Stock Market Bottom? Think Again… Determining bear market bottom is much easier in hindsight than doing it in real time. That's because the stock market (SPY) offers up many impressive bounces that give the illusion...

This story originally appeared on StockNews

Determining bear market bottom is much easier in hindsight than doing it in real time. That's because the stock market (SPY) offers up many impressive bounces that give the illusion of the worst being over...just before you drop to even lower lows. So price action is a tricky way to determine bottom. Which brings us back to the fundamental attributes like what is happening with the inflation and the economy to determine our path forward. That will be at the heart of our discussion in this week's commentary.….

Please enjoy this updated version of my weekly commentary.

The truth is that its very difficult to gauge bottom from price action alone. You only have to look at the bottoming process from past bear markets to show how difficult it is to call it over. And why investors are so frequently pulled into "sucker's rallies" before true bottom is found.

This brings us back around to an exploration of the future outlook for the economy and what that means for share price valuations.

Because falling economy > falling earnings > falling PE levels > MUCH LOWR stock prices.

At this moment we very much look like we have just entered a recession. Technically speaking that happens when you have 2 consecutive quarters of negative GDP.

Well Q1 was a surprisingly bad -1.6% that many investors sloughed off because early Q2 projections looked quite healthy.

But far too many of the subsequent economic reports have been well under expectations and now the GDP Now estimate from the Atlanta Fed has fallen to -1.2% for the current quarter. So barring some miracle we are already smack dab in the middle of a recession.

That is the picture of here and now. The key is what happens moving forward. That is why we next have to think about the Fed's uphill battle fighting inflation.

Plain and simple the Fed got it wrong on inflation. For a long time they talked about it being transitory and did nothing. Now they are coming to the rescue WAY TOO LATE and thus raising rates at the fastest pace in modern history.

The full awareness of this mistake is what got investors fearful that the Fed would gladly trade in a recession for taming inflation. Thus, the correction that started in January, and was confirmed as a bear in mid June, was actually a good reading of the ominous tea leaves.

All signs were pointing to a worsening recession and harsher moves by the Fed until we got a welcome sign of relief on the inflation front.

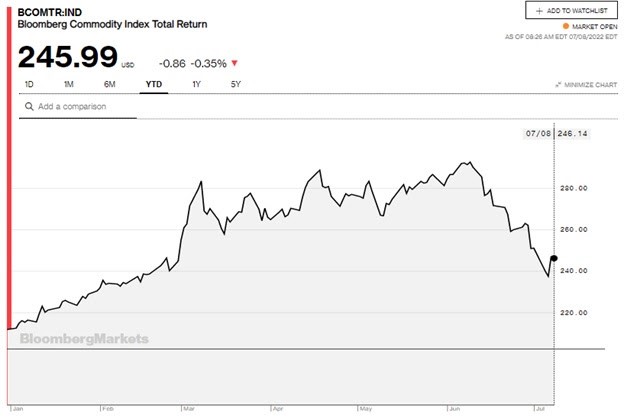

I am talking about the very timely decline in commodity prices which is quite evident in this year to date commodity price chart below.

This easing of inflationary pressures (including lower prices at the gas pump) is the #1 reason why it's been 3 weeks since exploring the bear market lows. In fact, today represents the second straight time the S&P 500 (SPY) has closed back above bear market territory (3,855), having some pondering if this bear market is indeed over.

The equation to explain that end of bear market logic goes as follows:

Easing of inflation > Less Aggressive Fed > Less Damage to Economy > Soft Landing > Shallow Bear Market > Bull Market returns second half of the year.

Sounds good right?

This is plausible and no doubt everyone's preferred outcome as we all enjoy bull markets over bears. Unfortunately, the odds of a worsening of economic conditions makes more sense with lower lows on the way.

Consider this. Just like an economic expansion and bull market is a long term process that takes time to unfold. The same is true for a recession and bear market.

We are only 6 months into that process which averages 13 months to grind its way to bottom. At this stage there is already too many things in motion that will cause additional negative effects. Namely job losses.

Reity, you must be kidding. The Government Employment Report came out today and it showed many more jobs added than expected. You must be smoking something funny to see a problem here.

As shared with you guys many times before, employment is a lagging indicator. Kind of like a smoke alarm that goes off AFTER the house has already burned down.

However, there are cracks showing up in the employment foundation if you look at other key reports. For example, weekly Jobless Claims have been rolling higher nearly every single week for 3 months. Any subsequent report closer to 300,000 claims per week will be a real wake up call to other investors.

Next is the monthly Challenger Job Cuts reports which shows movement in the # of announced corporate layoffs. The June report announced Thursday was 58.8% higher than May with a note that says:

"Employers are beginning to respond to financial pressures and slowing demand by cutting costs. While the labor market is still tight, that tightness may begin to ease in the next few months"

Meaning the wheels are in motion for employment to be the next domino to fall. And that equation goes like this:

Job loss > lower income > lower spending > deepening of recession > lower corporate earnings > lower share prices

To be clear, I am open to the possibility that the moderating inflation picture could win the day which would lead to a white flag for this bear market.

However, given my background in economics, and 40+ years of watching its interrelationship with the stock market (SPY), the much smarter money rides on the recession grinding lower...and the bear market mauling its way lower as well.

What To Do Next?

Right now there are 6 positions in my hand picked portfolio that will not only protect you from a forthcoming bear market, but also lead to ample gains as stocks head lower.

This strategy perfectly fits the mission of my Reitmeister Total Return service. That being to provide positive returns…even in the face of a roaring bear market.

Yes, it's easy to make money when the bull market is in full swing. Anyone can do that.

Unfortunately most investors do not know how to generate gains as the market heads lower.

So let me show you the way with 6 trades perfectly suited for today's bear market conditions.

And then down the road we will take our profits on these positions and start bottom fishing for the best stocks to rally as the bull market makes it rightful return.

Come discover what my 40 years of investing experience can do you for you.

Plus get immediate access to my full portfolio of 6 timely trades that are primed to excel in this difficult market environment.

Wishing you a world of investment success!

Steve Reitmeister…but everyone calls me Reity (pronounced "Righty")

CEO, StockNews.com

Editor, Reitmeister Total Return & POWR Value

SPY shares closed at $388.67 on Friday, down $-0.32 (-0.08%). Year-to-date, SPY has declined -17.56%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Steve Reitmeister

Steve is better known to the StockNews audience as "Reity". Not only is he the CEO of the firm, but he also shares his 40 years of investment experience in the Reitmeister Total Return portfolio. Learn more about Reity's background, along with links to his most recent articles and stock picks.

The post Stock Market Bottom? Think Again… appeared first on StockNews.com