These 3 AI Stocks Are Ready to Lead in 2025

AI is gaining traction, as are these alternatives to NVIDIA and the hyperscalers. Ambarella, Palantir, and AeroVironment monetize AI today and business grows.

This story originally appeared on MarketBeat

Look no further if you are looking for AI winners who will shine in 2025 and who aren’t NVIDIA (NASDAQ: NVDA) or hyperscalers like Microsoft (NASDAQ: MSFT), Google (NASDAQ: GOOGL), and Amazon (NASDAQ: AMZN). Palantir (NASDAQ: PLTR), AeroVironment (NASDAQ: AVAV), and Ambarella (NASDAQ: AMBA) are alternatives to mainstream AI plays on track for gains in 2025. Each offers a unique play on AI supported by an ability to monetize the technology over the long term. As big a market as the AI infrastructure industry is, the services and applications will produce the most growth over time, and these companies are well-positioned to benefit.

Palantir: A Full-Service AI Platform to Rule Them All

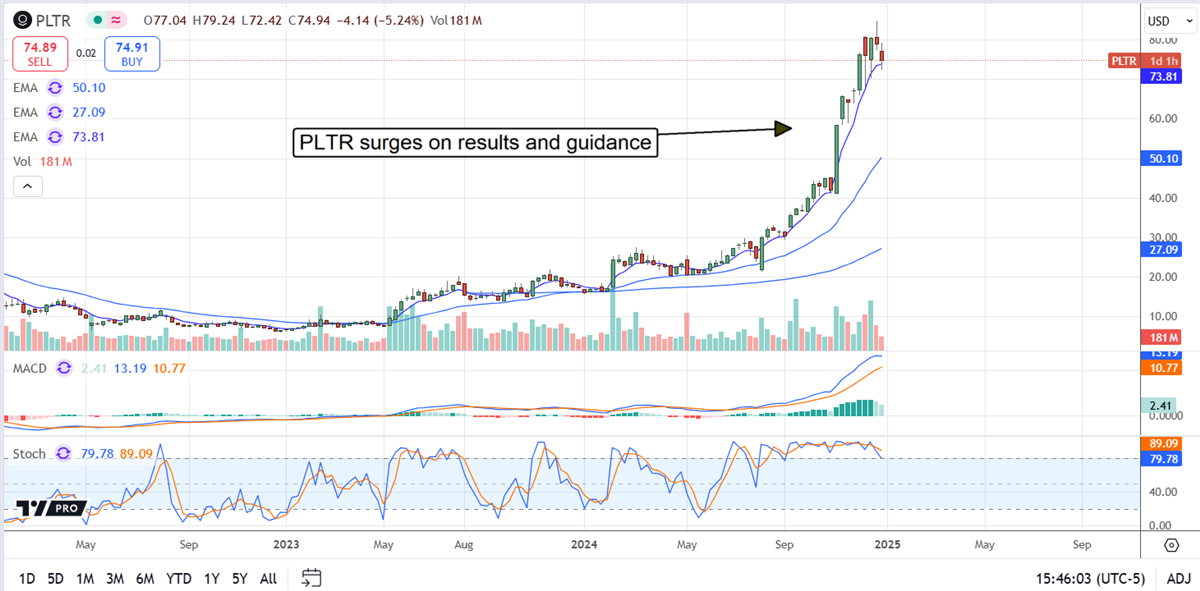

Palantir stock skyrocketed in 2024, and it still has a long way to go before hitting its peak. The surge in share prices is driven by a robust growth outlook supported by a move into the public sector. Originally intended to aid governments, Palantir’s AI-empowered platform provides a comprehensive solution that is well-suited to businesses and industries and capable of providing security and actionable business insights.Results in 2024 include double-digit growth, revenue accelerating sequentially, year-over-year (YoY) improving profitability and guidance, and outperformance.

The outlook for 2025 is robust, with growth expected to sustain in the mid-20% range and likely cautious. The takeaway from FQ3 2024 is that the new AIP strategy is gaining traction, with new use cases developing daily. The critical detail is that Palantir’s platform is suitable for any business or industry that generates data, which includes them all.

Analysts’ sentiment will be a driver for this market in 2025. After years of lagging and naysaying, the analysts have begun warming to Palantir and increasing the coverage. The activity in the second half of 2024 includes numerous price target increases, with the consensus price target rising, if not the sentiment rating. Possible catalysts for the stock price include improving sentiment, which is still pegged at Reduce.

AeroVironment Applies AI for Government Use

AeroVironment makes a range of uncrewed aircraft, drones, and ground vehicles for the government and federal agencies. Its products are in demand due to heightened global tensions, re-armification trends, and their effectiveness in combat situations. The company uses AI to enhance decision-making, allowing drones to increase autonomy and reaction times, a technology that will eventually trickle down to the consumer level.

AeroVironment’s loitering munitions systems allow unmanned aircraft to remain on station undetected, waiting for targets of opportunity or on-call for ground support as needed. The systems can be armed with various components, including weaponry and surveillance, removing humans from dangerous situations.

Analyst trends for AeroVironment are positive, including increasing coverage and a rising price target. The consensus figure rose 80% in 2024, nearly 50% above the price action in early 2025.

Ambarella Makes Computers See

Ambarella is still a small semiconductor lab but has gained traction after shifting to Edge/AI computer vision applications. Its full-stack approach to CV makes it well-suited to various applications, including defense, business, industry, and consumer. It uses AI at the edge, allowing computers to visualize their surroundings in real time.

Applications for Ambarella’s technology include drones, security, manufacturing, and autonomous vehicles. Results in 2024 included sequential acceleration, a return to YoY growth, profitability, outperformance, and improved guidance. The company says momentum is building in the IoT and automotive end markets, and its guidance is likely cautious. The IoT is expected to proliferate in 2025 as more 5G networks come online and use cases develop.

Analysts’ trends are driving this stock to new highs. The sentiment improved significantly by mid-year 2024, including numerous price target increases and sentiment upgrades. The stock is pegged at Moderate Buy with a potential for 15% to 30% upside by mid-year.

Look no further if you are looking for AI winners who will shine in 2025 and who aren’t NVIDIA (NASDAQ: NVDA) or hyperscalers like Microsoft (NASDAQ: MSFT), Google (NASDAQ: GOOGL), and Amazon (NASDAQ: AMZN). Palantir (NASDAQ: PLTR), AeroVironment (NASDAQ: AVAV), and Ambarella (NASDAQ: AMBA) are alternatives to mainstream AI plays on track for gains in 2025. Each offers a unique play on AI supported by an ability to monetize the technology over the long term. As big a market as the AI infrastructure industry is, the services and applications will produce the most growth over time, and these companies are well-positioned to benefit.

Palantir: A Full-Service AI Platform to Rule Them All

Palantir stock skyrocketed in 2024, and it still has a long way to go before hitting its peak. The surge in share prices is driven by a robust growth outlook supported by a move into the public sector. Originally intended to aid governments, Palantir’s AI-empowered platform provides a comprehensive solution that is well-suited to businesses and industries and capable of providing security and actionable business insights.Results in 2024 include double-digit growth, revenue accelerating sequentially, year-over-year (YoY) improving profitability and guidance, and outperformance.