Order From U.S. Army Fuels Surge In Enovix Stock Enovix's stock soars 40% over the last month after securing a significant order from the U.S. Army, while analysts predict further upside.

By Ryan Hasson

This story originally appeared on MarketBeat

Shares of the lithium-ion manufacturer, Enovix (NASDAQ: ENVX), have added to its impressive run, with stock up 40% in the last month. Just under a month ago, when I first covered Enovix, shares were up 13.5% YTD. Fast forward three weeks, and the stock is now up close to 55% YTD. So what's caused the sharp move in recent weeks, and is the risk: reward still favorable to the long side?

Enovix is a leading manufacturer of advanced lithium-ion batteries in several applications, including vehicles, consumer electronics, and grid storage. Enovix's innovative battery design offers higher energy density, improved safety, and a longer life cycle than traditional lithium-ion batteries. The company's website says, "Enovix is on a mission to power the technologies of the future. Everything from IoT, mobile and computing devices, to the vehicle you drive, needs a batter." And Enovix plans on being the manufacturer of those batteries.

Enovix Receives Order From U.S. Army

On the 27th of June, 2023, shares of Enovix broke out of the longstanding consolidation and traded above-average volume. The surge in price and volume came as the company announced that it received a purchase order to produce battery cells for the U.S. Army.

The company announced the progression of its U.S. Army program, with a commitment to producing commercial cells for use within U.S. Army soldiers' central power source.

Dr. Raj Talluri, President and CEO of Enovix, said: "This achievement is yet another proof point on our journey to scale."

Analysts See 68% Upside

Analysts remain bullish on the name, with the consensus rating at a Buy based on eleven analyst ratings. The consensus price target of $31.08 predicts a possible 68% upside in the stock. All eleven analysts covering the name have a Buy rating. Most recently, in May, Robert W. Baird boosted their price target from $64 - $67, predicting a 469% upside.

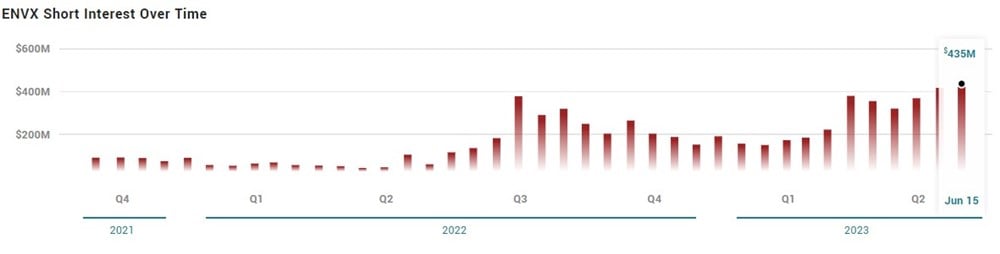

Short Interest Remains Elevated

Month over month, the short interest grew from 26.21% to 26.66%, or $416 million to $435 million volume sold short. With the short interest continuing to make new highs and the stock recently breaking out on a positive catalyst, longs will be growing more confident.

The Stock's Recent Performance

Before breaking out, and as previously identified, the stock was trading in a favorable setup. The consolidation near critical resistance provided a unique opportunity if the stock were to break higher on increased volume firmly. It was probable that the stock would break out and experience momentum, especially given the significant short interest, bullish sentiment among analysts, Q1 insider purchases, and favorable technical setup.

After the explosive move above the previous resistance, $15, the stock is now trading near a crucial resistance area, $20. Those looking to get involved should wait for a pullback and higher low as a possible entry as the uptrend and turnaround further develop in the stock.