Where Do Stocks Go from Here?

The S&P 500 (SPY) has already made new highs just above 6,000. However, that seems to be a point of stiff resistance. This begs the question of what happens next?…

This story originally appeared on StockNews

The S&P 500 (SPY) has already made new highs just above 6,000. However, that seems to be a point of stiff resistance. This begs the question of what happens next? And what should an investor do to stay on the right side of the action? Read on below for Steve Reitmeister’s time answers and top 10 stocks.

We have already reached my year end target of 6,000 for the S&P 500 (SPY). Even better, my belief that small caps would do at least 2X better has proven to be true as well.

This explains why the Reitmeister Total Return portfolio has “opened up a can of whoop ass” on the market with year to date gains of +30.73%.

This all begs the question as to what the end of the year looks? And what should investors do to be on the right side of the action?

Answering these key questions will be the focus of commentary today.

Market Outlook

The time-honored saying is “The Trend is Your Friend“.

So with the election solidified, economy on track and probable Santa Claus rally on the way in December, then there is little reason to doubt that stocks will keep pushing higher into the year end.

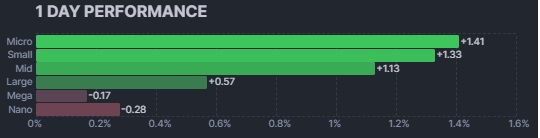

However, I think Monday’s action gives a good taste of what the action looks like going forward starting with a view of performance by market cap:

As shared in the intro, smaller stocks are finally enjoying some time leading the bull market parade with larger stocks taking a back seat. Even more telling was the actual losses for the Mega Caps as it is fair to see their valuations are getting fairly stretched.

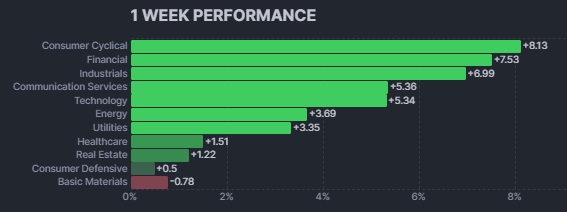

On top of that you have an interesting view by sector. In this case I prefer to show you results for the past week to appreciate what has been in favor since the election:

This is a very Risk On mix of stocks. Note that Technology is lagging. In fact, that sector was down -0.63% on Monday. This is a sign that investors might be done hitting the “Easy Button” with their stock investments which has led to obscene overvaluations for many of the popular tech names (especially mega cap tech).

Adding it altogether and I think the S&P 500 maybe has upside to 6,200 at most with 6,100 being more likely. This points to a solid yet modest return to end the year.

Again, I think smaller stocks will continue to lead as they should be playing catch up after 4 straight years of underperformance to large caps. A 5-10% gain for that group to close out the year would not be a surprise to me.

This is a trend I expect to continue into 2025 where I think the S&P 500 has low single digit gains on the year given that valuations are stretched (PE of 23).

Yet a 15-20% gain for the small cap index (Russell 2000) and 10-15% gain for mid caps is an appropriate action for next year given the groups much more modest PE of 16.

As shared with you guys in the past, the POWR Ratings is outstanding at picking stocks in any environment given the average annual return of +28.54%. However, its best years of outperformance are when value is in fashion…and when small caps lead the charge.

Both seem to be on tap for 2025 and thus strongly believe my portfolio focused on the POWR Ratings should continue to have another year of tremendous outperformance.

What To Do Next?

Discover my current portfolio of 10 stocks packed to the brim with the outperforming benefits found in our exclusive POWR Ratings model. (Nearly 4X better than the S&P 500 going back to 1999).

All of these hand selected picks are all based on my 44 years of investing experience seeing bull markets…bear markets…and everything between.

And right now this portfolio is beating the stuffing out of the market.

If you are curious to learn more, and want to see my top 10 timely stock recommendations, then please click the link below to get started now.

Steve Reitmeister’s Trading Plan & Top 10 Stocks >

Wishing you a world of investment success!

Steve Reitmeister…but everyone calls me Reity (pronounced “Righty”)

CEO, StockNews.com and Editor, Reitmeister Total Return

SPY shares rose $0.06 (+0.01%) in after-hours trading Tuesday. Year-to-date, SPY has gained 26.77%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Steve Reitmeister

Steve is better known to the StockNews audience as “Reity”. Not only is he the CEO of the firm, but he also shares his 40 years of investment experience in the Reitmeister Total Return portfolio. Learn more about Reity’s background, along with links to his most recent articles and stock picks.

The post Where Do Stocks Go from Here? appeared first on StockNews.com

The S&P 500 (SPY) has already made new highs just above 6,000. However, that seems to be a point of stiff resistance. This begs the question of what happens next? And what should an investor do to stay on the right side of the action? Read on below for Steve Reitmeister’s time answers and top 10 stocks.

We have already reached my year end target of 6,000 for the S&P 500 (SPY). Even better, my belief that small caps would do at least 2X better has proven to be true as well.

This explains why the Reitmeister Total Return portfolio has “opened up a can of whoop ass” on the market with year to date gains of +30.73%.