Warner Brothers Discovery is a Powerhouse Entertainment Play

Media entertainment company Warner Brothers Discovery (NYSE: WBD) stock has languished since its spin-off as it fell to new all-time lows at $12.77 .

This story originally appeared on MarketBeat

Media entertainment company Warner Brothers Discovery (NYSE: WBD) stock has languished since its spin-off as it fell to new all-time lows at $12.77 and down (-41%) year-to-date. Formerly Discovery Networks, the merging with WarnerMedia has created a content powerhouse including popular brands like Food Network, Discovery, CNN, TLC, Cartoon Network, Animal Planet to the Science Channel, Cinemax, and HBO Max. Its vast content library spans documentaries, reality shows, blockbuster major motion pictures, and arguably the most iconic comic book brand DC. DC alone has the most recognizable superhero franchises in the world, including Superman, Batman, Wonder Woman, and Justice League. The stock had insider buying through April and May in the $18 to $20 range and even attracted the Big Short fund manager Mike Burry. The Company trades at 7.25X earnings and has enough content to rival the big streamers, including Netflix (NASDAQ: NFLX), Disney (NYSE: DIS), Amazon Prime Video (NADSAQ: AMZN), and Paramount (NASDAQ: PARA). While the Marvel Comic Universe (MCU) may have peaked, its rival DC Extended Universe (DCEU) is just getting started. Its collectively streaming audience is 100 million subscribers and growing. WBD also owns popular video gaming franchises, including the LEGO brand video games, Mortal Kombat, Suicide Squad, and the Batman Arkham series. The streaming wars rocketed up stock prices for streaming and content companies in 2021 and collapsed them in 2022. Prudent and patient investors seeking exposure in a media entertainment content powerhouse can watch for opportunistic pullbacks in shares of Warner Brothers Discovery.

Fiscal Q1 2022 Earnings Release

On April 26, 2022, WBD released its fiscal first-quarter fiscal 2022 results for the quarter ending March 2022. Since this was the first quarter since the merger, it didn’t include WarnerMedia business, only for Discovery Inc. The revenues for fiscal Q1 2022 were $3.16 billion, up 13% year-over-year (YoY). International advertising revenues rose 5%. Net Income was $456 million. Total adjusted OIBDA was $1.027 billion. The Company ended the quarter with $4.2 billion of cash and cash equivalents on gross debt of $15.1 billion net leverage 2.7X. The Company ended the quarter with 24 million DTC subscribers, up 2 million since Q4 2021. WBD CEO David Zaslav commented, “With Warner Bros. Discovery, we are creating a pure-play media company with diversified revenues and the most compelling IP ownership, franchises, and brand portfolio in our industry. Importantly, we also have an unrivaled global footprint of touchpoints to get our content into the hands of consumers on every screen. We are putting together the strategic framework and organization to drive our balanced approach to grow our businesses and maximize the value of our storytelling, news, and sports. To do this, we have brought together a strong leadership team in a streamlined structure to foster better command and control and strategic clarity across the entire company. I could not be more excited about the massive opportunity ahead.”

Conference Call Takeaways

CEO Zaslav spoke about the transformation merger between Discovery and WarnerMedia and how bright the future looked for the pairing. He spoke of the world-class IP content and distribution capabilities of the Company through tv, streaming, and theatrical for a balance monetization model. The goal is to drive durable and sustainable free cash flow generation. The Company plans to offer both ad-free premium content and lower priced ad-light tier, which is modeled after its tremendous success with its highest ARPU product. Collectively, the streaming network has 100 million subscribers and growing. The distribution network has the ability to ring cash registers by theatrical, gaming, premium home video, Pay TV, and free-to-air broadcast. The merger will also drive more than $3 billion through its cost synergy plan.

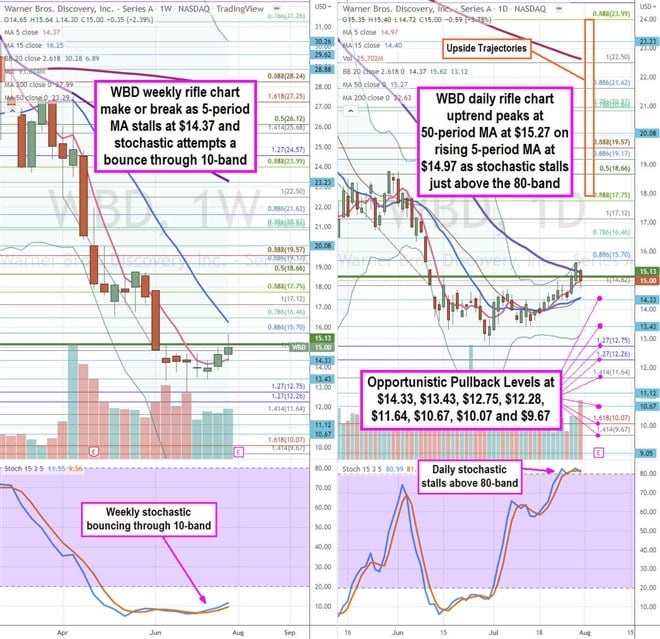

WBD Opportunistic Pullback Price Levels

Using the rifle charts on the weekly and daily time frames provides a precise view of the landscape for WBD stock. The weekly rifle chart put in a post-merger bottom near the $12.75 Fibonacci (fib) level. The weekly rifle chart downtrend is starting to stall as the weekly 5-period moving average (MA) stalls at $14.37 while the 15-period MA resistance continues to fall at $16.25. The weekly stochastic is also trying to bounce up through the 10-band. The weekly market structure low (MSL) buy triggers the breakout above $15.13. The weekly lower Bollinger Bands (BBs) sit at $6.89, and weekly upper BBs sits at $30.26, with the weekly 50-period MA resistance at $23.29. The daily rifle chart has been uptrending as it peaked off the daily upper BBs at $15.62 and the daily 50-period MA at $15.27. The daily 5-period MA is rising at $14.97 followed by the daily 15-period MA support at $14.40. The daily stochastic is stretched above the overbought 80-band level as it stalls for a potential reversal or a high band mini pup. Prudent investors can monitor for opportunistic pullback price levels at the $14.33, $13.43, $12.75 fib, $12.26 fib, $11.64 fib, $10.67, $10.07 fib, and the $9.67 fib. Upside trajectories range from the $17.75 fib level up towards the $23.99 fib level.

Media entertainment company Warner Brothers Discovery (NYSE: WBD) stock has languished since its spin-off as it fell to new all-time lows at $12.77 and down (-41%) year-to-date. Formerly Discovery Networks, the merging with WarnerMedia has created a content powerhouse including popular brands like Food Network, Discovery, CNN, TLC, Cartoon Network, Animal Planet to the Science Channel, Cinemax, and HBO Max. Its vast content library spans documentaries, reality shows, blockbuster major motion pictures, and arguably the most iconic comic book brand DC. DC alone has the most recognizable superhero franchises in the world, including Superman, Batman, Wonder Woman, and Justice League. The stock had insider buying through April and May in the $18 to $20 range and even attracted the Big Short fund manager Mike Burry. The Company trades at 7.25X earnings and has enough content to rival the big streamers, including Netflix (NASDAQ: NFLX), Disney (NYSE: DIS), Amazon Prime Video (NADSAQ: AMZN), and Paramount (NASDAQ: PARA). While the Marvel Comic Universe (MCU) may have peaked, its rival DC Extended Universe (DCEU) is just getting started. Its collectively streaming audience is 100 million subscribers and growing. WBD also owns popular video gaming franchises, including the LEGO brand video games, Mortal Kombat, Suicide Squad, and the Batman Arkham series. The streaming wars rocketed up stock prices for streaming and content companies in 2021 and collapsed them in 2022. Prudent and patient investors seeking exposure in a media entertainment content powerhouse can watch for opportunistic pullbacks in shares of Warner Brothers Discovery.

Fiscal Q1 2022 Earnings Release

On April 26, 2022, WBD released its fiscal first-quarter fiscal 2022 results for the quarter ending March 2022. Since this was the first quarter since the merger, it didn’t include WarnerMedia business, only for Discovery Inc. The revenues for fiscal Q1 2022 were $3.16 billion, up 13% year-over-year (YoY). International advertising revenues rose 5%. Net Income was $456 million. Total adjusted OIBDA was $1.027 billion. The Company ended the quarter with $4.2 billion of cash and cash equivalents on gross debt of $15.1 billion net leverage 2.7X. The Company ended the quarter with 24 million DTC subscribers, up 2 million since Q4 2021. WBD CEO David Zaslav commented, “With Warner Bros. Discovery, we are creating a pure-play media company with diversified revenues and the most compelling IP ownership, franchises, and brand portfolio in our industry. Importantly, we also have an unrivaled global footprint of touchpoints to get our content into the hands of consumers on every screen. We are putting together the strategic framework and organization to drive our balanced approach to grow our businesses and maximize the value of our storytelling, news, and sports. To do this, we have brought together a strong leadership team in a streamlined structure to foster better command and control and strategic clarity across the entire company. I could not be more excited about the massive opportunity ahead.”

Conference Call Takeaways

CEO Zaslav spoke about the transformation merger between Discovery and WarnerMedia and how bright the future looked for the pairing. He spoke of the world-class IP content and distribution capabilities of the Company through tv, streaming, and theatrical for a balance monetization model. The goal is to drive durable and sustainable free cash flow generation. The Company plans to offer both ad-free premium content and lower priced ad-light tier, which is modeled after its tremendous success with its highest ARPU product. Collectively, the streaming network has 100 million subscribers and growing. The distribution network has the ability to ring cash registers by theatrical, gaming, premium home video, Pay TV, and free-to-air broadcast. The merger will also drive more than $3 billion through its cost synergy plan.