Do you cringe at the thought of navigating complex credit card processing fee schedules? If so, flat-rate processing might be the answer. This model offers credit card processing for a predictable monthly fee, allowing entrepreneurs to take the guesswork out of budgeting.

Sounds like a win, right? Well, it depends on your business. While flat-rate processing boasts an easy-to-understand fee structure, it isn’t a great fit for everyone. Read on to uncover the pros and cons of flat-rate processing so you can decide if it’s a golden ticket to streamlined payments — or a recipe for hidden fees.

What is credit card processing?

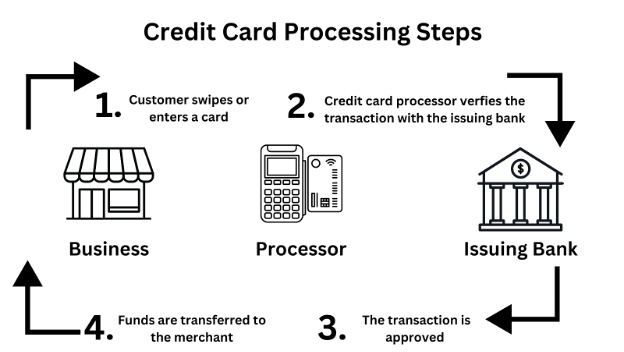

Although a credit card transaction appears to take place instantaneously, it actually involves a series of steps known as credit card processing. The moment a customer swipes or inserts a card into a card reader, a secure gateway encrypts the card information and sends it to the card’s credit card network (e.g., Visa or Mastercard), acting as a central hub. This network then contacts the customer’s issuing bank to verify funds, receiving an approval or denial in turn. If approved, the network instructs the bank to hold the purchase amount. Finally, the network facilitates a transfer of funds from the customer’s bank to the merchant’s acquiring bank, minus processing fees.

This intricate dance involves several key players: the customer, the merchant, a payment gateway, the credit card network, the issuing bank, the merchant’s bank, and a credit card processing company. The credit card processor itself plays a critical role in securing the transaction, routing it through the network, and ensuring smooth settlement between the two banks.

The cost of this process is referred to as credit card processing fees, and flat-rate credit card processing is one model for structuring these fees.

Learn more in our ultimate guide to choosing a credit card processor.

What is flat-rate credit card processing?

Flat-rate credit card processing, also known as flat-fee processing, is a simplified pricing model for accepting credit card payments. The alternative is interchange-plus, and it’s helpful to understand what that is first.

Under a traditional interchange-plus plan, the merchant pays a per-transaction fee and a markup above the interchange rate. The interchange rate, which is set by the credit card company, often varies based on factors such as transaction type, card brand, business type, and more.

On the other hand, flat-rate processing involves charging a fixed percentage rate for every type of transaction (and, sometimes, a fixed fee as well). Instead of breaking up fees into different categories, the interchange fee and the processor’s markup are simply merged together. This can be appealing for many small businesses because it eliminates the guesswork of transaction fees and provides predictable monthly budgeting.

Flat-Rate vs. Interchange-Plus Credit Card Processing

Feature | Flat-Rate Processing | Interchange-Plus Pricing |

Pricing Structure | Single rate and/or fee, regardless of the transaction, industry or card type. | Per-transaction fee + interchange fees set by credit card company + processor markup. |

Complexity | Easy to understand; you know exactly what you’ll pay each month for accepting credit cards. | More complex; you must understand interchange fees and processor markup to estimate how much you may pay each month to accept credit cards. |

Benefits | Predictable monthly costs, so budgeting is easier. | Potentially lower fees for businesses with high average transaction value. |

Drawbacks | May be more expensive for businesses with low transaction values. | Less predictable costs. |

Good for | Businesses that prioritize simplicity and ease of budgeting. | Businesses that want more control over processing costs. |

Flat-rate credit card processing example

Let’s say you run a coffee shop with a monthly average of 500 transactions and an average transaction value of $5. Using flat-rate credit card processing, your credit card processing costs might look like the following.

- Credit card processor’s flat rate:6% + $0.10 per transaction

- Monthly fee calculation:

- $0.10 per transaction x 500 transactions = $50.00

- Percentage fee: 2.6% x ($5 x 500 transactions) = $65.00

Total monthly fee: $50.00 + $65.00 = $115.00

This example assumes all transactions are swiped. Some processors charge different rates for keyed-in transactions.

Pros and Cons of Flat-Rate Processing

As you weigh whether flat-rate processing is the right credit card processing model for your business, consider these pros and cons.

Pros of flat-rate processing

- Simplicity and predictability: Flat-rate processing involves a single monthly fee, making budgeting relatively easy. You know exactly what you’ll pay for each sale.

- Ease of use: There is no need to understand complex interchange fees or worry about fluctuating costs with this structure.

- Favorable for low-ticket businesses: If your business generates a high volume of small transactions (think coffee shops or convenience stores), flat-rate processing can be cost-effective. You won’t be hit with high per-transaction fees that might eat into your profits.

Cons of flat-rate processing

- Potentially higher costs: For businesses with a high average transaction value (think electronics stores or furniture stores), flat-rate processing can be more expensive than interchange-plus pricing.

- Hidden fees: While advertised as a flat fee, some processors might have additional fees buried in the fine print, like early-termination fees or monthly minimums.

- Limited scalability: As your business grows, flat-rate processing might not be the most cost-effective option. You could be missing out on potential savings with interchange-plus pricing.

Best credit card processors for flat-rate credit card processing

Check out these credit card processing companies that offer flat-rate pricing and learn about more options in our reviews of the best credit card processors. Note that some processors charge a subscription fee in addition to processing fees.

- Stax: Under Stax’s subscription model, you pay a monthly subscription fee ranging from $99 to $199 per month, plus a small flat fee of 8 cents to 15 cents per transaction over the interchange fee, depending on the type of transaction.

- Merchant One: A high approval rating makes Merchant One a great pick for high-risk businesses seeking flat-rate pricing. The company charges a monthly subscription fee of just $6.95 a month, plus a flat credit card processing rate of 0.29% to 1.99%, depending on the type of transaction.

- Payment Depot: This low-fee processor offers a variety of flat-rate pricing options. Payment Depot charges a monthly subscription fee of $59 to $99 per month. It charges an additional small flat fee from 7 cents to 15 cents per transaction over the interchange rate, depending on the type of transaction.

- Helcim: On average, Helcim charges a flat 1.94% plus 8 cents for credit card transactions made on a physical Helcim terminal. Helcim also charges 2.51% plus 25 cents for online sales, invoice payments, and keyed-in transactions.