point at $29.74 billion on January 29, 2023. After this peak, the revenue decreased to $25.88 billion by April 30, 2023. Significant data points:

- October 31, 2021: $24.27 billion

- January 30, 2022: $26.91 billion

- May 1, 2022: $29.54 billion

Focusing on more recent data, NVDA experienced a decline in revenue from $29.74 billion on January 29, 2023, to $25.88 billion on April 30, 2023. The growth rate between the first value ($9.71 billion) and the last value ($25.88 billion) is approximately 166%.

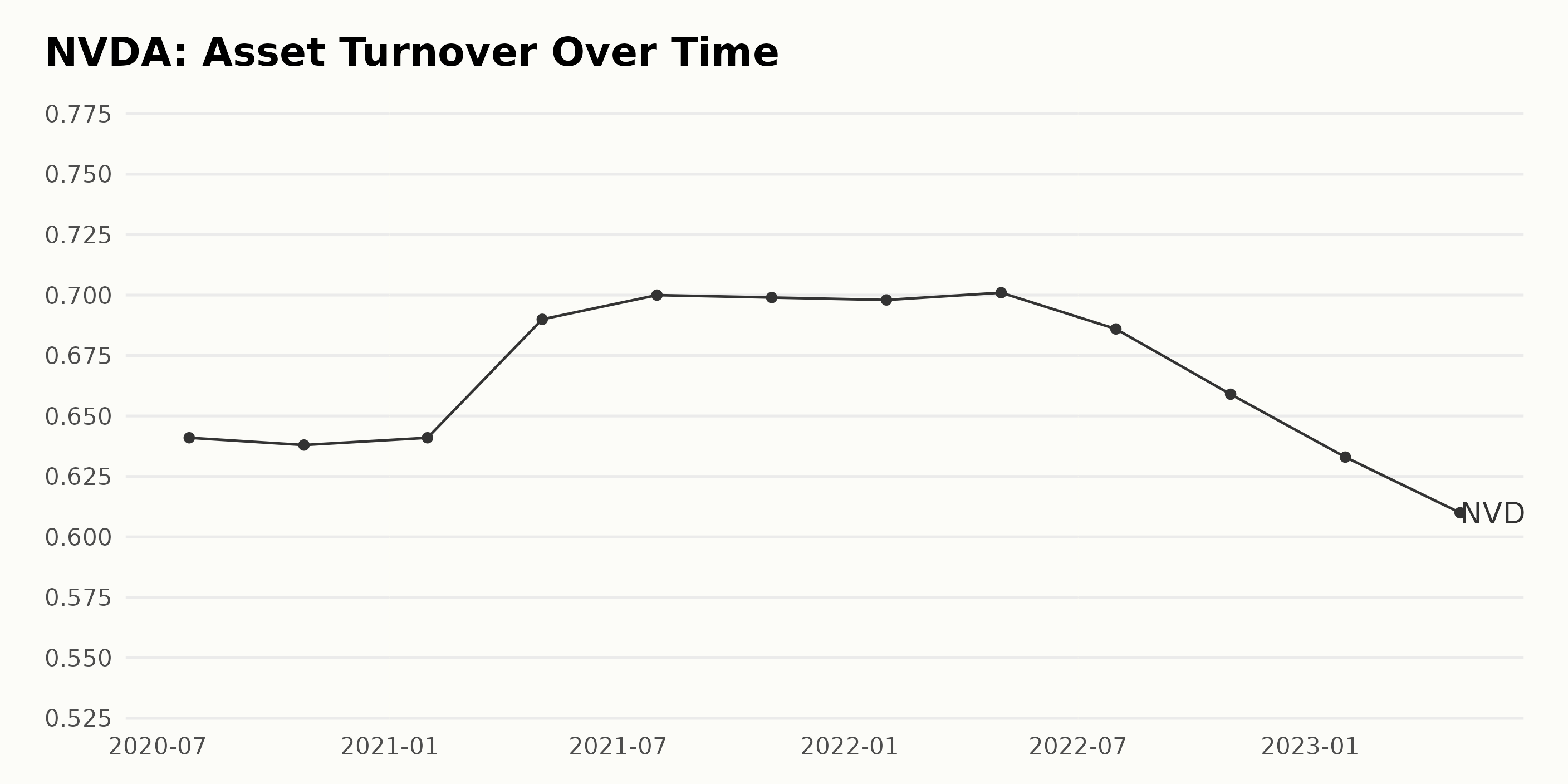

The following summary highlights the trend and fluctuations in NVDA’s Asset Turnover Ratio from January 2018 to April 2023:

The asset turnover ratio started at 0.97 in January 2018 and gradually increased to 1.05 in April 2018. It exhibited a downward trend from April 2018 (1.05) to October 2019 (0.69), with slight fluctuations in between. The asset turnover ratio experienced a brief increase from October 2019 (0.69) to January 2020 (0.71) before resuming a downward trajectory until October 2022 (0.66). A slight increase in the asset turnover ratio occurred from October 2022 (0.66) to January 2023 (0.63), followed by a decline to 0.61 in April 2023.

Overall, the growth rate of the asset turnover ratio of NVDA decreased, measuring a 0.61 value in April 2023 compared to 0.97 in January 2018.

Examining NVIDIA Corporation’s Share Price Surge from December 2022 – June 2023:

Examining NVIDIA Corporation’s Share Price Surge from December 2022 – June 2023:

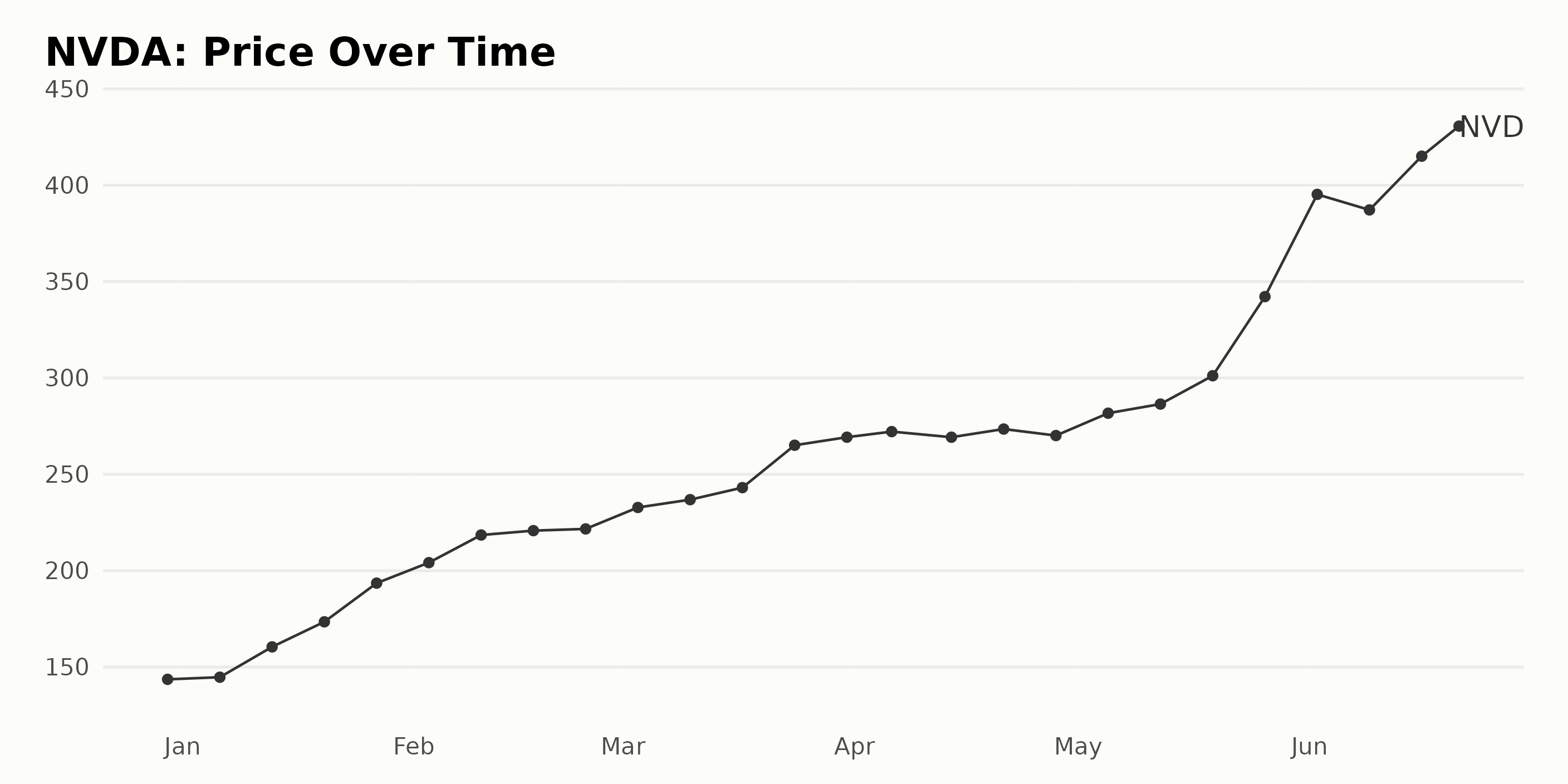

The data provided below shows the share price of NVDA from December 23, 2022, to June 22, 2023. The trend observed during this period indicates an overall increase in the share price of NVDA. The growth rate accelerates significantly towards the end of the period.

The share price of NVDA shows a clear upward trend with accelerated growth between May and June 2023. Here is a chart of NVDA’s price over the past 180 days.

Examining NVDA’s POWR Ratings

Examining NVDA’s POWR Ratings

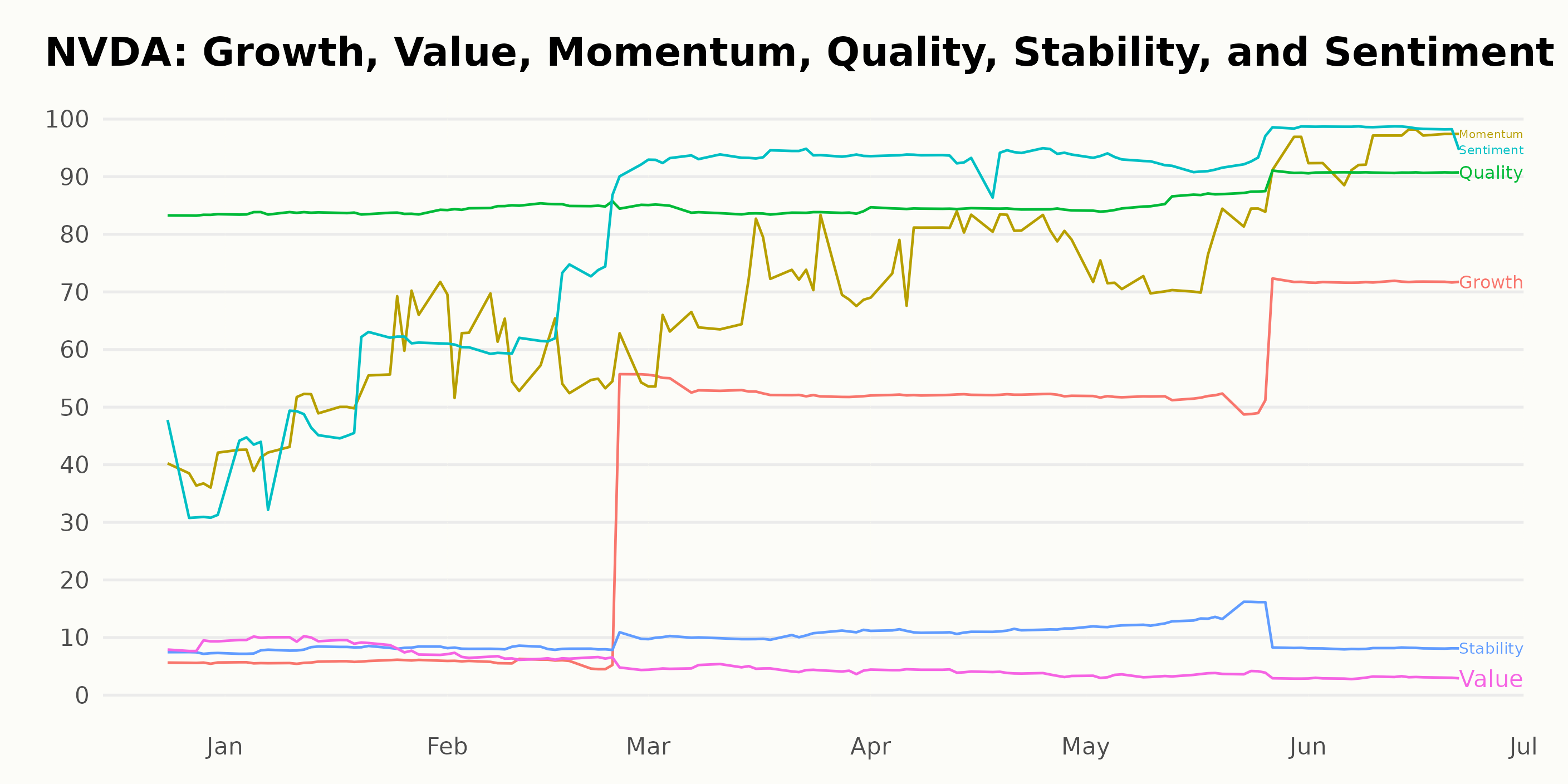

NVDA has an overall C rating, translating to a Neutral in our POWR Ratings system. The stock is ranked #43 among 91 stocks in the C-rated Semiconductor & Wireless Chip industry. It also has an F grade for Value and a D for Stability.

Here is an overview of the changes in its POWR Ratings and rank in the Semiconductor & Wireless Chip category, which consists of 91 stocks:

- December 24, 2022: POWR Ratings – D, Rank in Category – 80

- February 25, 2023: POWR Ratings improved to a C, and rank in category improved to 68

- May 20, 2023: Continued improvement, Rank in Category – 55

- May 27, 2023: Rank in Category improved to 51

- June 3, 2023: Significant improvement, Rank in Category – 43

- June 22, 2023 (latest value): POWR Ratings- C, Rank in Category – 41, showing an overall improvement since the beginning of the year.

How does NVIDIA Corporation (NVDA) Stack Up Against its Peers?

Other stocks in the Semiconductor & Wireless Chip sector that may be worth considering are Infineon Technologies AG ADR (IFNNY), Renesas Electronics Corporation (RNECF), and SUMCO Corporation (SUOPY) as they have better POWR Ratings.

What To Do Next?

Discover 10 widely held stocks that our proprietary model shows have tremendous downside potential. Please make sure none of these “death trap” stocks are lurking in your portfolio:

NVDA shares were trading at $430.90 per share on Thursday afternoon, up $0.45 (+0.10%). Year-to-date, NVDA has gained 194.93%, versus a 14.78% rise in the benchmark S&P 500 index during the same period.

About the Author: Kritika Sarmah

Her interest in risky instruments and passion for writing made Kritika an analyst and financial journalist. She earned her bachelor’s degree in commerce and is currently pursuing the CFA program. With her fundamental approach, she aims to help investors identify untapped investment opportunities.

The post NVIDIA (NVDA): Is This Chip Stock a Worthy Buy? appeared first on StockNews.com

Although the shares of leading chip maker NVIDIA (NVDA) have been soaring, its deteriorating financials could indicate trouble ahead. Is the chip stock a worthy buy? Let’s analyze its financial metrics to know more.

While prominent chip maker NVIDIA Corporation’s (NVDA) shares have seen a significant gain this year mainly due to the AI boom, the company reported disappointing results for the fiscal 2024 first quarter, which raises concerns about the company’s near future growth prospects.

In addition, considering the anticipated macroeconomic difficulties including supply chain disruptions in the semiconductor industry, high borrowing costs, and decreased consumer spending due to inflation and recession, it would be prudent to wait for a better opportunity to invest in this stock.