OPEC Meeting: Is Saudi Arabia Trying to Squeeze the Oil Market?

In a surprising move, Saudi Arabia announces a significant oil production cut, causing tension within OPEC and raising questions about future oil prices.

This story originally appeared on MarketBeat

In a surprising move, Saudi Arabia pledged to reduce its oil output by 1 million barrels per day for July at the June 4 OPEC meeting. This adjustment, which may continue monthly, places Saudi oil production at its lowest point in a decade, excluding the pandemic-induced slump.

Moreover, the broader OPEC+ group is extending the April production curtailments until December 2024, a year beyond the initial plan.

This move by Saudi Arabia indicates a significant deviation from tradition, hinting at disagreements within the OPEC coalition. The June 4 OPEC meeting was labeled by the Wall Street Journal as “one of the most contentious production meetings in recent years.”

Some market analysts guess that Saudi Arabia was shooting for a “shock and awe” cut, leading to an abrupt tightening of the oil market and an upward price shock. However, the early market response is muted, with crude oil prices

Some call it a “shock and awe” cut, which aims to dramatically tighten the oil market and create an upwards price shock. However, initial market reactions to the cut are muted, with West Texas crude oil up only 1% in afternoon trading, following a 5% gap up in prices.

Why Is Saudi Arabia Cutting Oil Production?

Saudi Arabia, commanding roughly 15% of the world’s energy reserves, wields significant influence over the global energy market. Changes in Saudi production levels can cause substantial shifts in crude oil prices.

Saudi Arabia and OPEC members use this market dominance to manipulate production and maintain a degree of control over oil prices.

Amid global recession fears and China’s sluggish rebound in oil demand post-reopening, crude oil prices have been downtrend despite the tight oil market.

Saudi Arabia’s production cut marks the third OPEC cut since oil prices peaked at a 14-year high in March 2022. The Saudi energy minister, Prince Abdulaziz, has reiterated the kingdom’s commitment to stabilizing the market, a phrase widely interpreted as a push for higher prices.

However, the earlier cuts in October 2022 and April 2023 failed to provide sustained price strength, with oil still hovering in the $70 range.

And despite oil prices gapping up about 5% on the news of Saudi Arabia’s production cut, oil prices sold off from the open and are within spitting distance of filling the gap up:

According to the Wall Street Journal, Saudi Arabia needs an oil price of $81 per barrel to balance its budget. As prices linger in the $70o range, the kingdom is ready to do anything to hike prices up, given its expensive plans to construct “cities of the future.”

But the Saudis failed to convert other OPEC members to join in a production cut. Instead, it was forced to self-sacrifice and cut its oil production by 10% to convince the other members to extend the April production cuts for another year.

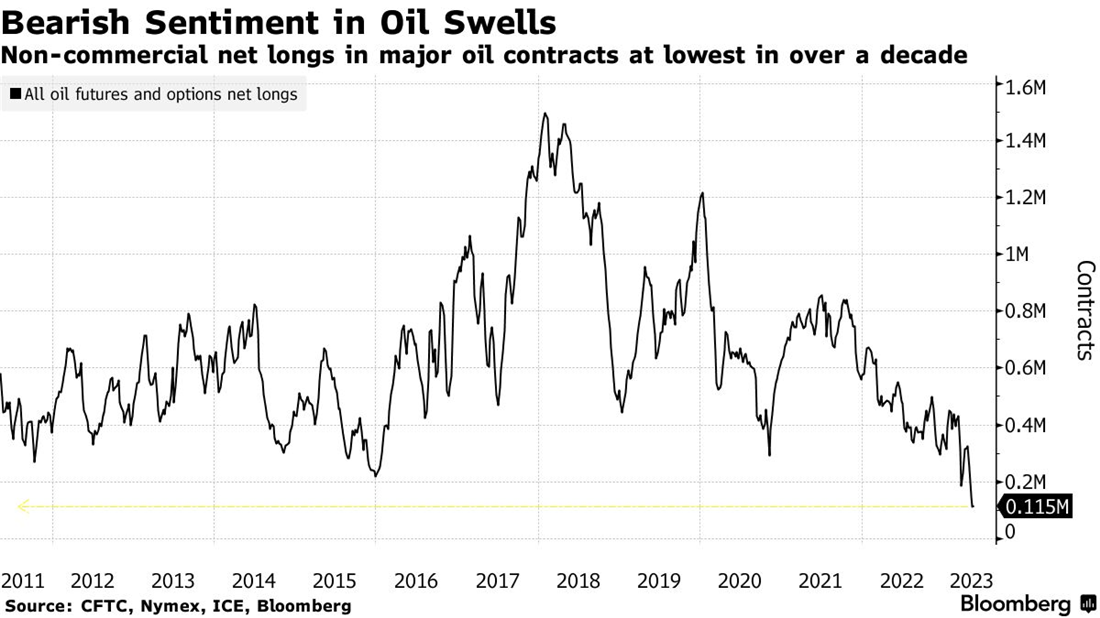

Abdulaziz hinted at this cut two weeks ago when he warned oil short sellers to “watch out.” And these cuts come right as Goldman Sachs reports that hedge funds had the most bearish energy positioning since 2020. Bloomberg showed that speculators are the most bearish they’ve been in over a decade:

According to Bloomberg’s David Fickling, Saudi Arabia needs oil prices to be about 14% higher for these significant production cuts to bear fruit. Consequently, Aramco, Saudi Arabia’s state-run oil company, is raising its oil selling prices for the US, Europe, and Asia following the output cut.

But the Saudis and their ally Russia have competing motives. Saudi Arabia is willing to cut production in the hopes of higher prices in the future. At the same time, Russia is eager to raise output as much as possible to fund its war effort against Ukraine. Due to Western sanctions, Russian oil reportedly sells well below spot prices, exerting further downward pressure on oil prices.

Russia has reportedly failed to cut back on production as it agreed to in recent OPEC cuts.

Bottom Line

Saudi Arabia’s gamble to slash oil production by 10% to sway oil prices higher is bold, especially because of the break from tradition to perform cuts alone.

The immediate market reaction doesn’t bode well for the Saudis’ plan, as crude oil prices sit within 1% of Friday’s close.

In a surprising move, Saudi Arabia pledged to reduce its oil output by 1 million barrels per day for July at the June 4 OPEC meeting. This adjustment, which may continue monthly, places Saudi oil production at its lowest point in a decade, excluding the pandemic-induced slump.

Moreover, the broader OPEC+ group is extending the April production curtailments until December 2024, a year beyond the initial plan.