Morgan Stanley Stock Getting Attractive on the Sell-Off

Investment bank Morgan Stanley (NYSE: MS) stock collapsed from its highs of $109.73 in just three weeks on fears of contagion from Russia.

This story originally appeared on MarketBeat

Investment bank Morgan Stanley (NYSE: MS) stock collapsed from its highs of $109.73 in just three weeks on fears of contagion from Russia. The Russian invasion of Ukraine has triggered swift sanctions against Russia and it’s banks including the Central Bank. The exposure to Russian banks has accelerated selling in U.S. banks despite the relatively small extent of exposure. This panic selling has ignored the benefits of upcoming interest rate hikes and the growing synergy of its parts. The Company has acclimated its acquisitions of E*TRADE and Eaton Vance well as it continues to grow its dividends and top line growth. The synergistic nature of the additions has bolstered its assets under management north of $5 trillion in addition to bolstering its securities lending business. The market volatility should be a boon to its retail trading business. Shares are trading at just 11.5X forward earnings. The Federal Reserve chairman Jerome Powell has indicated a 0.25 interest rate hike in March and several more throughout the year. Prudent investors seeking exposure in a leading investment banker can watch for opportunistic pullbacks in shares of Morgan Stanley.

Q4 Fiscal 2021 Earnings Release

On Jan. 19, 2022, Morgan Stanley released its fiscal fourth-quarter 2021 results for the quarter ending December 2021. The Company reported earnings per share (EPS) profits of $2.01 versus $1.96 consensus analyst estimates, a $0.05 beat. Revenues grew 6.8% year-over-year (YoY) to $14.52 billion, falling short of analyst estimates for $14.59 billion. The full year 2021 ROTCE was 19.8% and firm expense efficiency ratio was 67%. Common Equity Tier 1 capital standardized ratio was 16%. Morgan Stanley CEO James P. Gorman commented, “2021 was an outstanding year for our Firm. We delivered record net revenues of $60 billion and a ROTCE of 20%, with stand-out results in each of our business segments. Wealth Management grew client assets by nearly $1 trillion to $4.9 trillion this year, with $438 billion in net new assets. Combined with Investment Management, we now have $6.5 trillion in client assets.”

Conference Call Takeaways

CEO Gorman discussed the 12-year transformation resulting in a doubling of revenues since the 2009 global financial meltdown. Each of its business segments have “defensible and sustainable” competitive advantages. The investment bank generated annual revenues of $30 billion in 2021. Wealth Management added almost $1 trillion in client assets with nearly $438 billion of net new assets in 2021. The services over $5 trillion of client assets with revenue on assets continues to remain over 50 basis points across 15 million customers. The Company has total assets under management (AUM) of $1.6 trillion with fees nearly tripled since 2014. CEO Gorman expects nearly $500 million of incremental NII in Wealth Managementwith another $200 million from the reversal of fee waivers. The annual dividend has doubled to $2.80 in 2021. He underscored the sum of parts to create a unique cumulative and synergistic effect, “We have scale, significant growth opportunities in wealth and investment management, coupled with a leading institutional business, and a strong commitment to capital return. The Morgan Stanley brand has never been stronger. We’ve been fortunate enough to acquire additional brands in the last few years that have tremendous value in expanding our footprint. The sum of these elements supports multiple expansion for the combined company.”

MS Opportunistic Pullback Levels

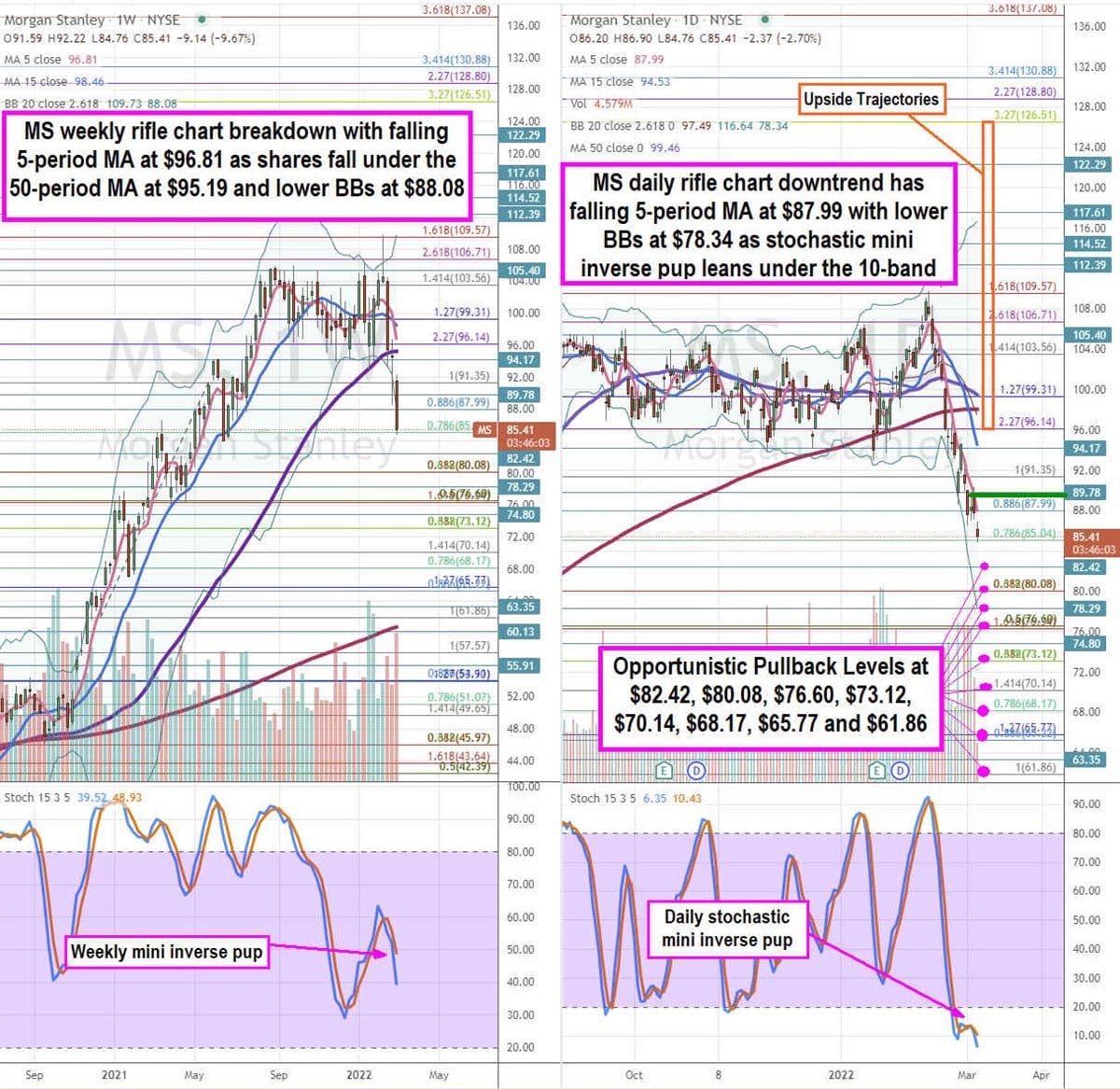

Using the rifle charts on the weekly and daily time frames provide a precise view of the price action playing field for MS stock. The weekly rifle chart peaked near the $109.57 Fibonacci (fib) level before falling to the $85.04 fib level. The weekly breakdown collapsed quickly as the weekly 5-period moving average (MA) is catching up at $96.81 followed by the 15-period MA at $98.46. The weekly 50-period MA sits at $95.19. The weekly lower Bollinger Bands (BBs) sit at $88.08 as the weekly stochastic mini inverse pup falls under the 40-band. The daily rifle chart breakdown has a falling 5-period MA at $87.99 followed by the 15-period MA at $94.53. The daily lower BBs sit at $78.34 as the stochastic falls again under the 10-band. The daily market structure low (MSL) buy triggers on a breakout above $89.28. Prudent investors can watch for opportunistic pullbacks at the $82.42, $80.08 fib, $76.60 fib, $73.12 fib, $70.14 fib, $68.17 fib, $65.77 fib, and the $61.86 fib level. Upside trajectories range from the $96.14 fib up towards the $126.51 fib level.

Investment bank Morgan Stanley (NYSE: MS) stock collapsed from its highs of $109.73 in just three weeks on fears of contagion from Russia. The Russian invasion of Ukraine has triggered swift sanctions against Russia and it’s banks including the Central Bank. The exposure to Russian banks has accelerated selling in U.S. banks despite the relatively small extent of exposure. This panic selling has ignored the benefits of upcoming interest rate hikes and the growing synergy of its parts. The Company has acclimated its acquisitions of E*TRADE and Eaton Vance well as it continues to grow its dividends and top line growth. The synergistic nature of the additions has bolstered its assets under management north of $5 trillion in addition to bolstering its securities lending business. The market volatility should be a boon to its retail trading business. Shares are trading at just 11.5X forward earnings. The Federal Reserve chairman Jerome Powell has indicated a 0.25 interest rate hike in March and several more throughout the year. Prudent investors seeking exposure in a leading investment banker can watch for opportunistic pullbacks in shares of Morgan Stanley.

Q4 Fiscal 2021 Earnings Release

On Jan. 19, 2022, Morgan Stanley released its fiscal fourth-quarter 2021 results for the quarter ending December 2021. The Company reported earnings per share (EPS) profits of $2.01 versus $1.96 consensus analyst estimates, a $0.05 beat. Revenues grew 6.8% year-over-year (YoY) to $14.52 billion, falling short of analyst estimates for $14.59 billion. The full year 2021 ROTCE was 19.8% and firm expense efficiency ratio was 67%. Common Equity Tier 1 capital standardized ratio was 16%. Morgan Stanley CEO James P. Gorman commented, “2021 was an outstanding year for our Firm. We delivered record net revenues of $60 billion and a ROTCE of 20%, with stand-out results in each of our business segments. Wealth Management grew client assets by nearly $1 trillion to $4.9 trillion this year, with $438 billion in net new assets. Combined with Investment Management, we now have $6.5 trillion in client assets.”