Profit From the Best AND Worst Stocks!

Stock markets suffered through a rough year in 2022. Major indices like the S&P 500 (SPY) and NASDAQ 100 were down double digits across the board. Yet this simple strategy…

This story originally appeared on StockNews

Stock markets suffered through a rough year in 2022. Major indices like the S&P 500 (SPY) and NASDAQ 100 were down double digits across the board. Yet this simple strategy showed a solid double-digit gain by taking profitable positions in both good AND bad stocks. This type of balanced approach will likely continue to outperform in what looks like to be a tough second half of 2023. Read on below to find out more.

2022 was one of the worst years for stocks in a long time. After a strong start to 2023, stocks are failing to break out at recent highs. What happens the rest of the year remains to be seen. The recent rise in interest rates along with a continued earnings recession is likely to be an overhang that will continue to stall stocks for the final two quarters of 2023.

The average annual return for stocks (S&P 500) over the past 150 years is roughly 9%, including dividends. Without dividends it drops to just over 4.5%. Inflation shaves about half off those returns.

A return back towards more historic returns may look pretty good in the coming 12 months. Stock selection will be critical to performing well in 2023, rather than just buying any stock -which was seemingly the way to easy gains up until 2022.

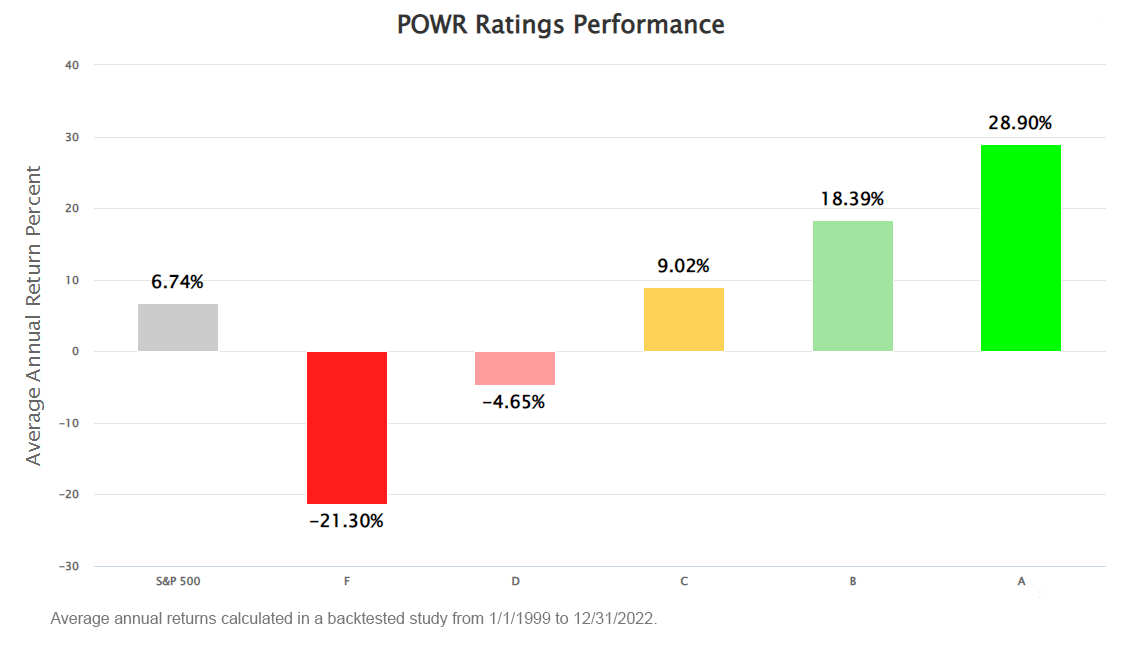

The POWR Ratings can certainly provide investors and traders with a clear edge when selecting stocks. Over the past 20 plus years, the A Rated strong buys in the POWR Ratings have outperformed the S&P 500 by over 22% annually.

While this level of outperformance is truly eye-opening, selling the F rated strong sell stocks would have beaten the overall market by an even greater degree.

These lowest rated stocks actually fell over 21% per year while the S&P 500 gained nearly 7% annually. This equates to an underperformance of roughly 28%! This means the bad stocks fell a bit worse than the good stocks rose in comparison to the S&P 500.

Many investors and traders are not comfortable shorting stocks. Unlimited potential loss increases the fear factor even more. Luckily, the options market provides a defined risk solution to profit from a pullback in stocks. Puts.

Owning a put option gives you the ability to sell a stock at a specific price before a certain time. The put buyer pays money upfront – called the option premium.

For instance, buying the Apple July $155 put at $4.30 gives the buyer the right to sell AAPL stock at $155 until expiration on 7/21/2023 (the third Friday in July).

The price of these bearish put options will increase as the stock goes down and decrease if the stock rises. The most at risk is $430 ($4.30 premium x 100)

Buying put options is a simple, but very effective way, to take a bearish stance on bad stocks (using Apple as an example, not that is a bad stock).

To help offset this bearish view, POWR Options combines it with a bullish trade that is done with a call purchase.

Owning a call option gives you the ability to buy a stock at a specific price before a certain time. The call buyer again pays money upfront – called the option premium.

For instance, buying the Apple July $175 call at $4.50 gives the buyer the right to buy AAPL stock at $175 until expiration on 7/21/2023 (the third Friday in July).

The price of these bullish call options will increase as the stock goes up and decrease if the stock drops. The most at risk is $450 ($4.50 premium x 100).

But instead of just combining puts and calls on the same stock, POWR options uses the power of the POWR Ratings to combine puts on the lowest rated (D and F) names along with bullish calls on the highest rated (A and B) stocks.

Sell the worst and buy the best-but define the risk.

Pairing a bearish put and bullish call together is called a “Pairs Trade”. These two trades together combine for a much more neutral outlook.

It is a strategy we successfully use day in and day out in the POWR Options Portfolio to take a more balanced “Pairs Trade” approach by combining bearish puts with bullish calls. It worked very well in 2022 and continues to work very well so far in 2023.

A recent example of this POWR Pairs approach using the power of the POWR ratings for bearish put plays and bullish call plays may help shed some light on things.

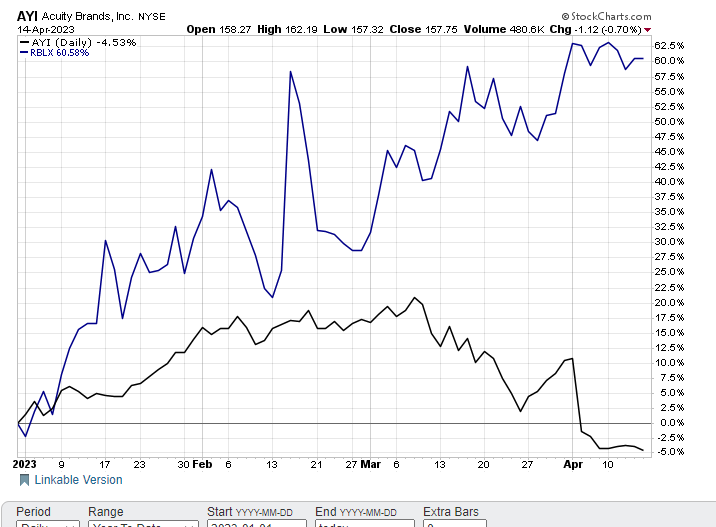

Below is a recent POWR Pairs trade done in the POWR Options Portfolio on Acuity Brands (AYI) and Roblox (RBLX).

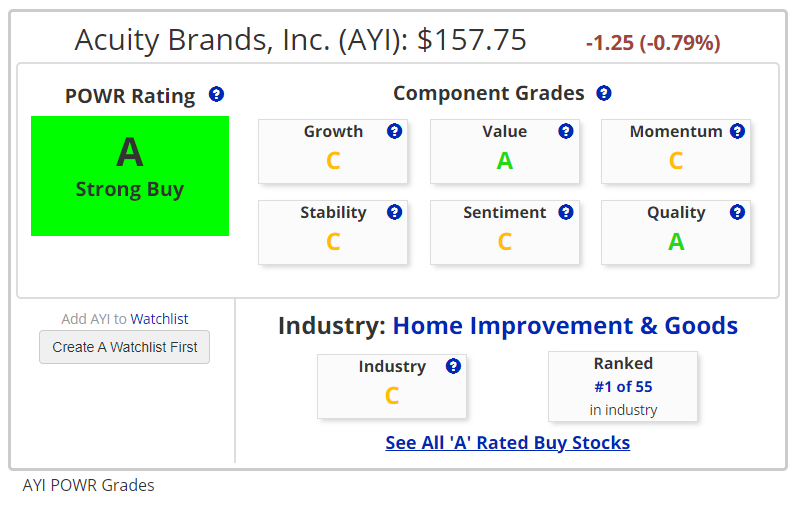

AYI was an A rated- Strong Buy -stock in a C rated Industry. Number one in the industry. Strong stock in a strong position.

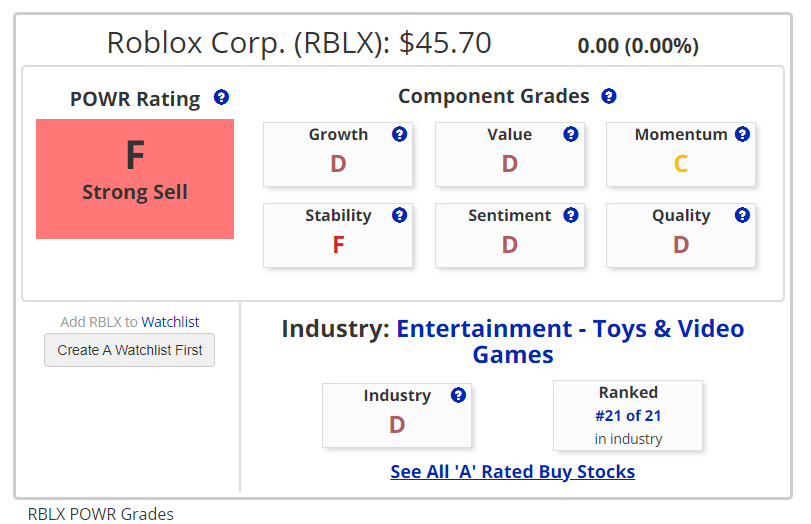

RBLX was an F rated -Strong Sell – stock in a D rated industry. Ranked at the bottom in the industry group as well, so pretty much the worst of the worst.

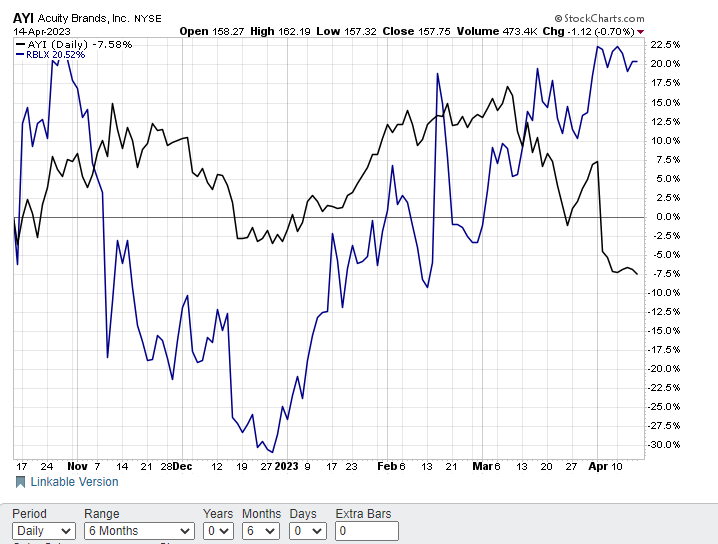

Yet over the past few weeks, much lower rated Roblox had been outperforming much higher rated Acuity by a wide margin.

In fact, since the beginning of the year A rated AYI was lower by almost 5% while F rated RBLX screamed much higher-up 60%!.

This set up ideally for a POWR Pairs trade. Buying bullish calls on the big-time underperforming Strong Buy AYI and bearish puts on the hugely outperforming Strong Sell RBLX.

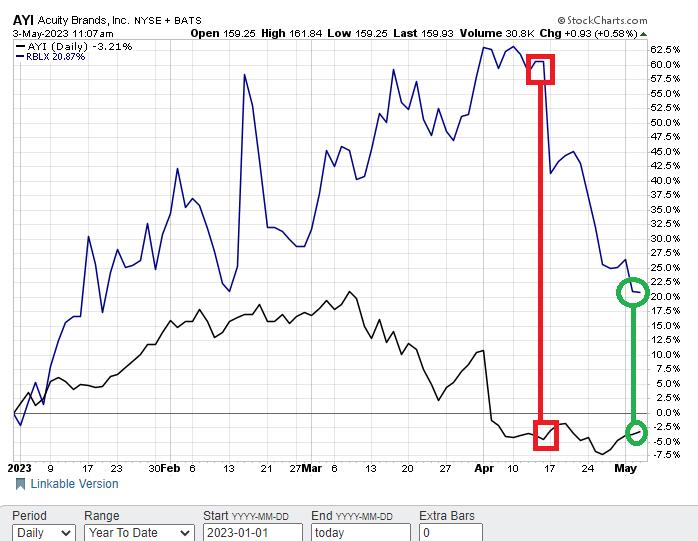

The expectation was for the spread between the two to converge back towards a more normal comparative performance with AYI outperforming RBLX.

That proved to be the case. RBLX dropped sharply while AYI traded sideways. The spread converged from over 60% at trade inception (red) to 25% at close out (green).

POWR Options closed out the POWR Pairs trade for a $210 overall gain. $40 loss on the AYI calls and a $250 gain on the RBLX puts.Trade took 16 days from start to finish. Over a 20% gain on the $970 invested in both the AYI calls ($500) and RBLX puts ($470). Not bad for a few weeks work on a neutral trade.

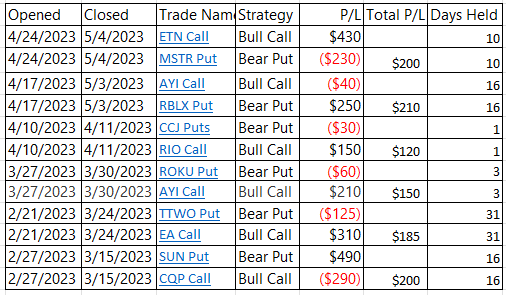

This table below shows the most recent six closeouts for POWR Options. All 6 were overall winning trades with a holding period averaging just a few weeks. All very similar to the AYI/RBLX POWR Pairs trade.

The ability to say nimble and be more neutral has served the POWR Options Portfolio so far. Our trading showed solid gains since inception versus losses for stocks in that same time frame.

Using the POWR ratings to help us select the best of the best stocks to be bullish on with call buys, along with the worst of the worst stocks to be bearish on with put purchases, will likely continue to prove profitable in 2023.

What To Do Next?

If you’re looking for the best options trades for today’s market, you should definitely check out this key presentation How to Trade Options with the POWR Ratings. Here we show you how to consistently find the top options trades, while minimizing risk.

Using this simple but powerful strategy I have delivered a market beating +55.24% return, since November 2021, while most investors have been mired in heavy losses.

If that appeals to you, and you want to learn more about this powerful new options strategy, then click below to get access to this timely investment presentation now:

How to Trade Options with the POWR Ratings

Here’s to good trading!

Tim Biggam

Editor, POWR Options Newsletter

SPY shares fell $0.44 (-0.11%) in after-hours trading Friday. Year-to-date, SPY has gained 8.31%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Tim Biggam

Tim spent 13 years as Chief Options Strategist at Man Securities in Chicago, 4 years as Lead Options Strategist at ThinkorSwim and 3 years as a Market Maker for First Options in Chicago. He makes regular appearances on Bloomberg TV and is a weekly contributor to the TD Ameritrade Network “Morning Trade Live”. His overriding passion is to make the complex world of options more understandable and therefore more useful to the everyday trader. Tim is the editor of the POWR Options newsletter. Learn more about Tim’s background, along with links to his most recent articles.

The post Profit From the Best AND Worst Stocks! appeared first on StockNews.com

Stock markets suffered through a rough year in 2022. Major indices like the S&P 500 (SPY) and NASDAQ 100 were down double digits across the board. Yet this simple strategy showed a solid double-digit gain by taking profitable positions in both good AND bad stocks. This type of balanced approach will likely continue to outperform in what looks like to be a tough second half of 2023. Read on below to find out more.

2022 was one of the worst years for stocks in a long time. After a strong start to 2023, stocks are failing to break out at recent highs. What happens the rest of the year remains to be seen. The recent rise in interest rates along with a continued earnings recession is likely to be an overhang that will continue to stall stocks for the final two quarters of 2023.

The average annual return for stocks (S&P 500) over the past 150 years is roughly 9%, including dividends. Without dividends it drops to just over 4.5%. Inflation shaves about half off those returns.