Solid Power Is Up, but It's Still Not a Worthwhile Battery Bet InvestorPlace - Stock Market News, Stock Advice & Trading TipsA bet on SLDP stock is shaping up like a rip-up at the track rather than a wager on a...

By Chris Tyler

This story originally appeared on InvestorPlace

InvestorPlace - Stock Market News, Stock Advice & Trading Tips

There's been a positive charge in electric vehicle (EV) battery play Solid Power (NASDAQ:SLDP) today. But is this excited behavior solid evidence that investors should purchase SLDP stock?

Let's take a look at what's happening in Solid Power off and on the price chart, then offer a risk-adjusted determination aligned with those findings.

Today, Wall Street is reacting to Russia's attack on Ukraine. And if you're not up on other current events, the provocation triggered a newly-minted bear market in the Nasdaq and precipitous, corrective downward spiral in other benchmarks.

But that was then, and this is now. Let's look at the forces moving SLDP stock.

What's Pushing Solid Power Shares Up?

Less than a couple hours into the Thursday trading session, shares of SLDP stock were up nearly 2% after a brief depowering of 9% out of the gate.

Not that Solid State is alone. Next-generation battery peer QuantumScape (NYSE:QS) has put together a similar move of a deep dive followed by a burst above the surface to dazzle the crowd.

They're not exactly by themselves, either. While the broader market was still in the red but off its worst levels, electric vehicle companies of all shapes, sizes and aspirations have bolted into the "plus" column. That includes Tesla (NASDAQ:TSLA), ChargePoint Holdings (NYSE:CHPT) and Rivian Automotive (NASDAQ:RIVN).

You get the picture. Today's snapshot of volatile fair pricing has formed around the looser idea of buying instead of selling as oil prices surge in response to the Russian invasion.

But when it comes to SLDP, don't expect any positive feedback in the form of geopolitically-driven sales.

As a concept-stage play, the outfit's High-Content Silicon and Li Metal Anode Cell technology is three years to five years away from critical "D-sample testing," as InvestorPlace's Ian Bezek recently noted.

And if everything goes as planned through 2025, only then will SLDP investors see quarterly reports sporting revenue as its commercial product debuts.

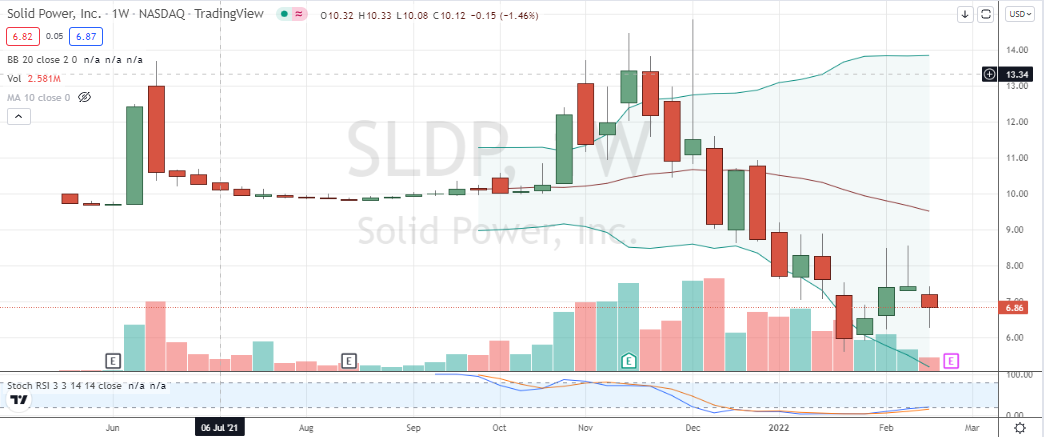

SLDP Stock Weekly Price Chart

Source: Charts by TradingView

Not that there's anything wrong with a speculative stock purchase inside investors' portfolios. That's SLDP stock in a nutshell, and for that matter, rival QS stock is in a similar position.

The reality is both Solid Power and QuantumScape's battery technology promise to radically raise the bar on battery performance and cost. They both strive to make the combustible engine go the way of other dinosaurs.

But how many ponies are you going to bet on? If I had a horse in the race, my money would be on QuantumScape.

The thing is that SLDP stock is trading near all-time-lows. The same can't be said of QS, though admittedly, it's hemorrhaged since December 2020's over-the-top high.

Also, Solid Power commands a small-cap valuation of just $1.3 billion. It has long since cratered below its former $10 net asset value. Everyone is underwater.

The Bottom Line on SLDP Stock

Again, and as ugly as it's been for QS shareholders, visible size and performance advantages make QuantumScape the stronger horse in the race.

Then, there's Solid Power's sponsor blank-check company, Decarbonization Plus Acquisition Corp. As Ian also points out, the financiers haven't been on the podium with other alt-energy special purpose acquisition companies (SPACs).

That could be taken as another warning. Wall Street's thirst for SPACs over the past couple of years opened the door to a great deal of bad actors.

Agreeably enough, Microsoft's (NASDAQ:MSFT) Bill Gates and Volkswagen (OTCMKTS:VWAGY) are betting on QuantumScape. Again, QS stock resonates more.

To fairly walk the aisle among bulls and bears, there's a chance a weekly bottom is forming for Solid Power, and its stochastics do look promising. But with everything that's been said, SLDP stock still looks like a car wreck to gawk at. Just be smart enough to walk away from it unscathed.

On the date of publication, Chris Tyler did not have (either directly or indirectly) any positions in the securities mentioned in this article. The opinions expressed in this article are those of the writer, subject to the InvestorPlace.com Publishing Guidelines.

Chris Tyler is a former floor-based, derivatives market maker on the American and Pacific exchanges. For additional market insights and related musings, follow Chris on Twitter @Options_CAT and StockTwits.

More From InvestorPlace

- Stock Prodigy Who Found NIO at $2… Says Buy THIS Now

- Man Who Called Black Monday: "Prepare Now."

- Get in Now on Tiny $3 "Forever Battery' Stock

- Interested in Crypto? Read This First...

The post Solid Power Is Up, but It's Still Not a Worthwhile Battery Bet appeared first on InvestorPlace.