Why Do Penny Stocks Often Crash After Rallies?

In-depth analysis of the legal pump and dumps that you see everyday on Most Active stock lists, and the blind spot that dooms so many penny stock trades.

This story originally appeared on MarketBeat

It’s a regular occurrence. Penny stocks always dominate the top daily gainers and losers lists, often skyrocketing 50% or more in a single day. But the rapid price appreciation is usually followed by an equally dramatic crash in the price.

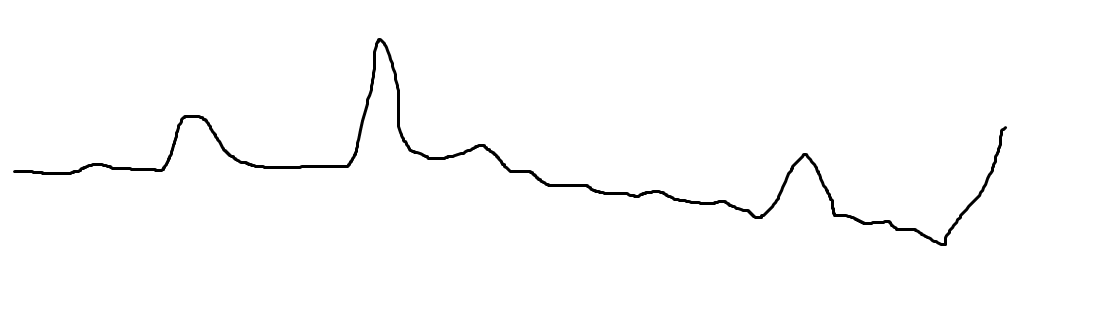

And you can probably picture these charts in your head. The price action looks more like an EKG than a stock chart. A treacherous long-term downtrend with aggressive upward spikes, quickly followed by a symmetrical crash.

Here’s a rough drawing of this EKG pattern:

Textbook investing theory says this shouldn’t happen. You can’t justify doubling a company’s value one day only to reverse course in a few days. Such sudden changes don’t occur in the real world.

So what gives?

The Modern Version of a Pump and Dump

You’re probably thinking of Leonardo DiCaprio asking for sixty seconds of your time so he can tell you about a groundbreaking airplane technology investment opportunity, a la The Wolf of Wall Street.

Reality is far less dramatic.

Most of these companies have market caps under $100 million. They are just barely holding onto their exchange membership with NYSE or NASDAQ. But don’t underestimate them; some companies can be terrible investments, but they find ways to survive.

Looking back at the charts of these stocks, many have been around for several decades, even trading under multiple names. They’re often the remnants of a 90s dot-com bubble stock. A fitting start.

However, these companies must find creative ways to raise capital to maintain their exchange membership and pay the associated listing fees.

Enter the hyped-up press release. They’re often full of promising developments like partnerships with larger companies, bids for government contracts, or a new product prototype. Anything to trigger FOMO in retail investors.

Rather than focusing on hard facts, these press releases are designed to attract naive retail traders and trigger a short-term rally. Then the momentum day traders jump in and add fuel to the fire.

However, rallies based on pure hype are unsustainable and bound to fail at some point. The vast majority do, as evidenced by that classic “EKG” chart pattern of rapid price spikes followed by equally quick crashes.

So why would a company even bother going through this if it just leads to a short-term rally in their stock? After all, it’d be insider trading for executives to sell following the launch of a press release.

The answer lies in a strategic loophole: the shelf offering.

Shelf offerings allow a company to register the sale of additional shares, giving them a 3-year window to sell the shares when market conditions are most favorable. Putting the shares “on the shelf” to sell in the future.

During a short-term rally, the company can ‘activate’ its shelf offering and sell shares directly to institutional investors (mostly hedge funds), often at a discount to the current market price. This allows the hedge funds to dump the discounted shares on the public, pocketing a quick profit and thus starting the “dump” phase of a modern pump and dump.

Take the example of Penny Stock XYZ, trading at $0.50 per share with 50 million shares outstanding and a market cap of $25 million. Two months prior, the company filed a shelf registration to sell 20 million shares.

One morning the company issued a press release teasing a potential partnership with a major player in their industry, causing the stock to rally to $0.80. As expected, the company then announces a direct offering of, let’s say, 5 million of the 20 million shares in their shelf registration and sells them at a discount to hedge funds.

The outcome is a dilution of shareholder equity, as the outstanding shares increased by 10%. Meanwhile, the immediate sale of 5 million shares into the market exacerbates the downward pressure on the stock and, thus, completes the “dump” phase.

Bottom Line

As a rule, you should be suspicious of any sudden spike in penny stock prices, even more so if the stock chart resembles the “EKG” pattern.

While trading penny stocks is best left to advanced traders who can handle the swings, there’s no doubt that many have made their fortune in this niche and will want to dip their toes in.

But it’s crucial to note the differences between large-cap trading stocks and penny stocks. Manipulation is rampant in penny stocks, making the risk of a sudden catastrophic loss much higher and the price action to act differently than your everyday large-cap stock.

One way to protect yourself and know what to expect is to read the company’s SEC filings and be aware of any ongoing share registrations, with the knowledge that a new one could drop as soon as you establish your position.

It’s a regular occurrence. Penny stocks always dominate the top daily gainers and losers lists, often skyrocketing 50% or more in a single day. But the rapid price appreciation is usually followed by an equally dramatic crash in the price.

And you can probably picture these charts in your head. The price action looks more like an EKG than a stock chart. A treacherous long-term downtrend with aggressive upward spikes, quickly followed by a symmetrical crash.