The Squeeze Is On For EVGo, Rally To Follow EVGo wowed the market with results and guidance that point to accelerating revenue driven by an expanding network and rising customer counts.

This story originally appeared on MarketBeat

If you've been watching the short interest in EVGo (NYSE: EVGO) and wondering when and if a squeeze will happen, it is. The company's q4 results and outlook affirm the business potential and have the stock up 25%. That is a significant move driven by short-covering that confirms support at a higher level than before. Given the proper catalyst, this has a bottom in play, and the market is set up for a rally. That catalyst could be found in the Q4 results, which show revenue up high triple digits and adoption of the technology accelerating but may come later in the year when more results are in.

EV charging will be a big business, and EVGo is electrifying the market. A significant portion of the Q4 revenue is due to a partnership with Pilot Flying J and GM (NYSE: GM) to set up a nationwide charging network. The network will be installed, operated and maintained by EVGo, exposing it to mainstream EV charging needs. The network will have 2,000 stalls, nearly enough to double the company's footprint. Add in the growing number of users, fleet accounts and company-owned locations and the stage is set for accelerating growth.

EVGo Pops On Record Results

EVGo had a shockingly good quarter with revenue of $27.7 million, up 282% compared to last year and $7 million ahead of the consensus. The revenue is driven by the addition of 59,000 new customers, which brings the total to 553,000. The increase in customer count and fleet accounts drove network throughput to 14.4-gigawatt hours, up 76.6%, aided by an increase in stall count. The company added 180 during the quarter, bringing the total to 2800 or 670 more than last year. The company expects revenue to accelerate again in 2023 after another 600 to 1,200 stall additions.

The guidance is interesting because it assumes revenue will be flat sequential compared to Q4 at the low end of the range. Given the expected ramp in stall count and partnership with Flying J, this is a cautious take and could result in revenue at the high end of the range. The high end assumes a low double-digit sequential compound growth rate which is also cautious in light of Q4 results. The take for investors is that guidance will likely be increased as the year unwinds.

Sell-Side Activity May Provide Another Catalyst

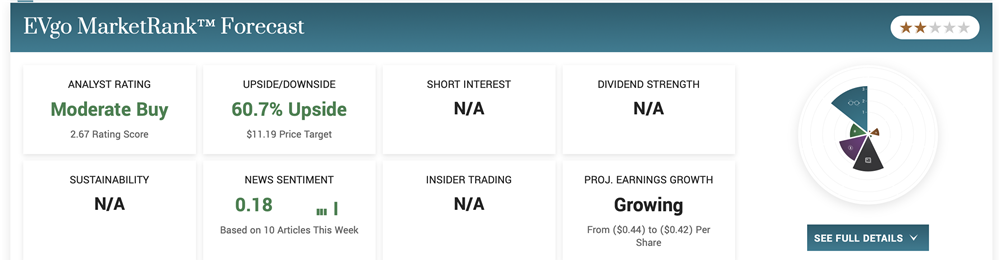

The analysts' activity in EVGo is sketchy and hasn't seen an update since the Q3 results were released, but there are 2 takeaways for investors. The 1st is that analysts still covering the stock have it rated at Moderate Buy with a price target 50% above the current price action. The 2nd is that Q4 results and results later this year could drive a shift in sentiment that increases the rating and price target. Add in a bullish institutional community, and there is a recipe for upward price movement. The institutions only own about 13% of the stock, but they began buying in Q1 after trimming some holdings last year.

The technical outlook is promising because EVGo shows support higher than previously and at the 150-day moving average. Investors can assume this is a sign of institutional buying and short-covering that could lead to a sustained rally. The next hurdle for the price action is near $7.75, a move above that could propel it into the $8.00 to $10.00 range. If not, EVGo may remain range bound at current levels until there is more news to drive the market. Until then, this company is expected to install more charging stalls and grow its business.