If you own a small business and money is tight, you may decide to save on accountant’s fees and do your business taxes yourself. By claiming all possible deductions, you can minimize your tax bill at the end of the year. However, to comply with tax law, you must know which expenses are deductible and which could potentially land you in trouble with the IRS.

Businesses that accept credit cards pay various processing fees to their payment processor. These fees are deducted from the total credit card sales revenue deposited to their business bank account. Since businesses don’t write a check to pay these fees, it can be confusing as to whether they are deductible business expenses. However, how you treat these fees when calculating your taxes can impact your overall tax bill significantly. Here’s what you need to know about deducting credit card processing fees on your taxes.

What are credit card processing fees?

Credit card processing fees are the fees a business pays to the payment processor that handles their transactions. Credit card payment processors charge several fees.

Interchange fees

Interchange fees, charged by card brands such as Visa, Mastercard, American Express and Discover, typically comprise the bulk of credit card processing fees.

Interchange fees vary by card brand and sometimes card type (credit vs. debit, card-present transaction vs. phone or online payments or rewards card vs. regular card). They take the form of a percentage of the transaction amount plus a flat fee per transaction. For example, the current interchange rate for a Mastercard debit card is 1.05 percent plus 22 cents per transaction. The current interchange rate for a Visa rewards card transaction where the card is physically present is 2.3 percent plus 10 cents per transaction.

Interchange rates are set by the card brands and are nonnegotiable. Credit card processing companies deduct interchange rate amounts from merchant transactions and send the appropriate amount to the respective card brands on your behalf.

Credit card processing markup

Most credit card processors charge a small percentage and sometimes a per-transaction amount on top of the interchange rate. This is their compensation for acting as an intermediary between the merchant and customers’ card-issuing banks.

For example, Clover’s current processing rate is 2.3 percent plus 10 cents per transaction, which includes the interchange rate. For a particular transaction, Clover would charge the merchant 2.3 percent plus 10 cents, pay the card brand its interchange rate and keep the rest.

Credit card processing fees, including markup, average between 1.5 percent and 3.5 percent, with per-transaction fees ranging from zero to 49 cents. A credit card processor that charges a markup may also charge a monthly fee.

Monthly fees

Some credit card processors charge merchants a monthly fee. This fee allows them to charge a small or even no markup on the interchange rate and still make money. Payment processors that provide advanced capabilities, such as full-featured point-of-sale (POS) systems, can charge for this capability through a monthly fee.

Additionally, merchants may pay a monthly fee to lease their credit card readers and other equipment. Monthly fees can be as little as $6.95 or as much as $199.

Incidental fees

Payment processors usually charge fees only in certain situations; these are called incidental fees. For example, if your business isn’t meeting requirements to keep customer data safe from potential cybercriminals, you may be charged a Payment Card Industry (PCI) noncompliance fee until you fix the situation. Another common incidental fee is a chargeback fee, which occurs when a customer disputes a transaction with your company and requests a refund through the credit card company.

Are credit card processing fees tax-deductible?

Yes. All types of credit card processing fees, including interchange fees, processor markups, monthly fees and incidental fees, should be tax deductible for businesses because they meet the following IRS requirements for deductible business expenses:

- Ordinary and necessary expenses: An “ordinary” expense is standard in a particular industry or business type. A “necessary” expense is helpful or necessary for your business to operate and thrive. Note that expenses must meet both of these criteria, not only one.

- Operating expenses (not capital expenditures): Expenses must be current, not large long-term investments, such as equipment, vehicles or real estate (there are other tax rules for these purchases).

- Expenses pertaining to the business: Only business expenses, not personal expenses, can be deducted from your business tax return. If a particular expense is partly for the business and partly for you personally, you can only deduct the business-related percentage.

Best practices for deducting credit card processing fees

When it comes to the IRS, it pays to do everything correctly and accurately. Here are some best practices for deducting credit card processing fees from your business taxes.

1. Separate business and personal expenses.

Separating business and personal expenses is crucial. Although unlikely, you may have used credit card processing for a personal payment. For example, perhaps a friend owed you money and, instead of paying it with cash or a check, they used a credit card to pay your business. In this situation, you could not deduct that transaction’s credit card processing fees.

2. Keep excellent records.

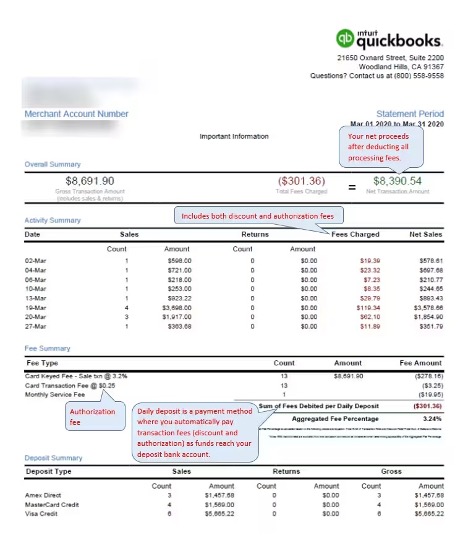

Tax deductions must be based on actual expenses, not estimates. Luckily, it is easy to determine the exact amount of your credit card processing fees by referencing your 12 months of credit card processing invoices for that tax year. Processing fees are broken down by type on each statement, so you just have to add them up for the year.

Check your credit card processing invoices to add up your deductible fees. Source: Intuit

Once you’ve calculated the credit card processing fees you can deduct, don’t throw away or delete your statements. Keep them in case you’re audited by the IRS in the future.

3. Only deduct credit card fees once.

Since most credit card processing fees are a percentage of sales, some business owners might consider them part of the cost of goods sold. Then, they might deduct them as a business expense. This results in the same expense being deducted twice and may cause the IRS to take a look at your returns in more detail and maybe even audit your business. Be sure you only deduct these expenses once per year.

4. Do not deduct fees if they are passed along.

Some businesses pass along their credit card processing fees to the customer in the form of a surcharge or convenience fee. If your business does this, you can’t deduct the total amount of your processing fees. However, you may still be able to deduct monthly and incidental fees.

5. Consult with an accountant.

Even if you do the bulk of your tax calculations and reporting on your own, you should still check with a tax advisor to ensure you are 100 percent compliant with tax law. An accountant or tax advisor will charge considerably less to review your tax return than do it all from the beginning.

How can businesses reduce their credit card processing fees?

Finding the best credit card processor for your business will depend on your industry, processing volume, seasonality and more. Here’s how to minimize your credit card processing fees as much as possible.

1. Shop around for a processor with reasonable rates.

There are plenty of payment processors to choose from, with various rates and plans. If you’re getting ready to accept credit cards, conduct detailed research to find credit card processors with low processing rates. Compare rates online and consult business owners in your industry to get processor recommendations. Additionally, evaluate each company’s reviews to see if merchants are generally happy with the payment processor’s rates and value.

If you already accept credit cards and want to lower your rates, you can always switch to a new payment processor. However, before switching, check your contract to see if you have an early termination fee. You should also ensure any new processors you consider are compatible with your existing card readers and POS equipment. Otherwise, the cost of buying new equipment may mean switching isn’t worthwhile.

2. Negotiate rates with your current payment processor.

Some credit card processors will review your account periodically to see if they can offer you a lower rate. However, you’ll typically have to initiate this process yourself. Note that the same processing company will charge merchants different rates based on its assessment of each merchant’s risk. The lower the perceived risk, the lower the processing rates.

Factors that contributed to increased perceived risk include the following:

- Being a startup

- Poor business or personal credit scores

- Risky industry

- Low transaction volume

- Frequent chargebacks

- Minimal credit card transaction history

If you have been with your current payment processor for several years, these factors may have changed over time. You can ask the processor to reassess your risk and lower your rate. You can also provide documentation, such as income statements, strategic agreements and equity cash infusion paperwork, that shows your business is successful and financially stable.

3. Choose a payment processing plan that works with your cash flow.

When choosing a payment processing plan, you have several options:

- Option 1: Higher processing fee on transactions but no monthly fee

- Option 2: Small monthly fee and lower processing fee

- Option 3: High monthly fee and very low processing fee (interchange fees or interchange fees plus a small markup)

Each pricing model can minimize overall processing fees for specific business types:

- Startups: When your business is just starting, you haven’t established a steady or robust revenue stream. You may not have many sales yet, but you do have significant overhead costs to establish your company:

- Choose option 1. This option won’t add to your overhead costs because there’s no monthly fee. You’ll pay a processing fee on the relatively few sales you make at this point, making this the most cost-effective plan.

- Seasonal businesses: If you do the bulk of your business within a three- or four-month period, it makes sense to keep your processing expenses aligned with your revenue instead of paying more in the months when your income is much lower:

- Choose option 1 if you have a relatively low transaction volume in your busy season.

- Choose option 2 if you have a high transaction volume in your busy season.

- Established, growing businesses: When your business has been operating for a while and you have a stable and growing income stream, higher processing rates (interchange plus markup) will eat into your profit margin:

- Choose option 2. At this point, your lowest-cost option is a blend of a monthly fee and lower rates.

- High-transaction-volume businesses: Once your business has consistently high monthly credit card sales, percentage processing fees will become significant:

- Choose option 3. A move to a higher monthly fee and interchange or interchange-plus processing rate will minimize your costs.

4. Minimize or eliminate incidental fees.

Incidental fees are meant to ensure compliance with specific requirements or preferred outcomes. You can avoid these fees if you’re diligent. Here are some examples:

- Chargebacks: Chargeback fees are among the most common incidental fees. To avoid chargebacks, fully explain your products’ specifications, uses and care to customers before and after purchase. Provide excellent customer service before, during and after the sale; collect and act on customer feedback; and address customer problems promptly.

- PCI noncompliance: To avoid PCI noncompliance fees, ensure that you follow best practices for protecting customer data, such as securing your network, encrypting payment information and monitoring employees with access to the data.

- Early termination fees: If the contract with your payment processor has a set term with an early termination fee, keep doing business until the contract term ends before switching processors.

5. Choose a payment processing plan with good value.

Payment processor plans vary widely. Some include minimal features and charge for add-ons while others have robust feature sets for a set price. Payment processors often have tiered pricing plans based on transaction volume or various software and hardware options. Examine all options carefully and choose a plan with only the features you need. You’ll ensure the lowest possible monthly fee without having to pay for add-on features.

When reviewing a payment processor’s contract, before signing, pay close attention to any “junk fees” listed, such as batch fees or terminal fees. A reputable payment processor won’t charge extra for functionality that should be included in any reasonable payment processing service.