Here's Why You Should Hold Onto Papa John's (PZZA) Stock Now Papa John's (PZZA) focuses on providing a better customer experience with enhancements to the digital ordering process. However, inflationary pressures are a concern.

This story originally appeared on Zacks

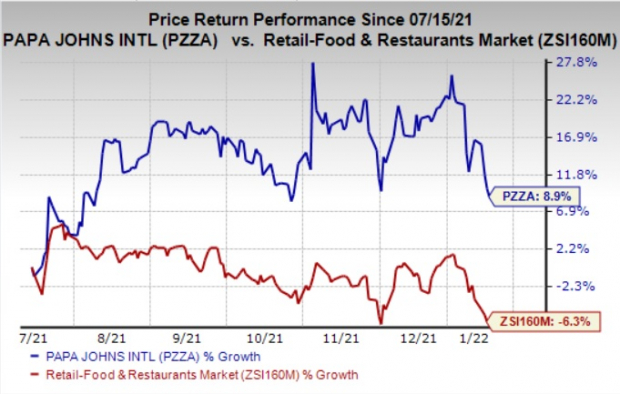

Shares of Papa John's International, Inc. PZZA have gained 8.9% in the past six months against the industry's fall of 6.3%. The company has been benefiting from menu innovation, digital initiatives and robust comps growth. Moreover, its focus on expansion initiatives bodes well. However, a decline in traffic from pre-pandemic levels as well as inflationary commodity and wage pressures remain concerns.

Let's discuss the factors highlighting why investors should retain the stock for the time being.

Factors Driving Growth

Papa John's continues to focus on product introduction to drive growth. Menu innovations like Epic Stuffed Crust and toasted handheld Papadias continue to witness solid popularity among customers, thereby boosting the top line. Backed by better brand position, the new products have driven higher ticket and traffic across dayparts without cannibalizing core premium products as well as complicating operations at other stores.

During the fiscal third quarter, the company initiated a new BaconMania promotion that comprises bacon servings across three different product platforms: Pizza, Papadias and Jalapeno Popper Rolls side. With primary results in the positive trajectory, the company anticipates the initiative to drive traffic and new customers in each menu platform, thereby enhancing the top line in the long term.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Papa John's is investing heavily in technology-driven initiatives like digital ordering to boost sales. The company's online and digital marketing activities have increased significantly in the past several years in response to the higher utilization of online and mobile web technology. PZZA is committed to providing a better customer experience with enhancements to the digital ordering process.

The company's loyalty program continued to witness a rise in digital transactions during the third quarter of fiscal 2021. Higher transaction sizes and better targeting of offers and promotions have been benefiting the company.

Meanwhile, Papa John's continues to impress investors with robust comparable sales growth. The company recorded positive comparable sales growth in the third quarter of fiscal 2021, which marks the eighth straight quarter of comps growth. It benefited from initiatives related to menu innovation, operational efficiencies and cost-saving efforts. Also, solid contributions were reported from third-party delivery aggregators. In the fiscal third quarter, total comparable sales rose 7.3% year over year compared with 23% growth reported in the prior-year quarter. At North America franchised restaurants, comps rose 6.8% compared with 25.6% growth in the year-ago quarter. Comps at international restaurants were up 8.3% year over year compared with 20.7% growth in the prior-year quarter.

Papa John's is committed to developing and maintaining a strong franchise system. The company is striving to eliminate barriers for expanding in existing international markets and identifying new market opportunities. In August 2021, the company expanded its partnership with Drake Food Service International to open more than 220 Papa John's restaurants by 2025. This includes more than 170 stores across Latin America, Spain and Portugal. Drake Food Service plans to open 50 new restaurants in the United Kingdom over the next four years. Under the terms of this expanded partnership, Drake Food Service will operate more than 560 Papa John's restaurants by 2025. Apart from this, the company signed a new deal with FountainVest Partners (in January 2022) to open more than 1,350 new stores across South China by 2040.

Concerns

Papa John's results in the coming quarters might be impacted by the emergence of the new COVID-19 variant. The restaurant industry has been facing declining traffic for quite some time. Although the majority of dining services are open, traffic is still low compared with pre-pandemic levels. Going forward, the company intends to monitor the situation on a regular basis to gauge the impacts of COVID-19.

The company has been continuously shouldering increased expenses, which are detrimental to margins. It has been facing significant supply-chain challenges and inflation across most commodities and categories. This resulted in cost pressure in the third quarter of fiscal 2021, including costs related to strategic staffing initiatives. Also, new hiring, referral and appreciation bonuses added to the woes. During the third quarter of fiscal 2021, total costs increased 5.8% year over year to $474.2 million from $448.4 million reported in the prior-year quarter. Going forward, the company anticipates commodities and labor headwinds to continue in the near term.

Zacks Rank & Key Picks

Papa John's currently carries a Zacks Rank #3 (Hold). You can see the complete list of today's Zacks #1 Rank (Strong Buy) stocks here.

Some better-ranked stocks from the Zacks Retail-Wholesale sector include Arcos Dorados Holdings Inc. ARCO, The Home Depot, Inc. HD and Macy's, Inc. M.

Arcos Dorados sports a Zacks Rank #1. It has long-term earnings growth of 42.9%. Shares of Arcos Dorados have increased 8.6% in the past year.

The Zacks Consensus Estimate for ARCO's 2022 sales and earnings per share (EPS) suggests growth of 10.4% and 255.6%, respectively, from the year-ago period's levels.

Home Depot sports a Zacks Rank #1. The company has a trailing four-quarter earnings surprise of 12.1%, on average. Shares of Home Depot have surged 40.4% in the past year.

The Zacks Consensus Estimate for HD's 2022 sales and EPS indicates a rise of 13.6% and 28.8%, respectively, from the year-ago period's levels.

Macy's currently sports a Zacks Rank #1. The company has a trailing four-quarter earnings surprise of 313.5%, on average. Shares of Macy's have increased 106.3% in the past year.

The Zacks Consensus Estimate for M's 2022 sales and EPS suggests growth of 39.6% and 320.4%, respectively, from the year-ago period's levels.

Infrastructure Stock Boom to Sweep America

A massive push to rebuild the crumbling U.S. infrastructure will soon be underway. It's bipartisan, urgent, and inevitable. Trillions will be spent. Fortunes will be made.

The only question is "Will you get into the right stocks early when their growth potential is greatest?"

Zacks has released a Special Report to help you do just that, and today it's free. Discover 5 special companies that look to gain the most from construction and repair to roads, bridges, and buildings, plus cargo hauling and energy transformation on an almost unimaginable scale.

Download FREE: How to Profit from Trillions on Spending for Infrastructure >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Macy's, Inc. (M): Free Stock Analysis Report

The Home Depot, Inc. (HD): Free Stock Analysis Report

Papa John's International, Inc. (PZZA): Free Stock Analysis Report

Arcos Dorados Holdings Inc. (ARCO): Free Stock Analysis Report

To read this article on Zacks.com click here.