Is Cadence Close To A Cup-With-High-Handle Breakout? Cadence Design Systems appears to be forming a cup with high handle pattern. However, its fate has tracked closely with that of the the broader market recently.

By Kate Stalter

This story originally appeared on MarketBeat

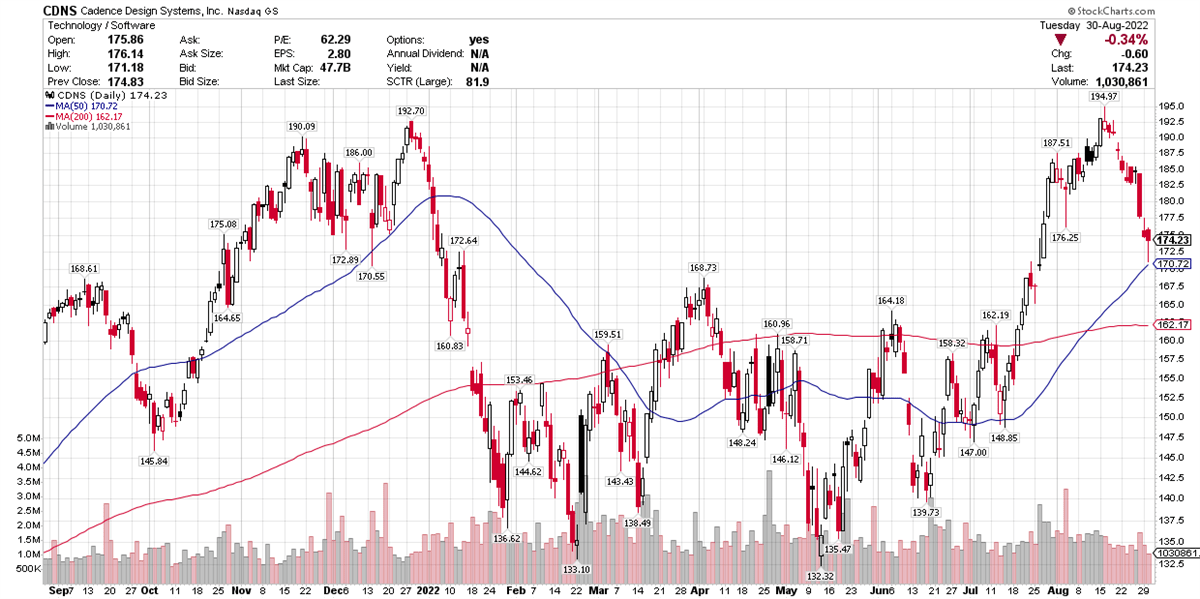

If you're a student of chart patterns, you'll notice that Cadence Design Systems (NASDAQ: CDNS) appears to be forming a cup with high handle.

Now, I'm well versed in many of these typical chart patterns. I'm not aware of any empirical data showing the probabilities of a cup with handle leading to a successful breakout, with a certain minimum return threshold over a specified period of time.

That said, there is plenty of anecdotal evidence going back decades, documented in historical "model books" and the like, showing that a cup-with-handle pattern can indeed, lead to a profitable breakout.

In a volatile market, like the one we've been experiencing since November, earnings have arguably been a more reliable catalyst for price gains. For example, Cadence shares popped after the company's earnings report last October.

That rally lasted until November, simultaneous with the broader market's retreat. Just like the S&P 500 corrected and attempted to rally before rolling over on January 4, Cadence followed the same trajectory, topping out on December 28.

Currently, the cup-with-high-handle buy point is $194.97. Many technical analysts recommend buying when the stock surpasses that point by $0.10, in heavy trading volume. Lower-volume breakouts can be successful, however.

Moving In Tandem With The Market

But what to make of Cadence's current retreat from that prior high, reached on August 16?

Well, for starters, and not coincidentally, that was the same day the S&P 500 notched a short-term high. You can easily see that with a glance at the SPDR S&P 500 ETF (NYSEARCA:SPY).

There's a widespread "common knowledge" saying that three-quarters of stocks follow the market's direction. Whether that's literally true or not doesn't really matter, as it's easy to see that stocks struggle to make gains while the broader market is choppy or in decline.

Cadence is clearly tracking along with the broader market. The stock is tracked by the S&P 500, but constitutes only 0.14159% of the index. That means it's going to move in tandem with index direction the majority of the time, unless some company- or industry-specific news sends the stock moving in the opposite direction, or in the same direction at a different rate.

So what about its specific sector and industry?

The Technology Select Sector SPDR ETF (NYSEARCA: XLK), which tracks the S&P large-cap tech sector, is down 20.26% year-to-date.

Cadence Outperforming The Tech Sector

Cadence, meanwhile, is down just 6.18% so far this year, thanks largely to a strong rally that began in late July, following the most recent quarterly earnings report.

The company earned $1.08 per share, up 26% from the year-ago quarter. Revenue was $857.5 million, up 18%. According to MarketBeat earnings data, Cadence beat views on the top and bottom lines.

Those results also exceeded management's guidance for the quarter. Cadence is well situated to take advantage of trends toward 5G adoption, artificial intelligence, and hyperscaling, which involves scaling a distributed computing environment as demand on the network increases.

The company specializes in electronic design automation software and some related hardware for circuit designers. As the business environment for semiconductor design continues to rapidly evolve, Cadence appears to be in a good position.

Companies in similar lines of business include Rambus (NASDAQ: RMBS), Navitas Semiconductor (NASDAQ: NVTS), Keysight Technologies (NYSE: KEYS) and Ansys (NASDAQ: ANSS).

Why is that important to know? Because when you select stocks for your portfolio, you don't want too much overlap in terms of industry. You also want to understand which stock, among those with similar businesses, has the best potential for the level of gains you're seeking.

At this juncture, Cadence is showing the most price momentum, among that group of companies. However, analysts also expect Rambus and Keysight to show strong earnings growth in the next two years, as they do with Cadence. Be sure you understand how a stock you're eyeing stacks up against similar companies.