UPS Slipping To More Attractive Levels On Weak Outlook

UPS had a tough quarter, but its dividend is safe enough in 2023. The stock returns to firming support levels and may produce a buy signal soon.

This story originally appeared on MarketBeat

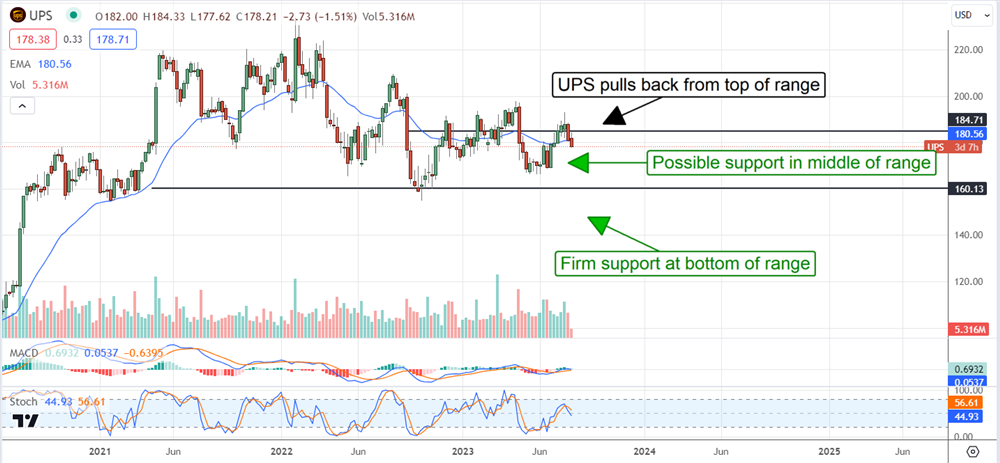

The United Parcel Service, Inc (NYSE: UPS) story is unchanged; internal improvements are offset by economic headwinds and canceling each other. The takeaway is that range-bound UPS is still range-bound, and the next entry point for income investors looking to build on their positions is close. UPS is a solid dividend-paying stock; this is a substantial opportunity for investors.

The stock yields over 3.5% at the top of the range, and new lows are unlikely. While near-term headwinds persist, the internal improvements set the company up for leverage on the rebound, the only question is when the rebound will begin, and it may not be soon.

UPS Has Tough Quarter, Guides Lower

UPS had a tough quarter impacted by declining volume, narrowing margin, and rising costs associated with the new Teamsters contract. The company reported $22.1 billion in net revenue, a decline of 10.9% compared to last year. This is 440 basis points less than the Marketbeat.com analysts’ consensus due to weakness in all 3 segments. Supply Chain Solutions was weakest, with revenue down 23% compared to last year.

International fell 13% on the combination of 6.6% lower volume and lower pricing, while Domestic business fell by 6.9%. A 10% decline in volume hit domestic business, attributed to lower digital and eCommerce traffic, which was only partially offset by higher pricing.

The margin news is mixed. The company’s operating margin narrowed in all 3 segments due to rising costs and deleveraging. This led to a sharp contraction in earnings and a 22% decline in adjusted EPS. The good news is that margin contracted less than expected and left the $2.54 in adjusted EPS $0.04 above consensus despite the top-line weakness.

The guidance is why the market fell more than 3.0% in early trading. UPS lowered its guidance for revenue and cut the guidance for margin due to the reduction in volume and costs associated with the Teamsters contract. The new contract is hailed as a win-win-win for all involved, but shareholders may not feel the same.

Revenue guidance was cut to $93 billion from the $96.6 target previously issued, while adjusted operating margin will fall to 11.8% for the year. That’s well below last year’s levels and 140 bps below Q2. This will result in lowered earnings and revenue targets from the analysts; it will probably result in lowered price targets and ratings.

The Analysts’ Sentiment Will Cap Gains In UPS

The analysts’ sentiment has been slipping for the last year and weighing heavily on the price action in UPS stock. The consensus of 21 analysts fell to Hold from Moderate Buy while the price target fell steadily.

The consensus target is about 5% above the pre-release action, now about 15% above the price action, but down compared to last year, last quarter, and last month, and it is likely to trend lower. Marketbeat.com’s tracking tools did not pick up any fresh revisions in the 1st 12 hours after the release, but we know they are coming.

Shares of UPS fell more than 3.0% in early trading to near the mid-point of its recent trading range. The fall found support at the middle of the range and may produce a rebound, but investors should not read too much into the move. The price action is biased to the downside, so a retest of support should be expected.

If the market is ready to buy this dip, the price action will quickly reflect that sentiment. If not, the stock could fall to $172 or lower before the next reporting cycle. In that scenario, the range’s low is near $160 and may provide solid support if reached.

The United Parcel Service, Inc (NYSE: UPS) story is unchanged; internal improvements are offset by economic headwinds and canceling each other. The takeaway is that range-bound UPS is still range-bound, and the next entry point for income investors looking to build on their positions is close. UPS is a solid dividend-paying stock; this is a substantial opportunity for investors.

The stock yields over 3.5% at the top of the range, and new lows are unlikely. While near-term headwinds persist, the internal improvements set the company up for leverage on the rebound, the only question is when the rebound will begin, and it may not be soon.