Upstart Stock Getting Attractive After an 82% Sell-Off

Cloud base artificial intelligence (AI) lending platform Upstart Holdings (NASDAQ: UPST) stock has collapsed (-82%) for 2022.

This story originally appeared on MarketBeat

Cloud base artificial intelligence (AI) lending platform Upstart Holdings (NASDAQ: UPST) stock has collapsed (-82%) for 2022. It’s hard to believe the stock was trading at a high of $401.49 in October of 2021. Shares were rocketed higher by triple-digit growth blowout earnings through 2021 thanks to robust demand perpetuated by loose monetary policy by the Federal Reserve. That took a severe turn for the worse since the Fed started raising interest rates. While margins may improve on loans, rising interest rates all but shatter demand for loans. The Fed is anticipated to accelerate its rate hikes to try to get a handle on the runaway 9.1% inflation. The platform has its own risk grade ratings as its system tends to have few default rates than traditional scores from FICO. AI-based credit underwriting was the next step in lending versus traditional credit underwriting. The recession risk and rising interest rates put banks on cautious footing, causing funding restraints. The Company converted loans on its balance sheet to cash, which hit revenues hard. The Company has $8.94 cash-per-share. Upstart lowered it guidance in May and lowered them even further in July, resulting in cascading waves of selling. The Company is focusing on the rollout of its auto retail product. The active auto dealership footprint spans over 35 different OEMs, including Volkswagen (OTCMKTS: VWAGY), Toyota Motors (NYSE: TM), and Subaru (OTCMKTS: FUJHY). Despite a downward forward trajectory, revenues still rose 155% in fiscal Q1 2022, and the Company is profitable. Prudent investors looking to get in on a leading AI-powered loan platform can watch for opportunistic pullbacks in shares of Upstart.

Fiscal Q4 2021 Earnings Release

On May 9, 2022, Upstart released its fiscal first-quarter 2022 results for the quarter ended March 2022. The Company reported an earnings-per-share (EPS) profit of $0.61 versus $0.53 consensus analyst estimates, a $0.08 beat. Revenues grew 155.6% year-over-year (YoY) to $310.14 million, beating analyst estimates for $300.13 million. Bank partners originated 465,537 loans totaling $4.5 billion, up 174%. Conversion on rate requests grew 21%, down (-22%) from year-ago period. Upstart Holdings CEO David Girouard commented, “Upstart just delivered our seventh consecutive profitable quarter and our fourth straight quarter with triple-digit year-on-year revenue growth. While this year is shaping up to be a challenging one for the economy, we know the drill and are confident that we can navigate whatever 2022 and beyond might hold.”

Downside Guidance

Upstart lowered its fiscal Q2 2022 revenues to between $295 million and $305 million versus $334.83 million consensus analyst estimates. Adjusted EBITDA us expected to be between $32 million and $34 million. Adjusted net income is expected to be between $28 million to $30 million. Upstart provided downside guidance for fiscal full-year 2022 revenues of $1.25 billion versus $1.4 billion consensus analyst estimates. Adjusted EBITDA is expected to be around 15%.

Conference Call Takeaways

CEO Girouard said 2022 was off to a great start, with record loan transactions growing by over $4.5 billion. The Company also added a huge number of dealerships and lenders in the quarter. Total dealers grew to over 500, as well as 57 banks and credit unions. They are adding a lender per week. They also have 11 lenders who require no minimum FICO score. The Company did over 11,000 auto refi loans in the quarter, up nearly 100% from 2021. The economy became challenging in recent weeks, notably in the financial services industry. Lending is a cyclical industry so expect volume and pricing to vary accordingly on the platform. Due to the rising economic risk coupled with higher returns demanded by banks and credit investors, the average loan pricing rose an average of 300 basis points since October 2021. Increasing rates for approved borrows, in essence, lowers the approval rates for applicants. Higher prices are expected this year due to the hawkish stance of the Fed.

UPST Opportunistic Pullback Levels

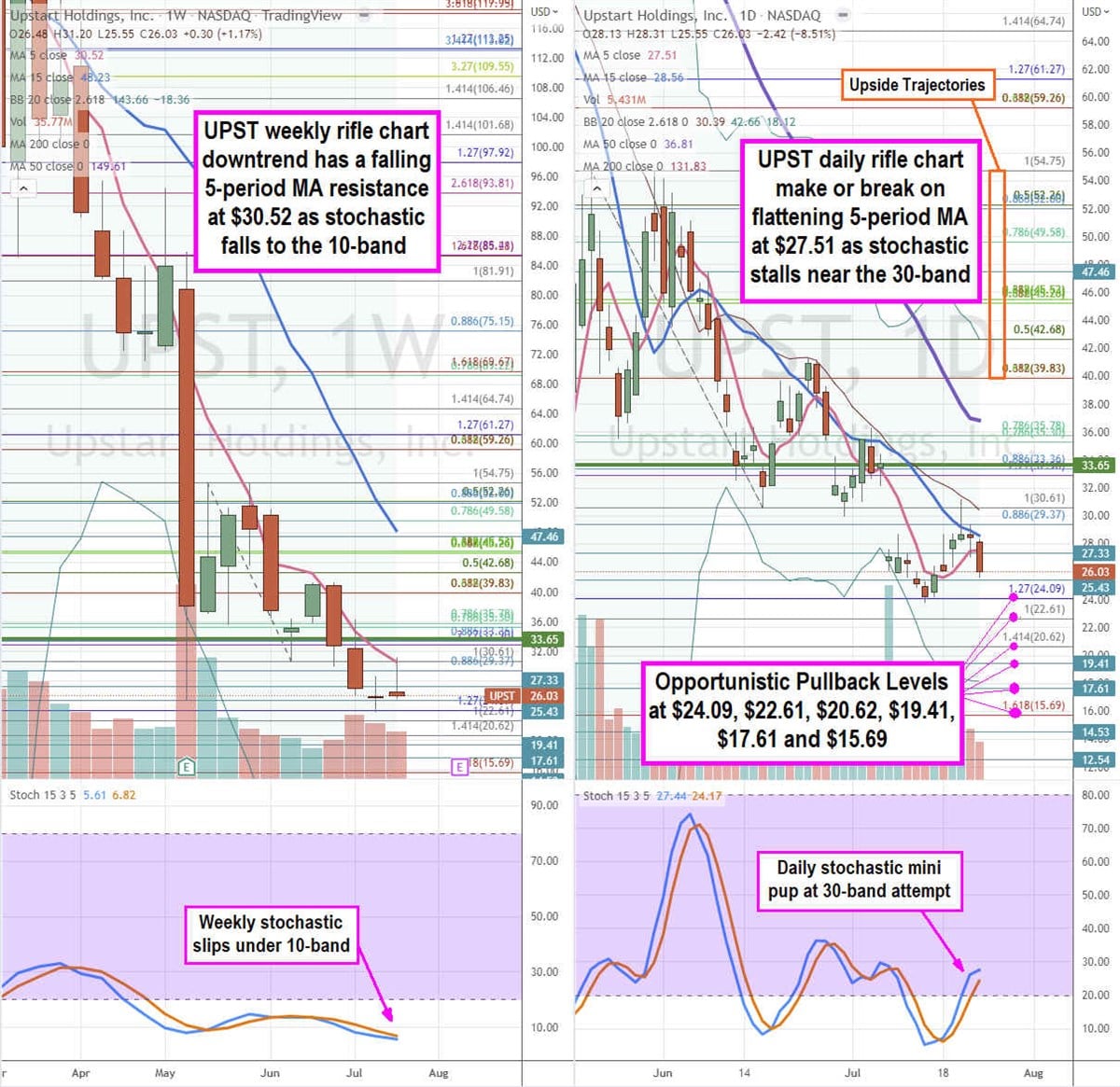

Using the rifle charts on the weekly and daily time frames provides a precise view of the landscape for UPST stock. The weekly rifle chart put in a swing low near the $24.09 Fibonacci (fib) level. The weekly downtrend has a falling 5-period moving average (MA) at $30.52 followed by the 15-period MA at $48.23. The weekly stochastic fall back under the 10-band on a mini inverse pup. The weekly lower Bollinger Bands (BBs) sit at $18.36. The weekly market structure low (MSL) buy triggers above $33.65. The daily rifle chart has a make or break. The daily 5-period MA stalled at $27.51 as the 15-period MA continued lower at $28.56. The daily 50-period MA sits at $36.81. The daily stochastic is stalled just under the 30-band as it attempts a potential mini pup. Prudent investors can monitor for opportunistic pullback levels at the $24.09 fib, $22.61 fib, $20.62 fib level, 19.41, $17.61, and the $15.69 fib level.

Cloud base artificial intelligence (AI) lending platform Upstart Holdings (NASDAQ: UPST) stock has collapsed (-82%) for 2022. It’s hard to believe the stock was trading at a high of $401.49 in October of 2021. Shares were rocketed higher by triple-digit growth blowout earnings through 2021 thanks to robust demand perpetuated by loose monetary policy by the Federal Reserve. That took a severe turn for the worse since the Fed started raising interest rates. While margins may improve on loans, rising interest rates all but shatter demand for loans. The Fed is anticipated to accelerate its rate hikes to try to get a handle on the runaway 9.1% inflation. The platform has its own risk grade ratings as its system tends to have few default rates than traditional scores from FICO. AI-based credit underwriting was the next step in lending versus traditional credit underwriting. The recession risk and rising interest rates put banks on cautious footing, causing funding restraints. The Company converted loans on its balance sheet to cash, which hit revenues hard. The Company has $8.94 cash-per-share. Upstart lowered it guidance in May and lowered them even further in July, resulting in cascading waves of selling. The Company is focusing on the rollout of its auto retail product. The active auto dealership footprint spans over 35 different OEMs, including Volkswagen (OTCMKTS: VWAGY), Toyota Motors (NYSE: TM), and Subaru (OTCMKTS: FUJHY). Despite a downward forward trajectory, revenues still rose 155% in fiscal Q1 2022, and the Company is profitable. Prudent investors looking to get in on a leading AI-powered loan platform can watch for opportunistic pullbacks in shares of Upstart.

Fiscal Q4 2021 Earnings Release

On May 9, 2022, Upstart released its fiscal first-quarter 2022 results for the quarter ended March 2022. The Company reported an earnings-per-share (EPS) profit of $0.61 versus $0.53 consensus analyst estimates, a $0.08 beat. Revenues grew 155.6% year-over-year (YoY) to $310.14 million, beating analyst estimates for $300.13 million. Bank partners originated 465,537 loans totaling $4.5 billion, up 174%. Conversion on rate requests grew 21%, down (-22%) from year-ago period. Upstart Holdings CEO David Girouard commented, “Upstart just delivered our seventh consecutive profitable quarter and our fourth straight quarter with triple-digit year-on-year revenue growth. While this year is shaping up to be a challenging one for the economy, we know the drill and are confident that we can navigate whatever 2022 and beyond might hold.”

Downside Guidance

Upstart lowered its fiscal Q2 2022 revenues to between $295 million and $305 million versus $334.83 million consensus analyst estimates. Adjusted EBITDA us expected to be between $32 million and $34 million. Adjusted net income is expected to be between $28 million to $30 million. Upstart provided downside guidance for fiscal full-year 2022 revenues of $1.25 billion versus $1.4 billion consensus analyst estimates. Adjusted EBITDA is expected to be around 15%.