Cybersecurity Stocks Are the Best to Buy Amid the Russo-Ukrainian Crisis InvestorPlace - Stock Market News, Stock Advice & Trading TipsThe Russia-Ukraine war has emphasized that modern warfare is cyber warfare. And that means cybersecurity stocks are set for huge...

By Luke Lango

This story originally appeared on InvestorPlace

InvestorPlace - Stock Market News, Stock Advice & Trading Tips

Look; you're smart and know that market crashes create great long-term buying opportunities. So you're probably already looking for stocks to buy right now. And I have one simple suggestion to make your search easier: Buy cybersecurity stocks.

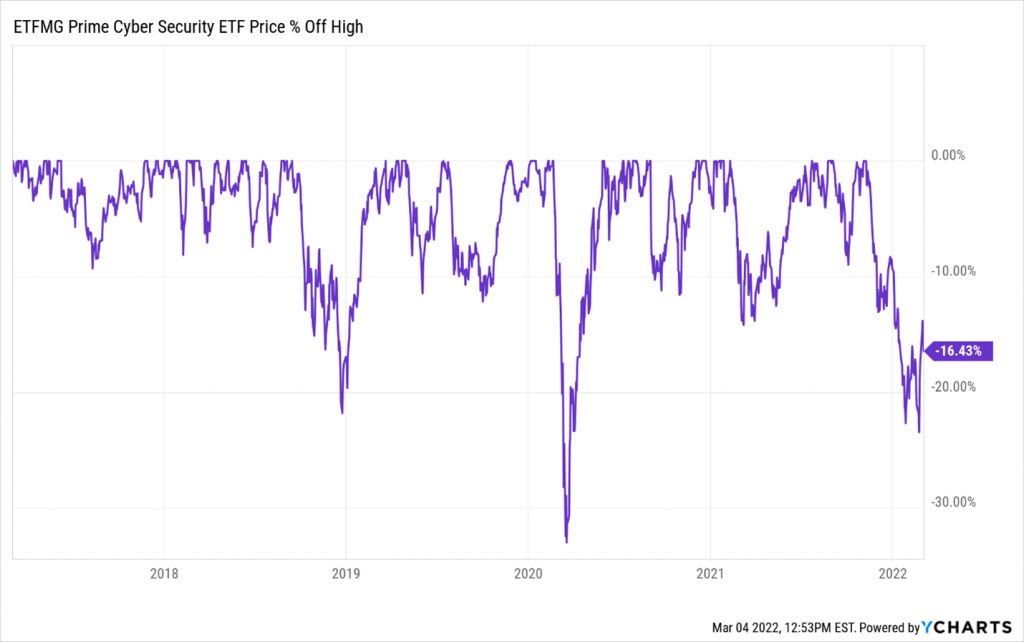

Like the rest of the market, cybersecurity stocks have been crushed over the past few months. The ETFMG Prime Cyber Security ETF (NYSEARCA:HACK) has dropped about 17% off its recent highs, marking its second biggest selloff of the past five years — and its biggest selloff aside from March 2020's Covid-19 crash.

But the fundamental reality is that cybersecurity stocks shouldn't be down big. Rather, they should be up big. The geopolitical turmoil sparked by the Russia-Ukraine war will generate enormous tailwinds for cybersecurity stocks over the coming months.

The investment implication? It's time to buy the dip in these stocks. In both the near and long term, they should win big!

The Russo-Ukrainian crisis has emphasized many things about the world — the need for energy independence, the importance of sanctions. And it made clear that Vladimir Putin is an absolute madman.

It's also emphasized that modern warfare is cyber warfare.

That is, war isn't exclusively fought on battlefields between people. It's also fought digitally in the cloud and between computers. Indeed, the Russo-Ukrainian conflict has, to date, been characterized by relentless cyber warfare.

Catalyst for the Cybersecurity Boom

A group under the pseudonym Anonymous has hacked into one of Vladimir Putin's yachts, Russian State Media, Russian internet service providers and TV networks, various EV chargers in Russia, Belarusian banks and railways and more. They've done things from leaking critical information to providing intel and playing the Ukrainian national anthem on state-owned TV stations in Russia.

Meanwhile, Russia has struck back, hacking into Ukrainian cameras and taking certain Ukrainian websites offline.

At the same time, Nvidia (NASDAQ:NVDA) and Toyota (NYSE:TM) were both hacked over the past week in events purportedly unrelated to Eastern Europe. But let's be honest. How could they not be? The U.S. and Japan both levied significant sanctions against Russia last week. And in their wake, America's biggest chipmaker and Japan's largest automaker are anonymously hacked.

The Cyber War has begun, only escalating from here.

And since those heavy sanctions have been imposed on Russia, Putin wants to retaliate against the U.S. and its allies. However, their routes are limited. Their options are:

Economic — but they can't hurt us that way because the Russian economy is a drop in the ocean compared to America's.

Militarily — but they can't really hurt us that way either since the Russian military is also tiny compared to the combined might of the U.S. and its allies.

Cyber — where they can hurt us because cyberwarfare is something the Russians have developed a reputation for being quite good at.

Therefore, Russia will likely expand this conflict into global cyberwarfare. And in that case, the U.S., its allied nations and all the major corporations in those countries are going to spend enormous sums of money on cybersecurity in the coming months.

The investment implication here is to buy cybersecurity stocks today before this cyber "gold rush."

Cybersecurity Stocks' Long-Term Upside Potential

The opportunity in cybersecurity stocks today is further enhanced by the fact that these stocks won't just benefit from a short-term spending surge. Rather, they'll profit from what will likely be a decade of huge growth across the whole industry.

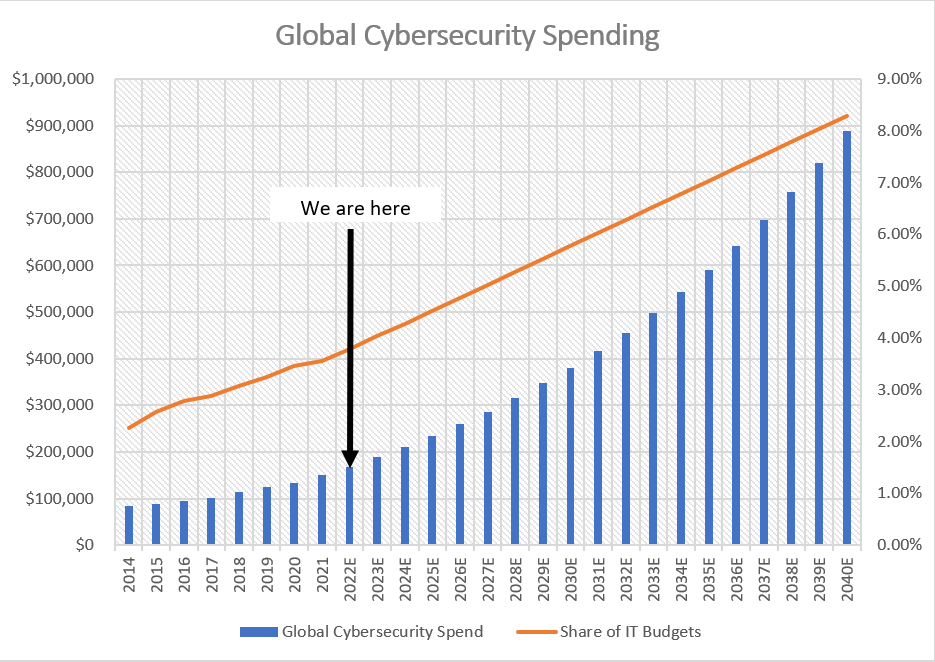

According to Gartner, worldwide spending on cybersecurity solutions has grown by ~9% per year since 2014. While that may not seem that impressive, simply consider three things:

- Cybersecurity spending constituted just 3.5% of IT budgets in 2021, a rather small portion, which implies huge room for share-of-budget expansion in the coming years.

- Cybersecurity spending growth has consistently accelerated over the past few years, as the need for cybersecurity solutions has become increasingly mission critical. Expenditure grew just 5% in 2015. In 2021, it grew by more than 12% and is expected to grow another 12% in 2022.

- The importance of cybersecurity solutions will continue to rise as we move into an increasingly digital-centric society. And amid this shift, cybersecurity spending growth should also continue to accelerate.

For those reasons, our analysis suggests we're in the first innings of a multi-decade breakout in the cybersecurity industry.

We believe that spending will grow to roughly 6% of IT budgets by 2030. It'll reach 8% of IT budgets by 2040, powering what we see as 11% annualized growth throughout the 2020s — and 8% growth through the 2030s.

In other words, this industry is just getting started.

Huge Incoming Rebound

You shouldn't see cybersecurity stocks as great options to buy now and sell in a few months for small gains. You should see them as great stocks to buy now and sell in 5-plus years for 100%-plus profits.

That's the core investment strategy in our flagship investment research advisory Innovation Investor. We buy stocks in the early stages of enormous growth, targeting multi-hundred-percent returns over a long-term window.

And that's why, in that advisory, we just did a deep dive into every publicly traded cybersecurity company on the market.

History is clear on the fact that market crashes create excellent buying opportunities — especially in high-quality assets. And that's why we firmly believe the best thing you can do in this turbulent market is buy the dip.

And the assets we like most on this dip? Cybersecurity stocks.

With those, you've got it all — long-term winners, huge revenue growth, wide competitive moats, big margins, scalable software business models. The stocks are down 30%, 40% and even 50% in some cases. Valuations have collapsed to record lows. And with the current Eastern Europe conflict, there's a huge demand catalyst unfolding right before our very eyes.

That's a cocktail for a huge long-term rebound in cybersecurity stocks.

In our research advisory this week, we're publishing the results of our deep dive in a unique report only available to subscribers. And it will include our top cybersecurity stocks to buy at the current moment.

Trust me. This is a report you can't afford to miss. These stocks could help supercharge and safeguard your portfolio for years to come.

On the date of publication, Luke Lango did not have (either directly or indirectly) any positions in the securities mentioned in this article.

The post Cybersecurity Stocks Are the Best to Buy Amid the Russo-Ukrainian Crisis appeared first on InvestorPlace.