Unity Software is the Other Video Game Engine To Watch

Video game engine creator Unity Software stock has joined Chinese electric vehicle (EV) maker XPeng, making it one to watch.

This story originally appeared on MarketBeat

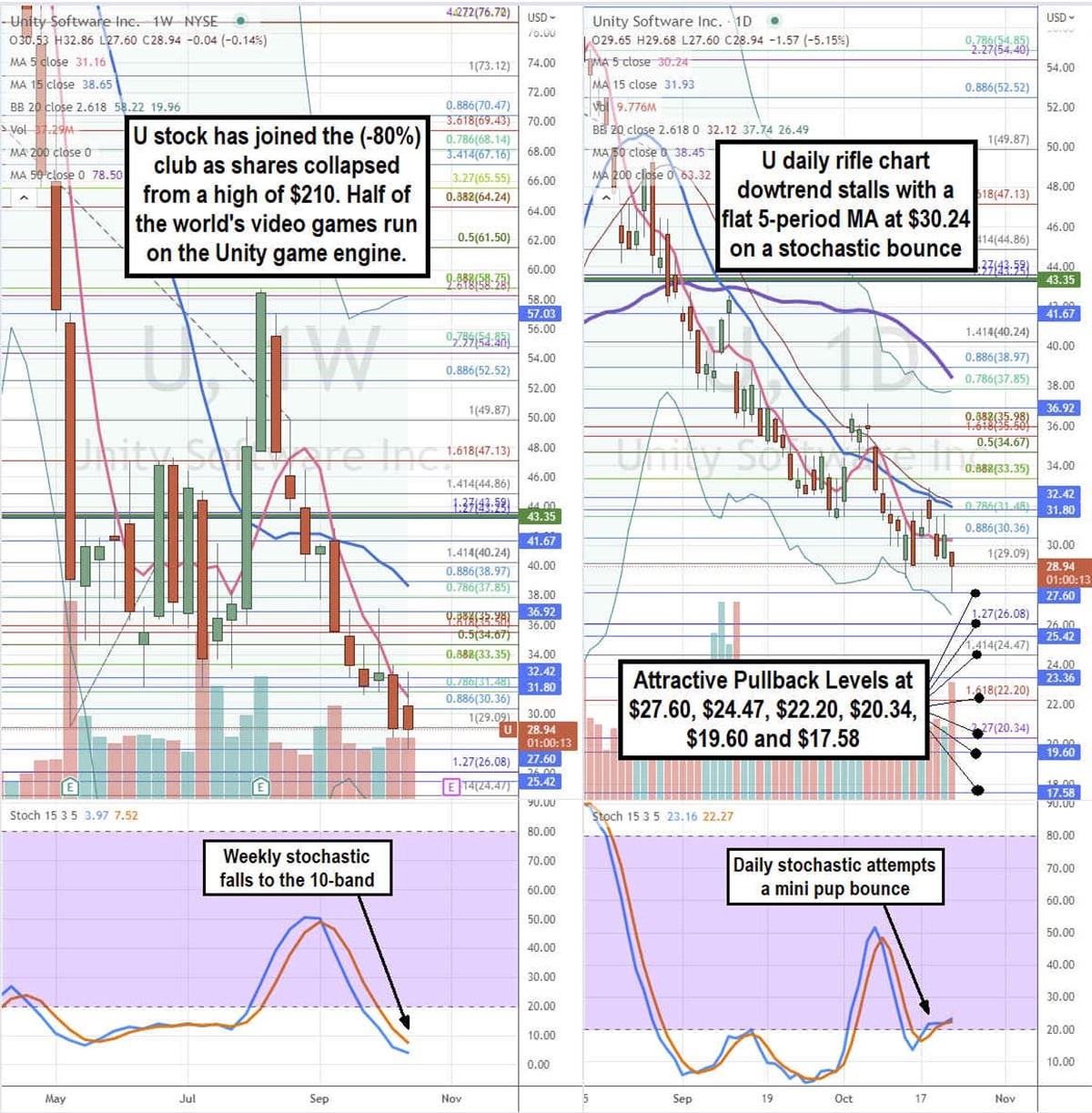

Video game engine creator Unity Software (NYSE: U) stock has joined Chinese electric vehicle (EV) maker XPeng (NASDAQ: XPENG) and artificial intelligence (AI) powered lending platform Upstart Holdings (NASDAQ: UPST) in the 80% club. These are stocks that have fallen -80% or more from their highs. The company provides an interactive real-time 3D content platform for developers to design, create, operate, and monetize 2D and 3D content. Nearly half of all the world’s video games, including those produced by major publishers Electronic Arts (NYSE: EA) and Take-Two Interactive (NASDAQ: TTWO), are created with the Unity 3D engine. It competes with privately owned Unreal Engine.

Outside of gaming, creators from architects, filmmakers and automotive designers including Mercedes Benz (OTCMKTS: MBGYY) use the Unity engine. Next-gen consoles like Sony PlayStation 5 (NYSE: SNE) and Microsoft Xbox One (NASDAQ: MSFT) are utilizing ever more complex 3D content to push gaming to new levels.

AppLovin Merger Proposal Shot Down

On August 15, 2022, Unity rejected a $20 billion all-stock merger proposal from AppLovin (NYSE: APP) for around $58.85 per share. The board of directors determined that a merger with AppLovin would not be superior to its acquisition of ironSource software, an app monetization technology platform. It decided to move forward with the acquisition of ironSource for $4.4 billion to close in Q4 2022 in the best interest of its shareholders. This started the downward spiral from a high of $58.63 to a 10-week sell-off to a lows of $27.60 on October 21, 2022. However, the decision was lauded by Needham’s analyst Bernie McTernan. The acquisition prepares Unity to accommodate diversified demand for content creation while hedging itself against lower consumer spending and tougher competition in the monetization industry.

Roblox Reversal of Fortune

Just as it seemed the video gaming segment was falling off a cliff with various warnings, including GPU maker Nvidia (NASDAQ: NVDA) and Roblox (NASDAQ: RBLX) reporting much improved September 2022 metrics that shot its shares up 18%. Its daily average users (DAU) rose 23% to 57.8 million. Total hours engaged rose 16% year-over-year (YOY) to $4 billion. Estimated bookings rose 11% and were between $212 million to $219 million. Estimated average bookings per daily active user were between $3.67 to $3.79. Estimated revenues were between $171 million to $180 million. Foreign currency fluctuations led to a reduction of 6% in YOY growth rate in September bookings.

Setting the Bar Lower

On August 9, 2022, Unity released its fiscal results for the quarter ending June 2022. The company reported an earnings per share (EPS) loss of $0.18, beating analyst estimates for -$0.21 by $0.03. Revenues grew 8.6% YOY to $297 million, missing $299.05 million consensus analyst estimates. The company grew its $100,000 clients to 1,085 from 888 in the same year-ago period. Unity partnered with Microsoft select Azure as its cloud partner build real-time 3D experienced from the Unity engine.

Lowering the Bar

Unity issued downside guidance for its Q3 2022 revenues to come in between $315 million to $335 million versus $346.25 million consensus analyst estimates with non-GAAP operating margin between (-10%) to (-16%). For full-year 2022, Unity expects revenues to range from $1.30 billion to $1.35 billion versus $1.36 billion consensus analyst estimates.

Video game engine creator Unity Software (NYSE: U) stock has joined Chinese electric vehicle (EV) maker XPeng (NASDAQ: XPENG) and artificial intelligence (AI) powered lending platform Upstart Holdings (NASDAQ: UPST) in the 80% club. These are stocks that have fallen -80% or more from their highs. The company provides an interactive real-time 3D content platform for developers to design, create, operate, and monetize 2D and 3D content. Nearly half of all the world’s video games, including those produced by major publishers Electronic Arts (NYSE: EA) and Take-Two Interactive (NASDAQ: TTWO), are created with the Unity 3D engine. It competes with privately owned Unreal Engine.

Outside of gaming, creators from architects, filmmakers and automotive designers including Mercedes Benz (OTCMKTS: MBGYY) use the Unity engine. Next-gen consoles like Sony PlayStation 5 (NYSE: SNE) and Microsoft Xbox One (NASDAQ: MSFT) are utilizing ever more complex 3D content to push gaming to new levels.

AppLovin Merger Proposal Shot Down

On August 15, 2022, Unity rejected a $20 billion all-stock merger proposal from AppLovin (NYSE: APP) for around $58.85 per share. The board of directors determined that a merger with AppLovin would not be superior to its acquisition of ironSource software, an app monetization technology platform. It decided to move forward with the acquisition of ironSource for $4.4 billion to close in Q4 2022 in the best interest of its shareholders. This started the downward spiral from a high of $58.63 to a 10-week sell-off to a lows of $27.60 on October 21, 2022. However, the decision was lauded by Needham’s analyst Bernie McTernan. The acquisition prepares Unity to accommodate diversified demand for content creation while hedging itself against lower consumer spending and tougher competition in the monetization industry.

Roblox Reversal of Fortune

Just as it seemed the video gaming segment was falling off a cliff with various warnings, including GPU maker Nvidia (NASDAQ: NVDA) and Roblox (NASDAQ: RBLX) reporting much improved September 2022 metrics that shot its shares up 18%. Its daily average users (DAU) rose 23% to 57.8 million. Total hours engaged rose 16% year-over-year (YOY) to $4 billion. Estimated bookings rose 11% and were between $212 million to $219 million. Estimated average bookings per daily active user were between $3.67 to $3.79. Estimated revenues were between $171 million to $180 million. Foreign currency fluctuations led to a reduction of 6% in YOY growth rate in September bookings.

The rest of this article is locked.

Join Entrepreneur+ today for access.

Already have an account? Sign In