United Natural Foods Stock is Ready to be Snacked On Organic foods and grocery products distributer United Natural Foods (NASDAQ: UNFI) stock has been performing relatively stronger than the benchmark indices trading down (-19%) on the year.

By Jea Yu

This story originally appeared on MarketBeat

Organic foods and grocery products distributor United Natural Foods (NASDAQ: UNFI) stock has been performing relatively stronger than the benchmark indices trading down (-19%) on the year. The Company provides organic and natural grocery products, vitamins, supplements, gourmet, ethnic, meat, deli, and private label products under many brands. The Company had to navigate through macro headwinds including inflationary pressures that saw food inflation hit 10.8%, record high fuel prices, and labor challenges impacting both its customers and business. While headwinds are expected to persist, supply chains and driver vacancies are improving with the new accelerated pay and flexible schedule programs. The Company expects food-at-home sales to remain strong as more people continue to work-from-home with managing tighter household budgets in light of food inflation. The Company serves both upstream premium offering and downstream value segment markets enabling it the breadth and agility to continue growing customers throughout various macro environments. United Natural Foods serves over 30,000 independent retail food locations. The Company also supports communities and the planet with its wide-ranging ESG initiatives. Prudent investors seeking exposure in a healthy lifestyle grocery products supplier can watch for opportunistic pullback levels in shares of United Natural Foods.

Fiscal Q3 2022 Earnings Release

On June 7, 2022, United Natural released its fiscal third-quarter 2022 results for the quarter ending April 2022. The Company reported a profit of $1.10 per share beating out consensus analyst estimates for $0.98 per share by $0.12 per share. Revenues rose 9.2% year-over-year (YoY) to $7.24 billion beating consensus analyst estimates for $7.09 billion. United Natural Foods CEO Sandy Douglas commented, "Our third quarter performance further demonstrates UNFI's agility and its focus on servicing customers despite a challenging operating environment. It's apparent that our Fuel the Future strategy is working and beginning to benefit our customers. As we look towards a successful end to our fiscal year, we continue to make progress in simplifying our business and focusing resources on the most important areas that create value for our customers, suppliers, and shareholders."

Raised Guidance

United Natural provided upside guidance for full-year fiscal 2022 EPS between $4.65 to $4.90 versus $4.16. Full-year 2022 revenues are expected between $28.8 billion to $29.1 billion versus $28.65 billion.

Conference Call Takeaways

CEO Douglas highlighted the many headwinds that United Natural faced in the quarter. The Company continues to stabilize its workforce and supply levels are increasing for many of its products. It finished the quarter with the second highest fill rate month of the year due to the proactive actions taken by the Company. The Company lowered its driver vacancy rate to 9% and DC vacancy rate to 7% by the end of the quarter thanks to its flexible scheduling and incentive pay. The Company continues to grow sales from existing and new customers which has driven it to raise its forward guidance. The Fuel the Future strategy is working to increase its market share of the $140 billion total addressable market (TAM). The four keys of the strategy are to deliver significant value, improve the partnership with suppliers, provide unmatched career opportunities to workers, and support communities with ambitious ESG initiatives. He concluded, "Our strategy to capture the opportunity is simple. We are focused on getting better at what we do. We are working toward enhancing our capabilities and improving our end-to-end execution for the benefit of our customers, suppliers, associates and by doing so, importantly, our shareholders."

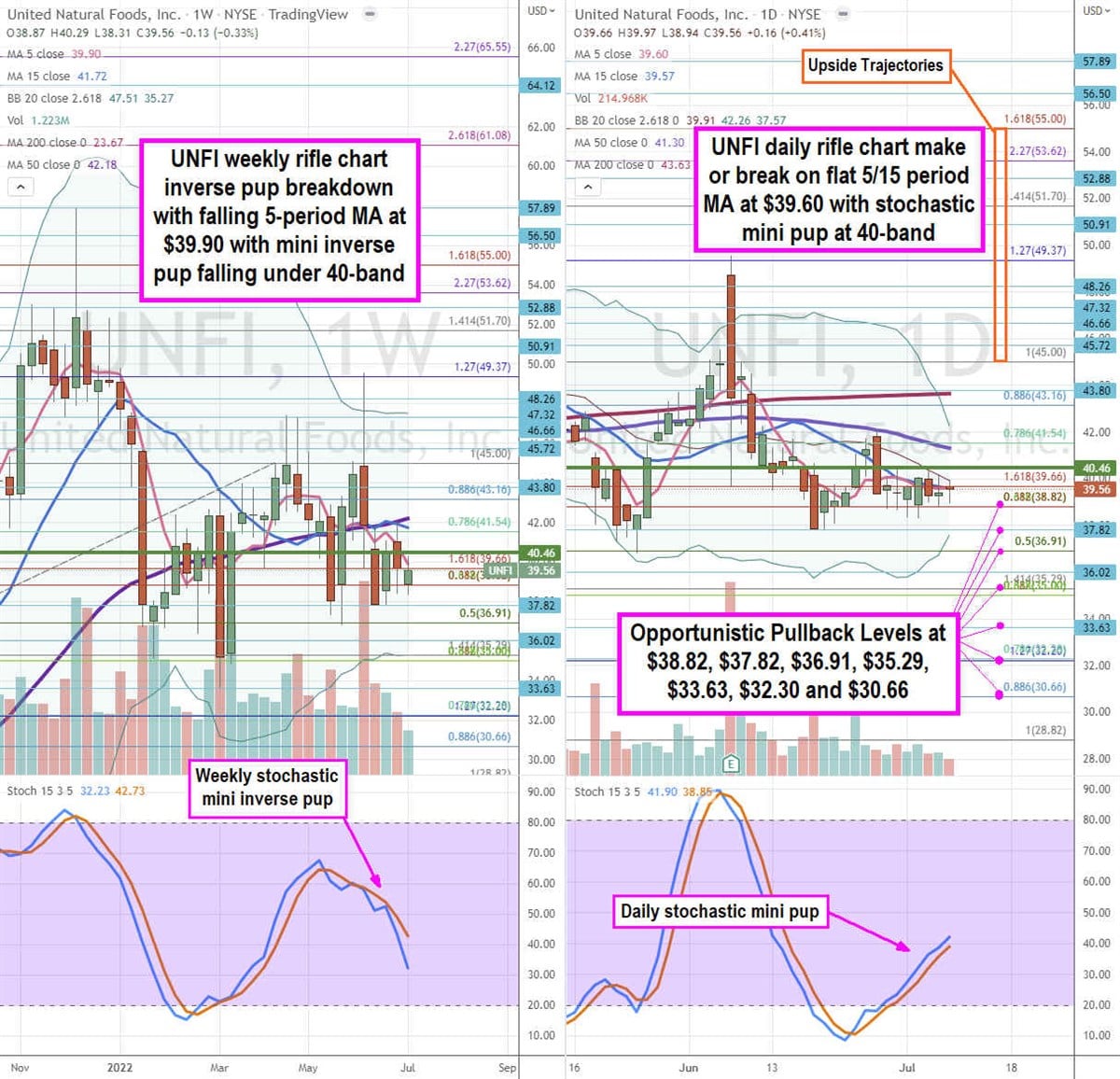

UNFI Opportunistic Price Levels

Using the rifle charts on the weekly and daily time frames provides a precision view of the landscape for UNFI stock. The weekly rifle chart recently peaked off the $49.37 Fibonacci (fib) level. The weekly inverse pup breakdown formed as the 5-period moving average (MA) falls at $39.90 followed by the 15-period MA at $41.72 and 50-period MA at $42.18. The weekly stochastic formed a mini inverse pup falling through the 40-band. The weekly lower Bollinger Bands (BBs) sit at the $35.00 fib area. The weekly market structure low (MSL) buy triggers above the $40.46 level. The daily rifle chart has been in a tight consolidation with a flat 5-period MA at $39.60 and 15-period MA at $39.57. The daily 50-period MA sits at $41.30 and 200-period MA at $43.63. The daily BBs are in a compression which precedes a price range expansion. The daily stochastic has a mini pup pushing up through the 40-band. Prudent investors can watch for opportunistic pullbacks at the $38.82 fib, $37.82, $36.91 fib, $35.29 fib, $33.63, $32.30 fib, and the $30.66 fib level. Upside trajectories range from the $45.00 fib up towards the $55.00 fib level.