Gold IRA: Is This New Type of Retirement Account a Good Post-Pandemic Investment?

Today’s precarious economic environment makes a strong argument for alternative retirement investments for the post-pandemic era. This, at least, is the prevailing sentiment among many investors and market-watchers who fear…

This story originally appeared on Due

Today’s precarious economic environment makes a strong argument for alternative retirement investments for the post-pandemic era. This, at least, is the prevailing sentiment among many investors and market-watchers who fear the effects of inflation, high borrowing costs, unstable foreign capital markets as exemplified by Evergrade, and a potential stock market pullback.

In fact, the year-over-year rise in the Consumer Price Index (CPI) for the 12-month period ending September 2021 was a staggering 5.4%. This jump exceeded expectations, and constitutes the biggest leap in the CPI since 2008, at the height of the global financial crisis.

Amid concerns of a highly inflationary economy and looming interest rate hikes, some investors are considering an alternative to their stock-heavy retirement investment portfolios to protect their wealth. Gold IRAs are their name, and they function identically to regular IRAs, except that they hold some percentage of their value in physical gold bullion.

As of last year, 10.8% of U.S. adults held gold as an investment. Today, this number is expected to be higher as the inflationary environment currently bodes well for hard assets. Naturally, this raises the question: Is a gold IRA a good investment in our past-pandemic economy?

What is a Gold IRA?

Before exploring the advantages and drawbacks associated with this retirement investment account, it’s important to first clarify a couple of things. First, what a gold IRA is and, second, what purpose it serves in an investor’s retirement portfolio.

A gold IRA is an individual retirement investment account in which some percentage of its allocation is in real gold. In order to classify as a gold IRA, these accounts cannot hold paper-based gold assets alone (i.e., mining stocks or ETFs)—rather, they must include physical bullion such as gold bars or sovereign-minted coins.

Even an IRA that allocates a mere 5% to gold bullion and the remaining 95% to stocks and bonds meets the criteria of a gold IRA. Simply put, any IRA is a gold IRA as long as some share of its value consists of physical gold assets.

The Purpose of a Gold IRA

Like all IRAs, gold IRAs provide special tax benefits for their owners. Traditional gold IRAs consist of pre-tax assets for which taxation is deferred until withdrawal, whereas Roth IRAs are made up of after-tax assets which grow tax-free.

Assets held within a Roth IRA are free from long-term capital gains taxes, whereas traditional IRAs are deducted upon deposit but taxed at withdrawal.

These tax benefits especially tempt precious metals investors. This is because investors typically hold gold and silver assets long-term, and can accrue a large tax liability at the time of sale. Thus, gold IRAs allow investors to contribute to their retirement nest egg on a tax-free basis while diversifying with alternative assets that can help manage risk.

Why Gold?

Gold has a long history as an investment and, more than that, as a reliable store of value. Dating back to 550 BC during the reign of King Croesus in modern-day Turkey, gold has been used to mint official coins and serve as a medium of exchange.

Given gold’s unique properties as a scarce, ductile, reflective, brilliant, and malleable metal, it has long been considered a prized commodity throughout the world. On top of that, its thermal and electric conductivity make it highly coveted as a modern industrial asset.

For retail investors, gold has come to be regarded as a disaster hedge. When the U.S. stock market experiences sustained downturns, the spot price of gold tends to perform positively. Consider the performance of gold during the following bear markets relative to the S&P 500:

- Black Monday 1987: -22.6% (S&P), +4.2% (Gold)

- Aug. 1 to 14, 1990: -21% (S&P), +11.1% (Gold)

- Oct. 2, 2000 to Oct. 2, 2002: -38.5% (S&P), +18% (Gold)

- Oct. 9, 20087 to Oct. 1, 2010: -20.1% (S&P), +78.9% (Gold)

- Dec. 1, 2019 to March 1, 2020: -19.8% (S&P), +7.6% (Gold)

It should go without saying that there are, and always will be, exceptions to this trend. However, the fact remains that gold has a tendency to outperform the equities market during times of systemic instability, uncertainty, and even outright recessions.

Diversification Benefits of a Gold IRA

Perhaps the main advantage of a gold IRA is that it provides unique risk management capabilities for retirement investors. As we near our target retirement date, it’s crucial that we manage risk accordingly. In particular, it’s important to reduce the chances of losing our financial resources when we need them the most—during retirement.

A simple stock market downturn or overnight sell-off could delay your retirement by years if you’re overexposed to stock market volatility. Knowing this, many investors nearing retirement choose to diversify their holdings to minimize their exposure to stock market risk.

The underlying premise is that gold has a low correlation (about ~0.25) to the stock market. Therefore, it functions as an extremely useful hedge against stock market volatility. Statistically, gold bullion markets stand strong when the stock market rises or falls in value, thereby fortifying an investor’s portfolio from erratic swings.

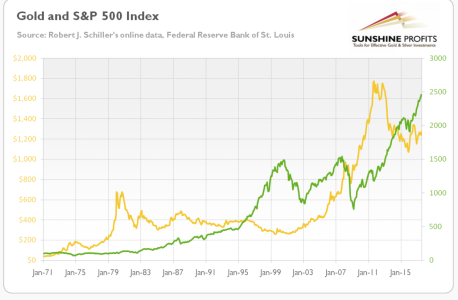

Figure 1. Source: Sunshine Profits

The chart above (Fig. 1) demonstrates that, although gold (yellow line, left axis) sometimes experiences sustained co-movement with the S&P 500 index (green line, right axis), there are nevertheless many instances of an inverse relationship. This is particularly evident in 1980, from 1997 to 1999, in 2008, 2012, and 2016—in each case, the price of gold moved opposite to the price of the S&P 500.

Alternative assets such as gold bullion are marked by much lower liquidity than stocks. Therefore, they cannot be bought and sold as quickly. The result is that fewer rash, knee-jerk reactions are made by gold investors, and market sentiment has more time to cool off and stabilize before investor behavior can aggravate the problem.

Risk Differentiation

In order to truly diversify your portfolio, you need to diversify not only the types of assets in which you invest, but also the types of risks you’re exposed to. There are five predominant forms of risk that investors must be aware of:

- Equity Risk (Equity Beta): A stock’s volatility relative to the market.

- Interest Rate Risk (Duration): The risk of a change in the federal funds rate changing the value of a bond or variable-rate instrument, such as an annuity.

- Credit Risk (Spread Duration): Potential losses incurred by defaulting or failure to repay one’s debt obligations.

- Inflation/Currency Risk: The risk of taking a loss on a currency exchange rate.

- Momentum: Intra-day acceleration of a security’s value due to derivatives trading.

For instance, a bond-heavy portfolio is highly exposed to interest rate risk. Gold bullion, on the other hand, does not carry any interest rate risk. Therefore, a bond-heavy portfolio could be insulated from risk by allocating some of its value in gold.

The same goes for stocks, which are exposed to credit risk. Gold bullion is free from credit risk and, therefore, makes for a suitable complement to a stock-heavy investment account.

Managing risk in this way is critical to long-term success as a risk-averse investor. Unless you can diversify the categories of risk to which you expose your wealth, you run the risk of taking significant losses due to market events that can disrupt your retirement plans.

Disadvantages of a Gold IRA

Like all investments, gold IRAs carry an opportunity cost. However, since IRAs (both Roth and Traditional) have mandated contribution limits, these opportunity costs are even more pronounced. As of 2021, individuals can contribute up to $6,000 per annum into their IRA, or up to $7,000 if the account holder is aged 50 or older.

Therefore, every dollar invested in a gold IRA is a dollar you can’t invest elsewhere, while also taking up limited IRA space. Of course, this consideration wouldn’t apply to those who haven’t yet maxed out their 401(k), since they could contribute to this retirement investment account instead while leaving their IRA dedicated to gold investing.

There’s also the issue of performance relative to the stock market. Traditionally, gold has been a slow mover that prefers stability, avoiding volatility and broad cyclical swings in favor of slow and steady appreciation. That stability, however, often comes at the expense of rapid growth.

For instance, as of October 27, the S&P 500 has appreciated +13.8% since April 1, 2021 (INDEXSP: $4,019 to $4,575). By comparison, the spot price of gold has risen +1.9% over the same time frame—a respectable gain given its historical average, but a lackluster one nonetheless in relation to the stock market.

How to Invest in a Gold IRA

If you think a gold IRA is right for you, consult a self-directed gold IRA company. The precious metals investing experts at Gold IRA Guide have reviewed over 70 providers on this page. Since the major brokerage companies do not offer self-directed IRAs, investors interested in this account type must contact third-party providers that specialize in alternative investments. Users can set up their accounts and add funds (via an IRA-to-IRA rollover or direct transfer) within several business days.

Comprehensive FDIC insurance backs Gold IRAs. In addition to backing them, FDIC insurance vaults and stores them in highly secure domestic depositories. In order to remain eligible for IRA inclusion, all gold assets must be stored in an IRS-approved storage facility—however, your gold IRA provider can take care of your storage and compliance concerns on your behalf.

Top 5 Gold IRA Companies

Whether a gold IRA is right for you or not will depend on your personal financial circumstance. However, if you’ve decided that this type of investment vehicle is the right decision, then consider the services of any of the following five IRS-approved gold IRA companies.

Below, I’ve listed the most reputable and well-reviewed companies in the precious metals investing space, based on their reviews, longevity, and other factors. Each of these alternative investment companies specializes in gold IRAs.

To find the perfect service for you, I suggest contacting several of them and shopping around for the best rates and deals.

1. Regal Assets

Hands-down the top provider for gold IRAs, no matter your level of exposure to precious metals, is Regal Assets. Whereas the other companies in the space are precious metals vendors, Regal Assets stands alone as a boutique gold IRA provider that assists investors with the setup, funding, and IRS-compliant metals selection processes.

With other providers, it’s easy to make a mistake and overstep IRS regulations. These mistakes can come at the cost of hefty fees, penalties, and back payments. Fortunately, Regal Assets walks investors through the process from end-to-end, so you can rest assured knowing that your account is compliant and insured.

Longevity is hard to come by in the precious metals investing industry. That’s why it should be a major vote of confidence whenever you find a company that’s been in business as long as Regal Assets (founded in 2009 in Beverly Hills, California). For over a decade, Regal Assets has built a loyal following of gold, silver, and platinum-group metal investors enticed by their competitive fees and excellent customer service.

- Years in Business: 11

- Type of Company: Gold IRA Company

- Annual Fees: Up to $190. Flat rate.

- Minimum Investment Required: $5,000

- Custodian: New Direction IRA

- Preferred Storage Vault: Brinks

- Company Headquarters: Los Angeles, California

2. JM Bullion

Founded in 2011, JM Bullion is one of America’s fastest-growing gold IRA companies. In 2016, they ranked 40th in Inc. Magazine’s annual “Inc. 500” list of top private companies. Since its inception, JM Bullion has prided itself on low fees, free and insured shipping, and a gold and silver buyback program for metals valued at $1,000 or above.

- Years in Business: 10

- Flagship Offering: Collectible and numismatic coins

- Annual Fees: Variable

- Minimum Investment Required: $2,500

- Custodian: New Direction IRA

- Preferred Storage Vault: Transcontinental Depository Services Vaults (TDS)

- Company Headquarters: Dallas, Texas

3. Kitco

For over four decades, Kitco has made a name for itself as one of the world’s most trusted names in precious metals IRA investing. Although their sliding scale fees can run slightly higher than their competitors, they more than make up for it by having one of the most secure offshore vaulting and storage operations in the industry.

- Years in Business: 44

- Type of Company: Collectible and numismatic coins dealer

- Annual Fees: Sliding monthly fees, plus $35 transfer and $75 administrative fees

- Minimum Investment Required: $2,000

- Custodian: GoldStar Trust Company

- Preferred Storage Vault: Hong Kong Allocated Storage Program

- Company Headquarters: Montreal, Canada

4. APMEX

Boasting over 200 employees nationwide, APMEX is a family business that has built a name for itself as a highly reputable firm in the gold IRA industry. They have sold over 130 million ounces of precious metals to retirement investors since 2000. However, their near-flawless track record of stellar customer service is perhaps a greater testament to their success.

- Years in Business: 21

- Type of Company: Collectible and numismatic coins dealer

- Annual Fees: Starting at $180

- Minimum Investment Required: $1,000

- Custodian: Equity Trust Company

- Preferred Storage Vault: Brink’s Global Services

- Company Headquarters: Oklahoma City, Oklahoma

5. GoldSilver.com

GoldSilver.com is known for its no-contract, flat-rate precious metals storage options. This company works closely with gold IRA companies to provide tax-advantaged access to precious metals, and does so at industry-low rates. Although their customer support may not be as strong as some of their competitors, they offer terrific value for the price as well as an extensive variety of gold bullion and coin offerings.

- Years in Business: 16

- Type of Company: Collectible and numismatic coins dealer

- Annual Fees: 0.06% of asset value per month

- Minimum Investment Required: Minimum purchase of 10 ounces of gold

- Custodian: Several Brink’s-operated vaults both international and domestic

- Preferred Storage Vault: Hong Kong Allocated Storage Program

- Company Headquarters: Santa Monica, California

In Summary: Regal Assets the Best for Gold IRAs?

Overall, Regal Assets provides the best service for investors looking to open a gold IRA. Other precious metals vendors, such as JM Bullion and Kitco, offer a great selection of metals that you can add to an IRA. However, only Regal Assets provides true gold IRA investing services.

An account with Regal Assets ensures that your precious metals are 100% IRS-compliant. It also ensures that your holdings are kept in secure and insured vaults (both offshore or domestic). Other service providers leave you on your own to handle the funding and initialization process. Thankfully, Regal Assets makes gold IRA investing simple and safe for investors of all stripes.

The Final Word

Of course, gold IRAs aren’t without their critics. It’s true that gold bullion doesn’t provide investment income like a dividend stock or a rental property. As such, it might not be the best option for younger investors for whom retirement is a distant dream. However, it does provide much-needed stability and peace of mind for older investors nearing retirement.

To reiterate, gold IRAs aren’t a perfect investment for all investors. However, a large number of retirement investors could use them strategically to improve their financial position.

Today’s post-pandemic economy contains rising inflation and an uncertain interest rate environment. Needless to say, a gold IRA may be a good idea for investors nearing retirement. Talk to your financial advisor about whether this increasingly popular investment account is right for you.

The post Gold IRA: Is This New Type of Retirement Account a Good Post-Pandemic Investment? appeared first on Due.

Today’s precarious economic environment makes a strong argument for alternative retirement investments for the post-pandemic era. This, at least, is the prevailing sentiment among many investors and market-watchers who fear the effects of inflation, high borrowing costs, unstable foreign capital markets as exemplified by Evergrade, and a potential stock market pullback.

In fact, the year-over-year rise in the Consumer Price Index (CPI) for the 12-month period ending September 2021 was a staggering 5.4%. This jump exceeded expectations, and constitutes the biggest leap in the CPI since 2008, at the height of the global financial crisis.

Amid concerns of a highly inflationary economy and looming interest rate hikes, some investors are considering an alternative to their stock-heavy retirement investment portfolios to protect their wealth. Gold IRAs are their name, and they function identically to regular IRAs, except that they hold some percentage of their value in physical gold bullion.