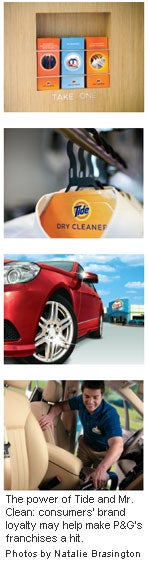

Big Brands Lend Their Names to the Franchise Service Industry Procter & Gamble is re-creating two of its iconic brands--Tide and Mr. Clean--as dry cleaning and carwash franchises

By Jason Daley

Opinions expressed by Entrepreneur contributors are their own.

If the citizens of Atlanta have been feeling as if they're being watched, who could blame them? In July 2009, 13 giant cutouts of Mr. Clean began staring down on them from the entryways of carwashes across the area. Meanwhile, the personal-care behemoth Procter & Gamble has been watching to see if its tanned, ripped, cue-balled mascot could draw dirty cars into sudsy tunnels.

At the same time, halfway across the country in Kansas City, Mo., the bright orange-and-yellow Tide logo was popping up on the front of three new Tide Dry Cleaners, as P&G made the first careful steps out of the home laundry business and into the full-service dry cleaning business.

Both enterprises are milestones: For the first time, a maker of household products is lending its brand names to the franchised service industry. Although P&G has been relatively quiet about its two Mr. Clean test facilities in Cincinnati, which opened in 2007, and its first year of franchising in Atlanta, the Mr. Clean Car Wash project has been deemed a success, and the company is planning to slowly franchise the concept in new markets. The Tide Dry Cleaners prototypes, opened in 2008, also made the grade and P&G began signing up franchisees in June.

"We want to extend some of our billion-dollar brand into the service space, where 50 percent of consumer dollars are," says Jeff Wampler, general manager for Tide Dry Cleaners. "We also want to offer up a world-class franchise proposition."

Although extending its brands is a natural move--there long have been household items such as the Mr. Clean Magic Eraser and Tide to Go stain-removing pens--P&G's move into the franchised service industry is a massive leap, even for one of the world's largest corporations. Some analysts speculate that the objective is to eke out a few points of growth for investors. Because the company is so massive--bringing in $80 billion in 2009--it takes a huge number to create even a 1- or 2-percent increase from year to year. Other experts say that apart from investor considerations, it is a smart move.

"Both franchises are in line and close to the brands' core values," says Derrick Daye, managing partner of BrandingStrategyInsider.com. "Consumers have the same expectation of a deep, rigorous clean at a Mr. Clean Car Wash as they do in a household cleaner. It's definitely a new direction for them, but in my gut I think it's going to be successful."

P&G has a few things on its side. It's moving into industries with no strong national franchises to compete with, and it's offering technological tweaks and new services to differentiate its concepts. The company recognizes that franchising is not its strong suit, so it has drafted partners to help its franchise subsidiary, Agile Pursuits, ease into the game. And P&G has controlled the rollouts, funneling most information through brand managers who unfailingly point up the positive buzz from grocery stores.

A lot is at stake. If P&G's foray into franchising doesn't resonate with consumers--if the quality associated with Mr. Clean and Tide doesn't translate into the service sector--the company's brands risk being downgraded. Then again, P&G has made few false moves with its core products over the last half century, and the Tide and Mr. Clean rollouts are slow, small and calculated.

"If they launched 450 stores at once, I'd be concerned," Daye says. "But P&G has a reputation for knowing their customers very well and spending a lot of money to research the marketplace. You always have to evolve or you go away; it's the law of the marketing jungle."

Mr. Clean

Carwashing, it turns out, is one of the most fragmented markets in the United States. According to an annual survey by Professional Carwashing and Detailing, only 10 carwash chains in the U.S. have more than 20 units. P&G's research found that the top 50 chains make up just 7 percent of the market. The rest are mom-and-pop operations. "A nationally branded carwash does not exist," says Dustin Garis, marketing director for Mr. Clean Car Wash. "There hasn't been a brand that could carry that national presence. And operational consistency is difficult for a single operator."

P&G believes Mr. Clean can support a national network. The product has a brand loyalty that stretches back to 1958, when it was launched. Within six months of its creation, Mr. Clean was America's No. 1 cleaning agent and inspired the longest-running jingle in TV history.

Today, each carwash has the hulking presence of a billboard-size Mr. Clean on its façade; nearly all its washing chemicals are branded as Mr. Clean; and the building's color scheme uses the same blue and white with lime-green accents.

Today, each carwash has the hulking presence of a billboard-size Mr. Clean on its façade; nearly all its washing chemicals are branded as Mr. Clean; and the building's color scheme uses the same blue and white with lime-green accents.

When it comes to the business of actually washing cars, P&G didn't look to reinvent the wheel. Instead, it searched for the strongest established companies in the industry and found the Arnett family, who already had a working franchise model in Atlanta and a commitment to bringing new technology to the carwash business. P&G brought the Arnetts onboard to research and refine their carwashing techniques and converted the family's 13 Atlanta-area Carnett's facilities--nine of which were already franchises--to expand the Mr. Clean Car Wash line.

"We know where our expertise lies and it was not in carwash operations," Garis says. "The Arnetts have been involved in carwashing for more than 20 years. It's scary how much they know. They are engineers, physicists and chemists. They use sonar to measure surface area to develop custom carwashes. It's absurd stuff, but it's amazing how good a job they do."

Besides installing Bruce Arnett as CEO of the Mr. Clean franchise, P&G also refined his proprietary computer-guided car washing machinery, which adjusts for different makes and models. Agile Pursuits Franchising also added new Mr. Clean-branded cleaning chemicals developed by its R&D division, including Mr. Clean Wheel Guard, which guarantees to keep tires shiny for four weeks, and Febreze odor eliminators for interior services.

P&G also has installed technology that helps control and tweak the carwashing process remotely, meaning it can maintain consistency throughout the network--say, by adjusting soap-to-water ratios or reconfiguring the wash tunnel for the introduction of a new product. A "coach cam" also allows corporate to watch franchisees and help them master new techniques.

And waiting areas have high-end touches, including a coffee bar, flat-screen TVs, Wi-Fi, video games and water cannons that kids can use to spray cars being cleaned. Prices vary by location, but Mr. Clean is aiming to keep its washes at or a little higher than average mom-and-pop prices.

In May, the first Mr. Clean outside the Ohio and Atlanta areas opened in Roundrock, Texas; two more followed in Cincinnati. The flagship Texas store, which will serve as a prototype for fresh builds throughout the country, was constructed without an official franchisee, though the company is hoping to fill that slot soon and expand slowly through Texas, New Jersey and Colorado, as well as Philadelphia and the Chicago area. All are areas the company has identified as underserved by carwashes, with plenty of green space for construction. The franchise fee is a modest $35,000, but build-out costs are a hefty $3 million to $5 million.

According to P&G, sales at the two company-owned test stores in Cincinnati jumped more than 30 percent in 2009, and the Atlanta locations are attracting new customers. Yes, the Mr. Clean logo has made a difference, but so has the ability to slip coupons into grocery store circulars and other established P&G advertising venues.

"The biggest benefit has been their marketing know-how," says Don Nix, whose Atlanta Carnett's carwash became a Mr. Clean in July 2009. "With their horsepower and experience building brands, it's been a boon to our enterprise. It's a brand people have known for 50 years. They're more likely to turn into the driveway of Mr. Clean than Don's Car Wash."

Tide

When P&G launched Tide in 1946, the world's first synthetic heavy-duty laundry detergent was so popular--and so superior to soap flakes--that shopkeepers had to ration the number of boxes customers bought. Almost overnight, Tide became an iconic American brand, and to this day--despite a half century of changes and reformulations--Tide commands a market share of more than 40 percent, even though it consistently is more expensive than its competitors.

That dominance could be a powerful force in the $8 billion dry cleaning sector. Like carwashes, dry cleaning is similarly fragmented, though a few chains--the Martinizing franchise with 500 stores worldwide and Zips in the mid-Atlantic--have created strong brands. Tide's strategy is to offer superior service, including drive-thru drop-off and pickup, a 24-hour drop box and lockers so that customers can pick up their cleaning after-hours. The dry cleaners are also trying to stand out with new technology, proprietary formulas that offer restoration of white, black and colors and environmentally friendly cleaning solutions.

P&G also didn't go into the dry cleaning business without some guidance. Since 2002, P&G has been a stakeholder in GreenEarth Cleaning, a Kansas City company that provides its silicon-based, eco-friendly dry cleaning chemicals. P&G also has partnered with GreenEarth to run two Kansas City dry cleaners, which were rebranded as Tide Dry Cleaners for a pilot test.

In Kansas City, Tide has played with different layouts, including a strip mall location and a stand-alone fresh build. The storefronts blend in with the area architecture, but inside, Tide's orange and yellow colors cover everything from the employees' shirts to the counters. The stores sell Tide-branded hangers, lint brushes and a wrinkle releaser called Tide Swash. Like their flagship product, Tide Dry Cleaners charge a premium for their services--about 5 percent to 10 percent above the market average.

"What they're doing is banking on their reputation in the domestic laundry industry, which is a major, major plus," says Alan Spielvogel, director of technical services for the National Cleaners Association. "But a national franchise as far as dry cleaning goes is very difficult. It's difficult to standardize a process. It's a little different than opening a Dunkin' Donuts. Each garment is handled a little differently, and each stain has a different technique to remove it."

But P&G says that after two years of tinkering, it has gotten the formula right in Kansas City. There are plans for a corporate store in Cincinnati to serve as a national model and training hub, while a search is on for franchisees to expand into Kansas, Ohio, Kentucky and Georgia. Franchise fees are set at $50,000, with a total investment of about $650,000 to $900,000.

Beyond that, P&G is not releasing its plans, but it expects to roll out nationally, letting the chain gradually build steam.

"When it was launched in 1946, Tide was seen as a washday miracle, and [it] changed the way mothers cared for their families," says Wampler of Tide Dry Cleaners. "We're doing the same thing with dry cleaning now. The fact that we have a market-leading brand coupled with franchise experts gives us the ability to win with this."