Is CVS Working Its Way Back to Its Record High? The pandemic brought a renewed interest in the health care sector. CVS Health (CVS) is one of the largest and most diverse health care companies in the country. The company has a strong history of earnings and revenue growth and its stock has shown recent bullish momentum. Will it get back to its record high? Read more to find out.

By Andrew Hecht

This story originally appeared on StockNews

- A massive healthcare franchise

- Bullish price action over the past year

- Impressive earnings and revenue trends

- Analysts love this stock

- A juicy dividend while waiting for capital appreciation

The 2020 global pandemic put the spotlight on US healthcare. As of April 23, COVID-19, the number of confirmed US coronavirus cases was over 33 million, with more than 590,000 fatalities. Over 43% of the US population has already received vaccines creating herd immunity to the virus. While the Pfizer (PFE), Moderna (MRNA), and Johnson and Johnson (JNJ) vaccines do not guarantee total immunity from COVID-19, scientists have proven they prevent hospitalizations and death from the pandemic.

Healthcare in the US has been a political football over the past years, but the pandemic has raised its profile. CVS Health Corporation (CVS) is a leading health services provider. The company's market cap stood at just over the $100 billion level on April 30, with the stock trending higher over the past year.

A massive healthcare franchise

At $76.40 at the end of last week, CVS had a market cap at the $100.148 billion level, an average of over 5.4 million CVS shares changes hands each day.

CVS provides health services in the United States. The Pharmacy segment offers a range of services for customers as it works with insurance companies, government, and many different plans. It operates retail specialty pharmacy stores, mail order services, compounding pharmacies, and branches for infusion and enteral nutritional services. The Retail/ITC segment sells prescription and over-the-counter drugs, consumer beauty, and personal care products and provides direct health care services via its MinuteClinic walk-in medical clinics.

As of the end of 2020, CVS operated approximately 9,900 retail locations, 1,100 Minute Clinics, online retail pharmacy websites, LTC pharmacies, and onsite pharmacies. CVS's Health Care Benefits segment offers traditional, voluntary, and consumer-related services for the general population. CVS has been around since 1963, with its headquarters in Woonsocket, Rhode Island.

Bullish price action over the past year

CVS shares reached an all-time high in July 2015 at $113.65. In March 2020, the stock dropped to a low of $52.04 as pandemic-related selling hit markets across all asset classes.

Source: Barchart

Source: Barchart

As the chart shows, CVS shares have made higher lows and higher highs over the past year, reaching a peak at $77.44 on April 21. The stock was just below that level at the end of last week. The trend remains bullish.

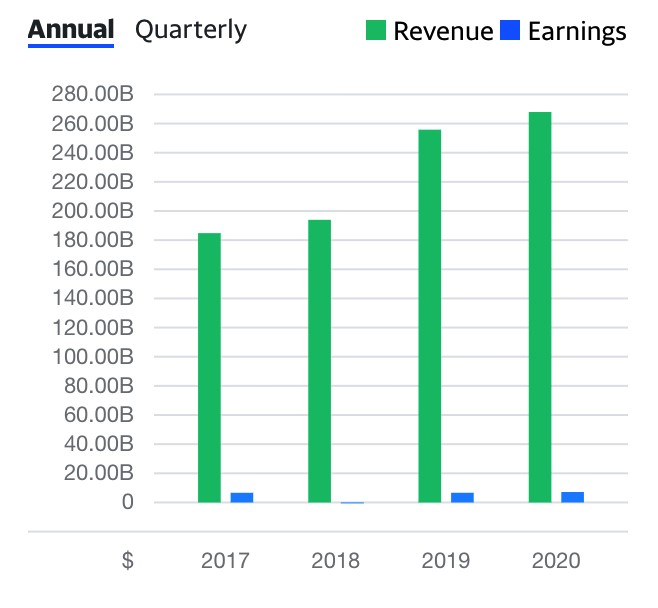

Impressive earnings and revenue trends

CVS will report its earnings on May 4, 2021. The consensus forecast is currently for EPS of $1.71. CVS has beaten the consensus estimates over the past four consecutive quarters.

Source: Yahoo Finance

Source: Yahoo Finance

The chart shows CVS is consistently profitable, exceeding analyst's expectations.

Source: Yahoo Finance

Source: Yahoo Finance

The revenue and earnings trends have been impressive. A survey of twenty-five analysts on Yahoo Finance has an average price target of $87.25 for CVS shares, with forecasts ranging from $72 to $102 per share. The stock was trading closer to the low end of the range at the end of last week.

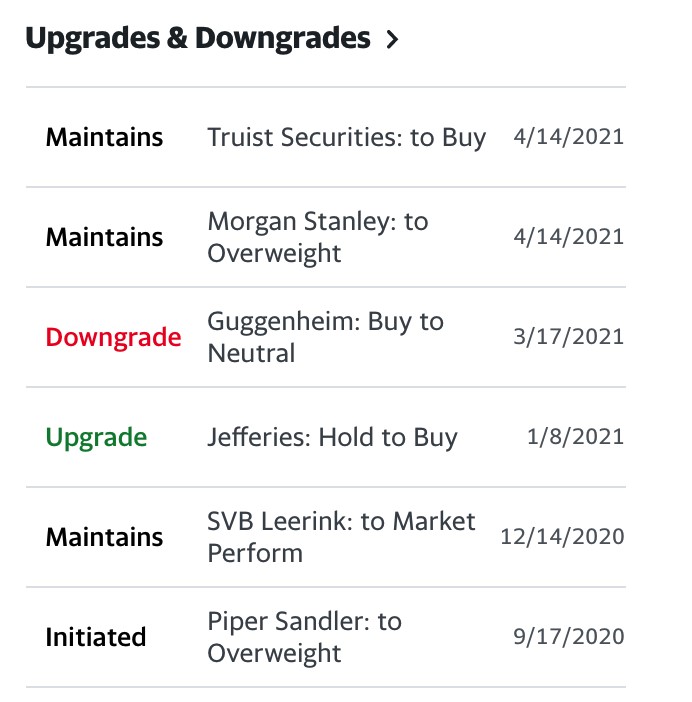

Analysts love this stock

It is challenging to find any analyst that does not like the prospects for CVS shares at just over $76.

Source: Yahoo Finance

Source: Yahoo Finance

As the chart illustrates, the most recent ratings have been buy and overweight during April 2021.

We are likely to see another positive earnings report on May 4, with EPS coming in over the $1.71 expectations.

A juicy dividend while waiting for capital appreciation

Meanwhile, CVS pays shareholders a $2.00 per share dividend. At $76, it translates to a 2.62% yield on the stock. There is lots of room between the current share price and the all-time high from 2015 at the $113.65 level. The pandemic has put healthcare at the top of the list for many consumers. CVS's locations and services set the company in the perfect position to profit over the coming months and years.

I view CVS as a growth stock with lots of upside potential that pays an attractive dividend while investors wait for capital appreciation. The latest price to earnings ratio is at just over ten times earnings, making CVS an inexpensive stock. In a market where it is a challenge to identify companies offering value, CVS stands out as a bargain at its current share price.

CVS shares fell $77.69 (-100.00%) in premarket trading Tuesday. Year-to-date, CVS has gained 17.35%, versus a 11.61% rise in the benchmark S&P 500 index during the same period.

About the Author: Andrew Hecht

Andy spent nearly 35 years on Wall Street and is a sought-after commodity and futures trader, an options expert and analyst. In addition to working with StockNews, he is a top ranked author on Seeking Alpha. Learn more about Andy's background, along with links to his most recent articles.

The post Is CVS Working Its Way Back to Its Record High? appeared first on StockNews.com