This Is Why The S&P 500 Could Have A Strong Summer Rally There is a catalyst emerging in the data that could lead the S&P 500 higher over the summer; the question is if it will break out of its range or...

This story originally appeared on MarketBeat

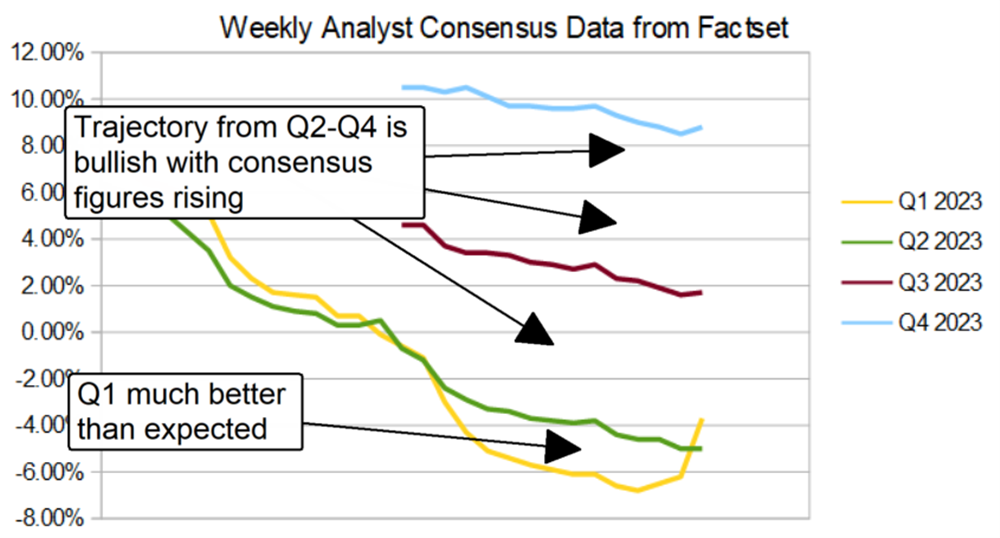

MarketBeat analyst Kate Stalter recently pointed out that the typical sell-in-May-and-go-away approach to investing could be the wrong one in 2023. Not only are their seasonal factors in play but cyclical ones that have some sectors set up to outperform over the summer. On top of that, there is a catalyst emerging in the data that could help lift stocks into the end of the year. That catalyst is an improvement in the earnings outlook, with the 2nd half EPS consensus figures rising.

MarketBeat analyst Kate Stalter recently pointed out that the typical sell-in-May-and-go-away approach to investing could be the wrong one in 2023. Not only are their seasonal factors in play but cyclical ones that have some sectors set up to outperform over the summer. On top of that, there is a catalyst emerging in the data that could help lift stocks into the end of the year. That catalyst is an improvement in the earnings outlook, with the 2nd half EPS consensus figures rising.

If this trend continues, the S&P 500 (NYSEARCA: SPY) will likely move up to the top of its trading range; the question is if it will break out and continue higher.

Earnings Season Is Half Over, and The Takeaway Is Bullish

Earnings season is half over, and the takeaway is bullish. Not only are the Q1 results better than expected, and the year's outlook is improving. The blended rate of S&P 500 earnings growth reported by Factset on April 28th was -3.7%, still deep in negative territory but well above its expected end-point for the quarter. The index was expected to post a decline of -6.8% at the start of peak reporting and only recover 100 to 200 basis points of that decline by the end of the season. At the current rate, the S&P 500 could post a decline of -1.0%, which is much better than expected and boosts market sentiment.

The guidance moves the market longer term, and index earnings power is at a tipping point. The consensus figure for Q2 is holding steady at -5%, which is negative at face value but telling when you dig deeper into the data. Based on the past 2 years of data, the consensus for Q2 should be trending lower at this point in the reporting season. The fact that it is holding steady suggests the worst of what 2023 has to offer regarding EPS has been priced into the market, and the growth trajectory improves from that point forward.

The growth trajectory turns positive in the 2nd half, but the consensus figures were trending lower and weighing on index prices. That trend may be over due to the recent uptick in the 2nd half consensus figures, but there is still a risk for the market. If the consensus estimates for the 2nd half trend higher from their bottom, they will lead the market higher. If not, the market may be capped at the top of its trading range. Either way, the stage is set for the market to rally.

Consumer Discretionary Leads In Q1

The Consumer Discretionary sector was expected to lead in Q1 with earnings growth above 30%, and it is doing so. The Consumer Discretionary Sector is not only leading with growth but is the top outperforming sector for the quarter, led by Amazon (NASDAQ: AMZN). Amazon accounts for 23% of the Consumer Discretionary Sector ETF (NYSEARCA: XLY), followed by a 13.5% stake in Tesla (NASDAQ: TSLA).

These companies show significant strength, which may not be echoed across the economy. Names like United Parcel Service (NYSE: UPS) and Packaging Corporation of America (NYSE: PKG) suggest a widespread slowdown in consumer spending that will impact the outlook as the year progresses. In the case of Amazon, profits are driven as much by cost-cutting, efficiencies and Amazon Web Services as anything else.

The Market Is Set Up To Rally, But Can It Sustain One?

The market is set up to rally, provided the 2nd half of the Q1 reporting season is similar to the 1st. In that scenario, the S&P 500 could rally into the summer and hit the next significant top sometime around the Q2 reporting season. If, at that time, the outlook for the 2nd half is still brightening, the rally is likely to continue. The real question is what 2024 will look like because the FOMC is still on track to keep interest rates high, and inflation is yet to be tamed.

The consensus for EPS growth in 2024 is in the low double digits and should lead the market higher over the long term, but not if the figures start to trend lower. In that scenario, the S&P 500 could be stuck in a multi-year rolling bear market supported by the hope of earnings improvement but capped by the reality of the new normal.