Down 32% YTD, is NVIDIA Stock Now a Buy? The shares of leading networking solutions company NVIDIA (NVDA) have been plummeting due to bearish market sentiment amid several macroeconomic headwinds. So, because the markets remain under pressure as the...

This story originally appeared on StockNews

The shares of leading networking solutions company NVIDIA (NVDA) have been plummeting due to bearish market sentiment amid several macroeconomic headwinds. So, because the markets remain under pressure as the Fed gears up to increase benchmark interest rates again this month, will NVDA be able to regain forward momentum soon? Read more to find out.

NVIDIA Corporation (NVDA) in Santa Clara, Calif., is a leading semiconductor and networking solutions company based in the United States. The company operates in two segments: Graphics; and Computing and Networking. Its products have applications in gaming devices, data centers, and automotive industries. NVDA has an ISS Governance QualityScore of 6, indicating relatively high governance risk.

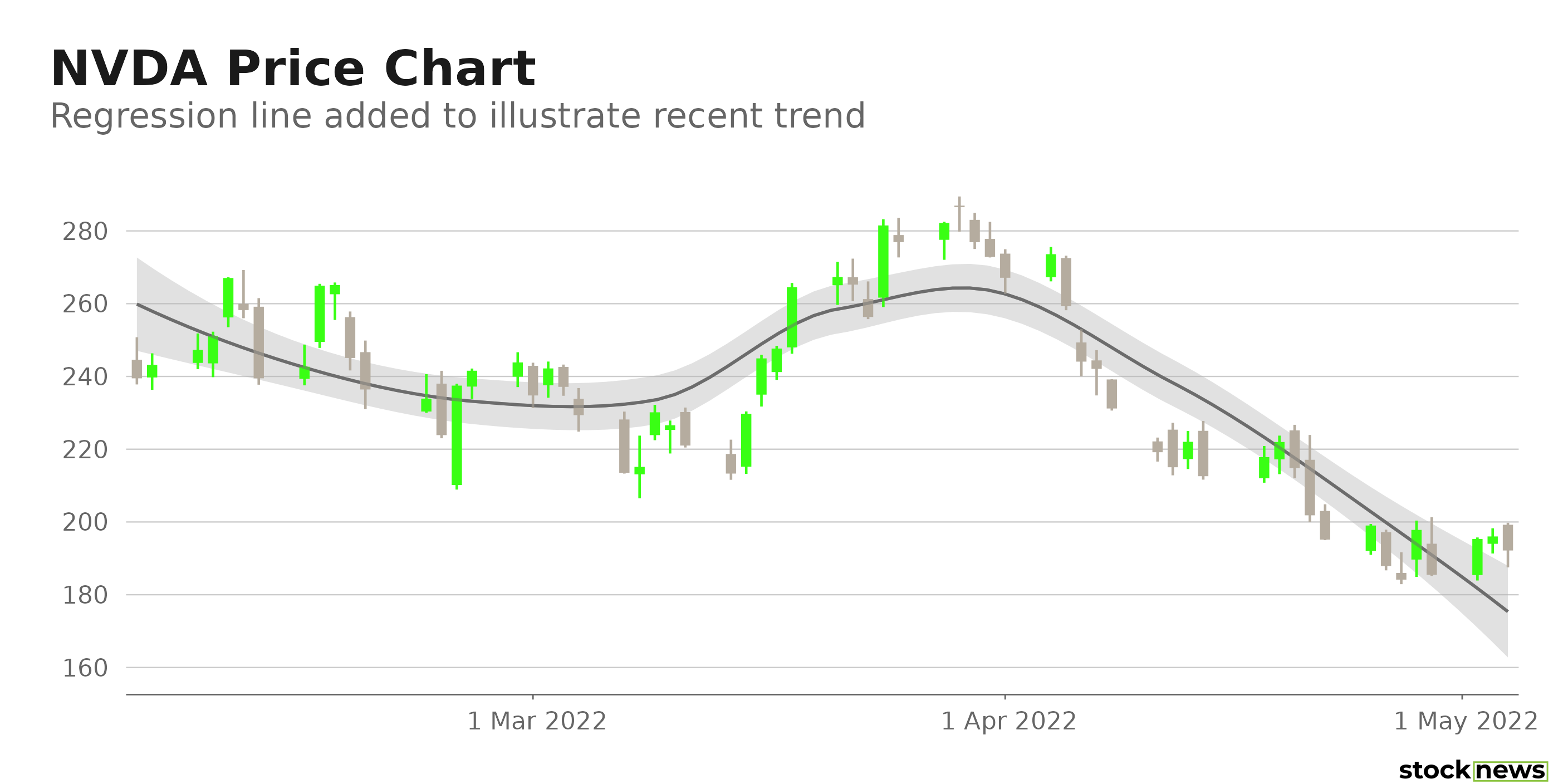

Shares of NVDA have declined 35.9% in price year-to-date and 29.3% over the past month to close yesterday's trading session at $196.02.

The ongoing market correction combined with bearish investor sentiment amid declining demand for personal computers has caused the stock to lose momentum so far this year.

Here is what could shape NVDA's performance in the near term:

Impressive Growth Story

NVDA's revenues have increased at a 32% CAGR over the past three years and at a 31.3% CAGR over the past five years. The company's EBITDA and net income have risen CAGRs of 40.2% and 33%, respectively, over the past three years. In addition, its EPS has grown at a 32.4% rate per annum over the past three years and at a rate of 43.1% per annum over the past five years. NVDA's levered free cash flow has improved at a 54.2% CAGR over the past three years. And its EBITDA and net income have risen at CAGRs of 39.5% and 42.4%, respectively, over the past five years. Its EPS has increased at a 43.1% rate per annum over the past five years.

NVDA's trailing-12-month revenues increased 61.4% year-over-year, while its net income rose 125.1% year-over-year. Also, the company's trailing-12-month EPS and levered free cash flow have improved 122.5% and 73.2%, respectively, year-over-year. Its trailing-12-month total assets rose 100% year-over-year.

Bullish Growth Prospects

Analysts expect NVDA's revenues to increase 43% year-over-year in its fiscal first quarter (ended April 30, 2022). Its $1.29 consensus EPS estimate for the about-to-be-reported quarter indicates a 41.5% improvement from the same period last year. In addition, the company's revenues and EPS are expected to rise 29.9% and 30.6%, respectively, year-over-year to $8.45 billion and $1.36 in the current quarter.

The Street expects NVDA's revenues to rise 29.2% year-over-year in the current year and 17.2% next year. Also, the company's EPS is expected to improve by 27% in the current year and 19.9% next year.

Premium Valuation

In terms of forward non-GAAP P/E, NVDA is currently trading at 34.78x, which is 85.9% higher than the 18.71x industry average. In addition, the stock is currently trading 14.11 times its forward sales, which is 357.4% higher than the3.09 industry average.

Also, NVDA's forward Price/Cash Flow and Price/Book ratios of 40.80 and 12.78, respectively, are significantly higher than the 17.76 and 4.18 industry averages. In addition, the stock's 31.03 forward EV/EBITDA multiple is 154.4% higher than the 12.20 industry average. And its forward EV/Sales ratio of 13.80 is 367% higher than the 2.95 industry average.

POWR Ratings Reflect Uncertainty

NVDA has an overall C rating, which translates to Neutral in our proprietary POWR Ratings system. The POWR Ratings are calculated by considering 118 distinct factors, with each factor weighted to an optimal degree.

NVDA has a grade of C for Momentum. It is currently trading below its 50-day and 200-day moving averages of $233.60 and $244.25, respectively, indicating a downtrend in sync with the Momentum grade. Also, the stock has a B grade for Growth but a D grade for Value. NVDA's robust growth story justifies the Growth grade, while its frothy valuation matches the Value grade.

Among the 95 stocks in the A-rated Semiconductor & Wireless Chip industry, NVDA is ranked #59.

Beyond what I have stated above, click here to view NVDA ratings for Stability, Sentiment, and Quality.

Click here to checkout our Semiconductor Industry Report for 2022

Bottom Line

Given the robust demand for semiconductors, NVDA is expected to grow substantially over the next few years. However, the current weakening demand and Fed's hawkish stance might limit NVDA's growth in the near term. Furthermore, as bearish market trends persist, shares of NVDA might plummet further, given their premium valuation compared to the company's peers. Thus, we think investors should wait until NVDA's valuations stabilize before investing in the stock.

How Does NVIDIA (NVDA) Stack Up Against its Peers?

While NVDA has a C rating in our proprietary rating system, one might want to consider looking at its industry peers, United Microelectronics Corp. (UMC), STMicroelectronics N.V. (STM), and Photronics, Inc. (PLAB), which have an A (Strong Buy) rating.

NVDA shares were trading at $191.59 per share on Wednesday afternoon, down $4.43 (-2.26%). Year-to-date, NVDA has declined -34.85%, versus a -12.00% rise in the benchmark S&P 500 index during the same period.

About the Author: Aditi Ganguly

Aditi is an experienced content developer and financial writer who is passionate about helping investors understand the do's and don'ts of investing. She has a keen interest in the stock market and has a fundamental approach when analyzing equities.

The post Down 32% YTD, is NVIDIA Stock Now a Buy? appeared first on StockNews.com