Top 10 Value Stocks

The S&P 500 (SPY) has shown mixed results in the last week, but if you are a value investor, then yesterday was a big day. That’s when we revealed to our readers the fatal flaws of traditional value investing and the solution to this problem—our Top 10 Value Stocks strategy. Read on below to find out more about this 3-step process and its +38.63% annual returns….

This story originally appeared on StockNews

Thursday May 6th was an important day for investors…

Why?

That is when we unveiled our Top 10 Value Stocks strategy with +38.63% average annual return. This strategy was many years in the making and we’re finally ready to share it with investors.

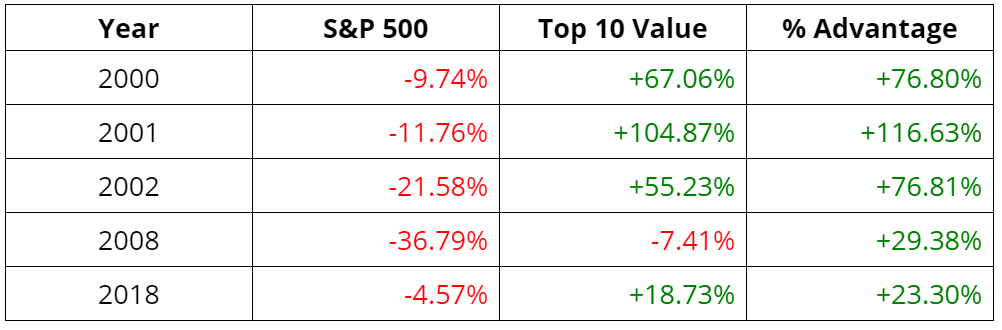

Not only does it score well in bull markets. Truly, its results in bear markets are even more impressive. Our studies show that over the last 21 years this strategy has topped the S&P 20 times. In fact, as you can see from the chart below, in 4 of those years we actually ended up in positive territory by a healthy margin:

We share full details on this new strategy, and the first picks to emerge, in this new presentation you can access now. Just click this link: Beware Value Stocks?

This presentation was hosted by myself, Steve Reitmeister, and our Chief Value Strategist, David Cohne. There we tell you about the fatal flaws of traditional value investing you must avoid and breakdown the 3-step process we use to unearth the best value stocks for today’s market.

And yes, we share with you insights on the next 4 picks coming from this coveted Top 10 Value Stocks strategy.

The sad fact is that there are so many unscrupulous marketers in the investment field that they make it seem like you can turn pennies into millions overnight. We all know that is rubbish.

Unfortunately it has turned investors numb to when a truly helpful investment tool is created. In this case we are talking about a leading data scientist putting in years of work to develop a stock rating system that consistently outperforms the market (Yes, I am talking about the POWR Ratings).

And then digging deeper into how to narrow down that universe to just the 10 best value stocks. This process leads to fewer stocks while also greatly increasing the performance.

So yes, +38.63% a year won’t make you a millionaire overnight. But it will certainly give you an advantage over the market that leads to greater investment success in the months and years ahead.

If that appeals to you, and you want to learn more about the Top 10 Value Stocks strategy, then click below to get access to this timely investment presentation:

Wishing you a world of investment success!

Steve Reitmeister

…but everyone calls me Reity (pronounced “Righty”)

CEO, Stock News Network and Editor, Reitmeister Total Return

SPY shares were trading at $422.52 per share on Friday morning, up $3.45 (+0.82%). Year-to-date, SPY has gained 13.38%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Steve Reitmeister

Steve is better known to the StockNews audience as “Reity”. Not only is he the CEO of the firm, but he also shares his 40 years of investment experience in the Reitmeister Total Return portfolio. Learn more about Reity’s background, along with links to his most recent articles and stock picks.

The post

appeared first on

StockNews.comThursday May 6th was an important day for investors…

Why?

That is when we unveiled our Top 10 Value Stocks strategy with +38.63% average annual return. This strategy was many years in the making and we’re finally ready to share it with investors.