Here’s How the Inflation Reduction Act Energizes Power Stock

Hydrogen fuel cell technology provider Plug Power (NASDAQ: PLUG) stock has gotten a shot in the arm with the passing of the Inflation Reduction Act of 2022.

This story originally appeared on MarketBeat

Hydrogen fuel cell technology provider Plug Power (NASDAQ: PLUG) stock has gotten a shot in the arm with the passing of the Inflation Reduction Act of 2022. The bill has brought life to renewable energy and electric vehicle (EV) stocks. The provider of hydrogen fuel cell (HFC) turnkey systems mission is to build green hydrogen energy networks, fleets, and cities. Plug Power expects over 80 tons of hydrogen use in 2024 and is committed to achieving 50% green content. Green hydrogen is created through electrolysis using electricity powered by renewable sources like solar energy or wind power. Plug Power has come further along with its penetration than competitors Fuel Cell Energy (NASDAQ: FCEL) and Ballard Power (NASDAQ: BLDP). It’s seen its electrolyzer business exceed expectations by 50% already this year in Europe. They expect the momentum to accelerate in the U.S. as evidenced by its 120MW deal with New Fortress Energy, which can expand to 500MW.

Inflation Reduction Act Ramifications

The $700 billion bill is aimed at reducing inflation by lowering energy costs, health care costs and trimming the deficit. It will promote the production of renewable energy and products to bolster supply to lower costs. The bill allocates $430 billion in spending towards the reduction of greenhouse gas emissions and invest in clean energy technologies and extending subsidies for the Affordable Care Act. It will also provide incentives by way of tax credits for switching to cleaner energy sources including energy efficient electric stoves, EVs, and solar. In essence, it will make it cheaper to install solar power systems by bumping up the tax credits that were set to expire at year’s end.

Impacts for Electric Vehicles

In regard to EVs, the bill provides up to a $7,500 credit to purchase a new EV or up to $4,000 to purchased a used EV for individuals making less than $150,000 or couples making less than $300,000 per year. However, the fine print dictates that the batteries must be made in the U.S. or sourced through its trading partners. This was intended to curb the reliance on China. The sourcing requirements gradually ramp up yearly. This is a challenge as China is the top producer of EV batteries with CATL current responsible for nearly 35% market share.

How Does Plug Power Benefit?

The Act directly impacts Plug Power’s electrolyzer and green hydrogen business according to its CEO, Andrew Marsh. The bill plays right into Plug Power’s wheelhouse of products. Plug Power makes zero-emission hydrogen fuel cell products ranging from GenSure and ProGen fuel cell engines to GenSure back up power systems and services. GenDrive is a drop-in fuel cell system to replace existing batteries for electric fleets. ProGen fuel cell engines enable OEMs to design and fit new EVs for fleets. GenFuel services includes the design and construction hydrogen storage sites with its proprietary dispensers for quick fueling. The Company already claims some of the largest brands as customers for its materials handling (forklift) products including NASA, Amazon (NASDAQ: AMZN), Boeing (NYSE: BA), FedEx (NYSE: FDX), Walmart (NYSE: WMT), and Home Depot (NYSE: HD).

CEO Comments on the Act

In its fiscal Q2 2022 earnings conference call, Plug Power CEO Marsh commented, “The recently passed bill would enact a clean hydrogen production tax credit, the PTC to incentivize the production of clean hydrogen, providing a major inflection for the world to achieve net zero by 2050 and for hydrogen, especially green hydrogen to provide 20% of the world’s energy… With the passage of the act, we expect a boom for our electrolyzer and green hydrogen business.” He continued, “All applications that use gray hydrogen today such as fertilizer manufacturing will now be able to buy green hydrogen at a competitive price with gray. Applications that are looking to move to hydrogen like steel and concrete manufacturing and natural gas heating will have a path to dramatically reduce their carbon footprint cost competitively.”

Looking Ahead

Plug Power provided its outlook looking ahead. For full-year 2022, the Company issued in-line guidance for revenues between $900 million to $925 million versus $915.27 million consensus analyst estimates. Strong policy backdrop sets a clear path to 2025 targets. The electrolyzer business is robust with a current backlog of 1.5GW versus targeted booking for 1GW. Its material handling business is experiencing robust demand.

Has PLUG Stock Gotten Ahead of Itself?

They say a stock price is a forward value of how the company should perform. The markets are forward looking and tend to precede events and news. PLUG stock bounced in three weeks to erase seven weeks of losses. Investors looking to get a piece of the action should administer patience. The passing of the Act was an anticipated event and a sell the news reaction will likely kick after the initial euphoria as seen in the near doubling of its share price for First Solar (NASDAQ: FSLR).

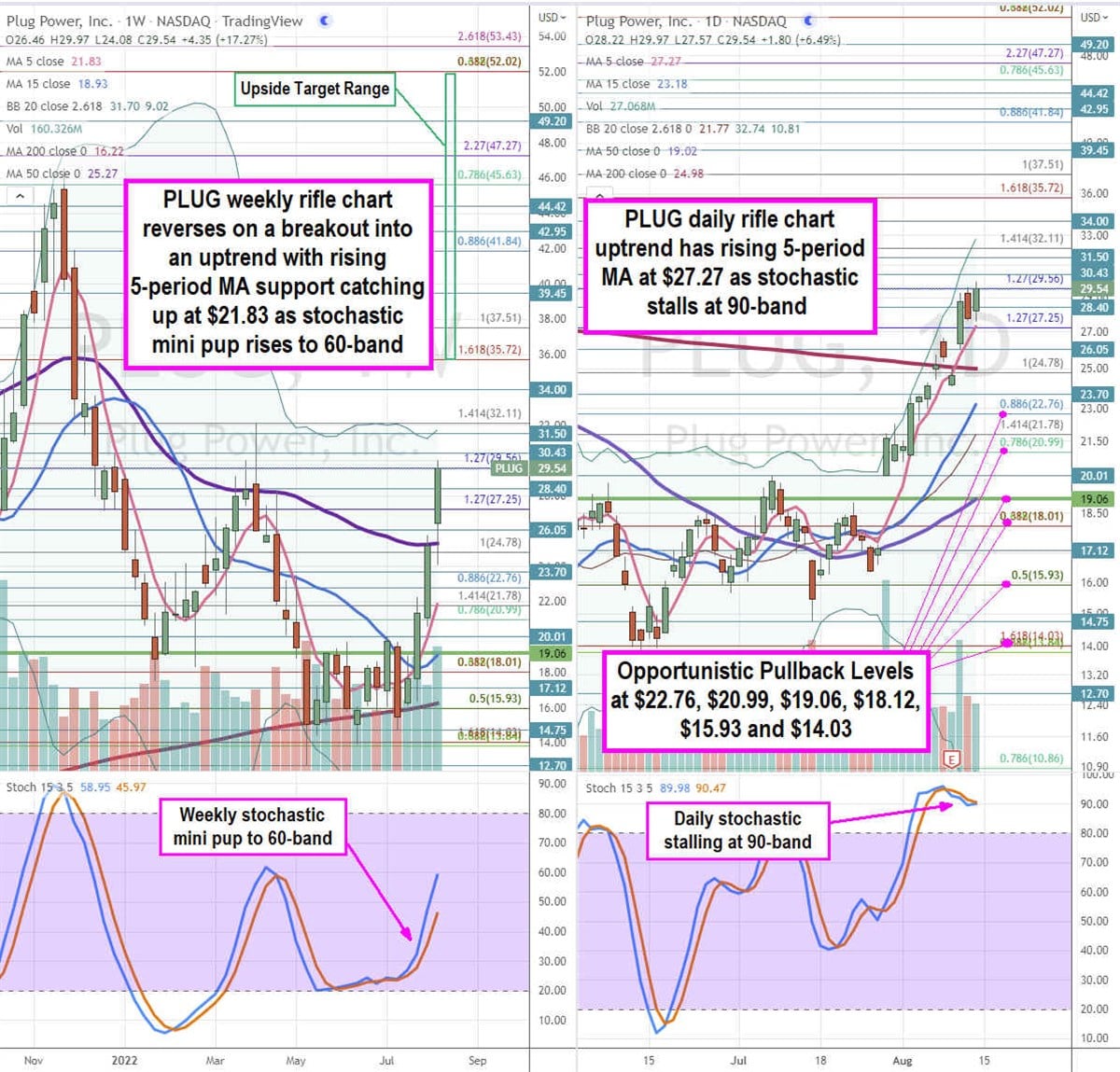

Chart Technical Analysis

Using the rifle charts on weekly and daily time frames provides a precision view of the landscape for PLUG stock. The weekly rifle chart last peaked near the $32.11 Fibonacci (fib) level. Shares proceeded to breakdown to $12.70 before stochastic formed a mini pup bounce to trigger the weekly market structure low (MSL) buy signal on the breakout through $19.06. The weekly breakout has a rising 5-period moving average (MA) support at $21.83 followed by the 15-period MA at $18.93. The weekly 200-period MA held the floor on the breakdown and is rising at $16.22. The weekly 50-period MA resistance broke at $25.27. The weekly upper Bollinger Bands (BBs) sit at $31.70. The daily rifle chart has been in a strong uptrend lifted by its rising 5-period MA at $27.27 followed by the 15-period MA at $23.18. Shares broke threw the daily 200-period MA at $24.98. The daily 50-period MA support is overlapping the weekly MSL trigger. The daily stochastic peaked and is stalled at the 90-band to either cross back up to thrust to the daily upper BBs at $32.74 or fall through the 80-band for an oscillation down. Prudent investors can watch for opportunistic pullback levels at the $22.76 fib, $20.99 fib, $19.06 weekly MSL trigger/daily 50-period MA, $18.01 fib, $15.93 fib, and $14.03 fib level. Upside targets range from the $35.72 fib up towards the $52.02 fib level.

Hydrogen fuel cell technology provider Plug Power (NASDAQ: PLUG) stock has gotten a shot in the arm with the passing of the Inflation Reduction Act of 2022. The bill has brought life to renewable energy and electric vehicle (EV) stocks. The provider of hydrogen fuel cell (HFC) turnkey systems mission is to build green hydrogen energy networks, fleets, and cities. Plug Power expects over 80 tons of hydrogen use in 2024 and is committed to achieving 50% green content. Green hydrogen is created through electrolysis using electricity powered by renewable sources like solar energy or wind power. Plug Power has come further along with its penetration than competitors Fuel Cell Energy (NASDAQ: FCEL) and Ballard Power (NASDAQ: BLDP). It’s seen its electrolyzer business exceed expectations by 50% already this year in Europe. They expect the momentum to accelerate in the U.S. as evidenced by its 120MW deal with New Fortress Energy, which can expand to 500MW.

Inflation Reduction Act Ramifications

The $700 billion bill is aimed at reducing inflation by lowering energy costs, health care costs and trimming the deficit. It will promote the production of renewable energy and products to bolster supply to lower costs. The bill allocates $430 billion in spending towards the reduction of greenhouse gas emissions and invest in clean energy technologies and extending subsidies for the Affordable Care Act. It will also provide incentives by way of tax credits for switching to cleaner energy sources including energy efficient electric stoves, EVs, and solar. In essence, it will make it cheaper to install solar power systems by bumping up the tax credits that were set to expire at year’s end.

Impacts for Electric Vehicles

In regard to EVs, the bill provides up to a $7,500 credit to purchase a new EV or up to $4,000 to purchased a used EV for individuals making less than $150,000 or couples making less than $300,000 per year. However, the fine print dictates that the batteries must be made in the U.S. or sourced through its trading partners. This was intended to curb the reliance on China. The sourcing requirements gradually ramp up yearly. This is a challenge as China is the top producer of EV batteries with CATL current responsible for nearly 35% market share.