Where Do Stocks Head from Here?

The Fed did their part to finally start lowering rates with that stocks burst higher with the S&P 500 (SPY) making a new all time high. Since then it has…

This story originally appeared on StockNews

The Fed did their part to finally start lowering rates with that stocks burst higher with the S&P 500 (SPY) making a new all time high. Since then it has not all been “rainbows and lollipops” which begs the question: Where do stocks head from here? Steve Reitmeister will answer that question in the article below.

The Fed delivered on expectations to start rate cutting with a solid 50 point basis move on Wednesday. Along with that was the expectation for another 150 points of reduction to be served up by the end of 2025.

This was more dovish than expected which helped push the S&P 500 (SPY) to new highs. Even more appealing was the broadening out of gains from just a handful of mega caps to many small and mid cap stocks.

Or to put it another way…the bull market for all has finally begun.

Let’s spend some time today looking into the specifics of this Fed decision and what lies ahead for investors. That will be the focus of today’s Reitmeister Total Return commentary.

Market Outlook

Here is the key excerpt from my commentary last week sharing 3 Paths for Stocks AFTER the Fed Meeting. I explain that this path was the most probable:

“50 Point Cut + But Cautious

This is the most likely outcome as right now investors put 63% odds on a 50 basis point cut being served up. Then combine this with typical Fed speak on how their next move would be based on the data and thus have no prescribed path for future cuts ordained.

Because this is the assumed outcome, then investors might push higher for a session or two in order to make new highs. But really much of this move is already baked into the cake of current stock prices. This would put each next Fed meeting into play as a key catalyst for what happens next.

The more dovish they become to cut rates faster…the more bullish for stocks. And the more cautious they are…the more likely stocks have a hard time moving substantially higher than now.”

I think the key section is that last paragraph. So please review again.

Even though Powell was his ever “data dependent” self…it was still a more dovish outcome than many expected. So there may be a bit more upside to this move going into year end. (More on that at the end of this Market Outlook section).

Now let me share the notes I took to summarize the event for a webinar I gave later that afternoon:

- 50 basis points…investors immediately hit the buy button on that news.

- Dot plot about future path of rate cuts? Shows the consensus around 3.25% by end of 2025 which is 1.5% lower than now. But not much lower thereafter.

- Anything else in the Summary of Economic Projections (SEP)? Pretty much the same as last time. Still predicting soft landing with a pretty flat lined 2.0% GDP projection for every year between 2024 and 2025.

- Unemployment stays aloft at 4.4% by end of 2025 and then comes down only slightly over next 2 years

- I would call this a muddle through outlook. Which likely explains why they don’t plan on bringing rates down much because if the economy softens at any point, then they will have some ammo at their disposal to lower rates and pick up pace of economy.

- How dovish vs. cautious was Powell about next steps? Balanced which was to be expected. The key is about their dual mandate (full employment and stable prices). Any further weakness to employment will likely have them cut faster even if inflation not easing as fast as hoped for.

- Data dependent language as expected.

- My bet is that they plan on going 50 basis points every 2-3 meetings allowing them to be cautious. But really that is not much different than doing 25 every meeting for a while.

- How does this effect my investment plan? Exactly as expected…no change

- General agreement between Fed and the market after investors were too optimistic too early about rate cuts. Nice to have alignment.

- They believe they are right on time with this cut. Not late or in a rush as some think the 50 basis point cut implies. I agree with this statement when you appreciate that inflation is still somewhat elevated…but given lagged effects on track to get inflation down to size without undue harm to the jobs market.

(End of My Fed Meeting Notes)

Trading Plan

At this stage I think that 6,000 is a possible peak for the S&P 500 this year. However, it should be a spot of firm resistance where much of 2025 is fought over that same battleground.

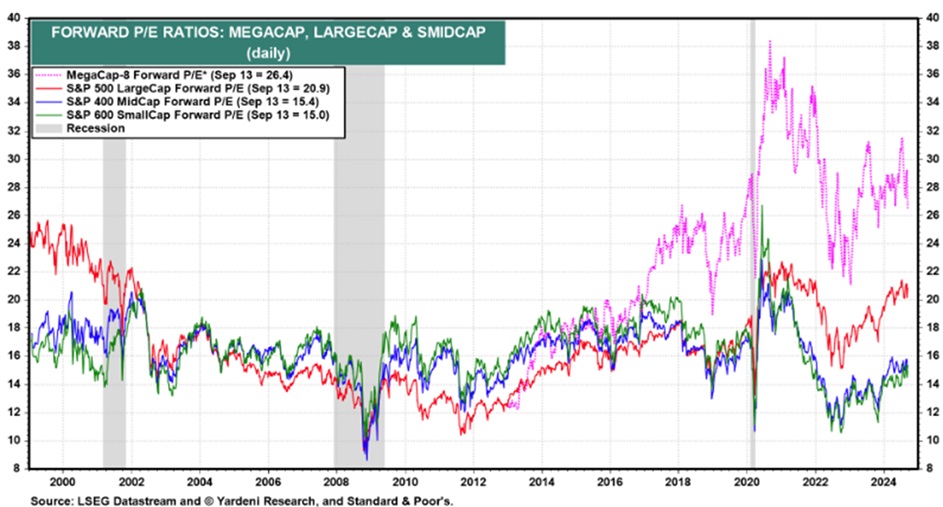

More importantly is for small and mid caps to outperform going forward and thus those indices should likely outpace the returns of their large cap peers. As this valuation chart shows mega caps (pink) are overvalued…large caps (red) are fully valued…and small (green) and mid caps (blue) are undervalued. Thus, naturally they are the groups to overweight now:

Indeed, small and mid caps have outperformed of late. Pretty much true for the past month.

More importantly, that is the most natural outcome during a bull market as investors should be more focused on smaller companies that typically have more impressive growth profiles. What’s even better at this moment is that the growth comes with a lower valuation making all the more attractive.

The best way to find the most attractive of these stocks is with the POWR Ratings system. (You knew I was going to say that 😉

The scan of 118 different factors including 13 measures of growth and 31 measures of value greatly increases the odds of being in a healthy growing company that will outperform the market. That certainly helps explain the +28.56% average annual gain for our coveted A rated stocks going back to 1999.

Please review all of your positions on StockNews.com and see how they stack up with our POWR Ratings. And to find my personal favorite picks, just read on below…

What To Do Next?

Discover my current portfolio of 11 stocks packed to the brim with the outperforming benefits found in our exclusive POWR Ratings model. (Nearly 4X better than the S&P 500 going back to 1999).

All of these hand selected picks are all based on my 44 years of investing experience seeing bull markets…bear markets…and everything between.

And right now this portfolio is beating the stuffing out of the market.

If you are curious to learn more, and want to see my 11 timely stock recommendations, then please click the link below to get started now.

Steve Reitmeister’s Trading Plan & Top 11 Stocks >

Wishing you a world of investment success!

Steve Reitmeister…but everyone calls me Reity (pronounced “Righty”)

CEO, StockNews.com and Editor, Reitmeister Total Return

SPY shares were unchanged in after-hours trading Tuesday. Year-to-date, SPY has gained 20.96%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Steve Reitmeister

Steve is better known to the StockNews audience as “Reity”. Not only is he the CEO of the firm, but he also shares his 40 years of investment experience in the Reitmeister Total Return portfolio. Learn more about Reity’s background, along with links to his most recent articles and stock picks.

The post Where Do Stocks Head from Here? appeared first on StockNews.com

The Fed did their part to finally start lowering rates with that stocks burst higher with the S&P 500 (SPY) making a new all time high. Since then it has not all been “rainbows and lollipops” which begs the question: Where do stocks head from here? Steve Reitmeister will answer that question in the article below.

The Fed delivered on expectations to start rate cutting with a solid 50 point basis move on Wednesday. Along with that was the expectation for another 150 points of reduction to be served up by the end of 2025.

This was more dovish than expected which helped push the S&P 500 (SPY) to new highs. Even more appealing was the broadening out of gains from just a handful of mega caps to many small and mid cap stocks.