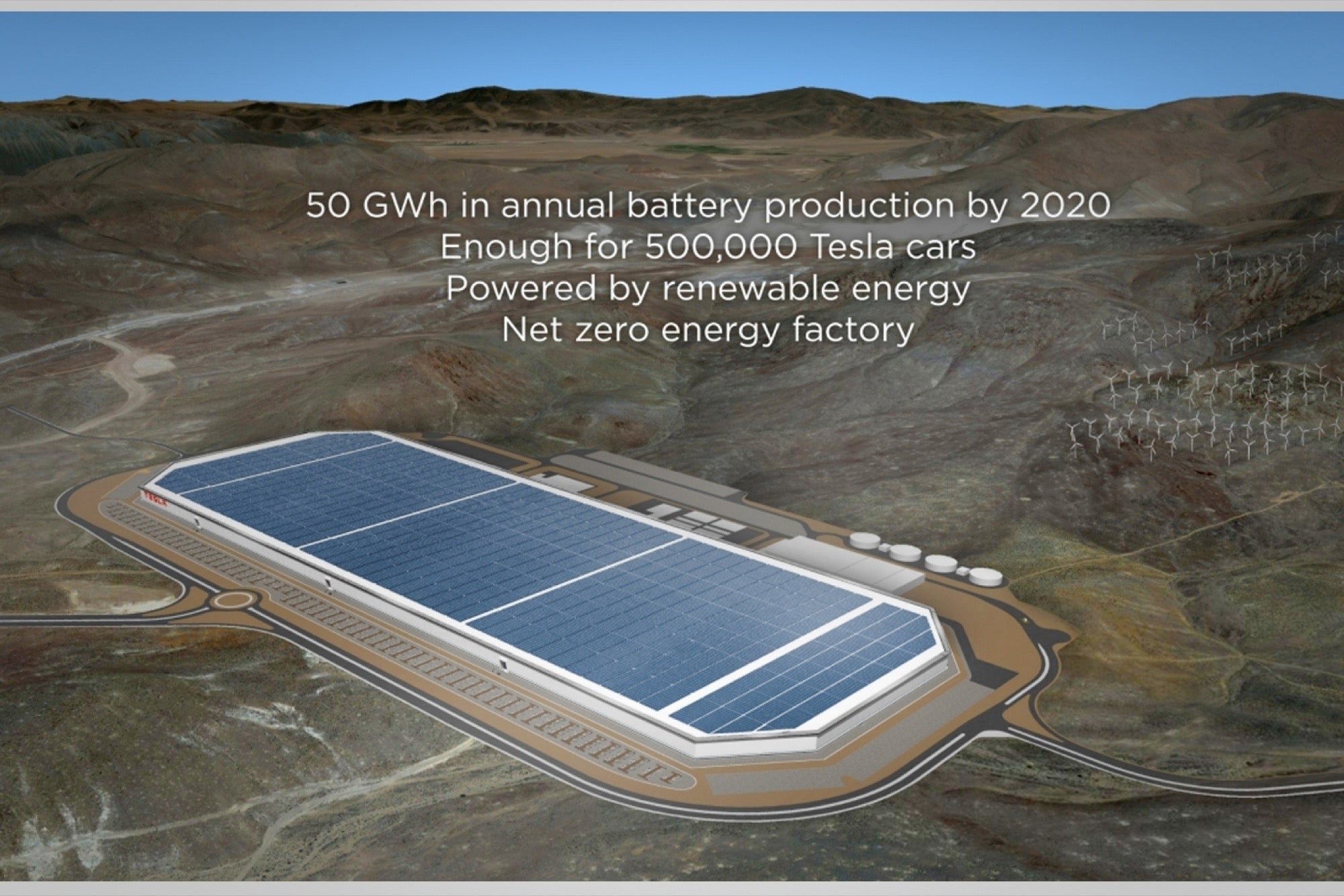

Why Tesla's Gigafactory Could Be Obsolete Before It Even Opens A disruptive shadow looms over Tesla Motors' giant Nevada-based battery facility.

This story originally appeared on Fortune Magazine

A disruptive shadow looms over Tesla Motors' giant Nevada "gigafactory"—the threat of rapidly advancing battery technology. While plenty of hurdles face new battery tech, the emergence of a viable and significantly better battery in the next five years could turn Tesla's $5 billion facility for mass producing lithium-ion batteries into a giga-albatross.

In January, Fuji Pigment Co. Ltd. (not affiliated with Fujifilm) announced that it had made a significant breakthrough in aluminum-air battery technology. Aluminium-air batteries have a theoretical capacity more than 40 times greater than the lithium-ion cells Tesla will soon mass-produce, and Fuji Pigment has stated it will commercialize its innovation by the end of 2015. This means that the gigafactory's products could already be outclassed before its target 2016 opening—and long before the estimated 7-10 years of full production it could take to recoup the factory's costs.

Battery innovation takes place within a rigid structure: every battery has two "sides,' the cathode and anode, which react through an electrolyte medium to produce power. An aluminum-air battery generates electricity from the reaction of oxygen and aluminum, using water as an electrolyte. A standard aluminium-air reaction consumes the aluminum anode, which must be physically replaced rather than electrically recharged. But Fuji Pigment claims that, by adding strategically placed layers of ceramic and carbon, it has managed to suppress corrosion and reaction byproducts, creating an aluminium-air battery that can be recharged multiple times by simply adding water.

Dr. Mark Hersam, professor of materials science and engineering at Northwestern University, says that it would be "stunning" if Fuji Pigment hit their target for commercialization. Among other unaddressed issues, he points out that aluminium-air batteries physically contract as they discharge, which can lead to fracturing and make them difficult to integrate into fault-intolerant automotive systems.

In an email, Ryohei Mori, Fuji Pigment's lead researcher on the aluminium-air project, sounded a slightly more cautious note than the company's January press release. "We are still at developing stage, and maybe in the near future . . . we can work together with large scale."

But Fuji Pigment is not the only company working on a better battery. Israel's Phinergy is also pursuing the aluminium-air dream, while American startups Pathion and Sakti 3 are looking at an even more radical innovation—solid-state batteries that replace liquid electrolytes with ceramic or crystal. Sakti 3 has successfully demoed a battery that produces 1,000 watt-hours of energy per liter of battery volume, which in practice could more than double the driving range of a current Tesla. Pathion CEO Michael Liddle projects that solid-state battery technology will be market-ready within two years.

Of course, the main point of the gigafactory is not to produce cutting-edge batteries, but to produce existing tech on a scale that will bring costs down—Tesla hopes to sell an electric sedan for $35,000. But in this regard, too, both aluminium-air and solid-state batteries have a potential edge. Aluminum is far cheaper than lithium, and solid-state batteries could be "printed' like computer chips, a much more efficient process than the layering and rolling of metal and gel that produces lithium-ion batteries.

According to Dan Radomski, vice president for industry and venture development at the consulting firm NextEnergy, it would be very difficult for Tesla to pivot in response to these innovations. "It's not too much different from us going from VHS to disc. It changes the entire supply chain."

The demands of the automotive sector may buy Tesla some time. Cars are subject to high and low temperatures that have a significant impact on battery performance, and the standard for safety is understandably high. While lithium-ion batteries have shown some problems in responding to high temperatures, decades of testing have gone into gaining it acceptance for use in cars.

Tesla will also likely have some options for upgrading the gigafactory's lithium-ion products. Researchers at Nangyang Technological University have developed a fast-charging titanium dioxide anode, and Mark Hersam's team at Northwestern has doubled the capacity of a lithium-ion anode by interlacing materials like graphene. Though cathode advances have trailed, integrating new materials would not require a wholesale overhaul of the gigafactory's lithium-ion production process.

Ultimately, the biggest question mark for the gigafactory's long-term viability are less technological than strategic. An innovation in a lab is not the same as a working product, and Pathion's Michael Liddle says that the piecemeal nature of battery research has limited real-world advances. Many startups and researchers can produce a better cathode, anode, or electrolyte, but all three must work together perfectly to make a battery. The capital to bring the pieces together, and bring production of new batteries to scale, has been scarce.

But that's likely to change with major manufacturers like Cadillac and BMW moving more aggressively into electrics. With range an ever more vital competitive point, increasing amounts of capital will be chasing the next big battery (GM is a major investor in Sakti 3). That could push the rate of change beyond what even Tesla CEO Elon Musk could have foreseen.