Who Wins the Stock Market Tug of War? Last week, we noted some signs that the market could be ready to move lower. Between last Wednesday and Monday's low, the S&P 500 (SPY) declined by 3....

This story originally appeared on StockNews

Last week, we noted some signs that the market could be ready to move lower. Between last Wednesday and Monday's low, the S&P 500 (SPY) declined by 3.5%. Over the last couple of days, we've bounced back and made up the bulk of these losses. As noted in previous commentaries, there's a tug of war going on between the various bullish and bearish forces in the market. On the bearish side, we have a market with weak breadth, concerns about the Delta variant, and signs that growth may have peaked. On the bullish side, we have low rates, an expanding economy, and expectations of more earnings growth over the next 12 months. So far, this earnings season is also coming in quite strong, although some companies have issued outlooks that were below expectations. In this week's commentary, we will preview earnings and update our market outlook. Read on below to find out more….

(Please enjoy this updated version of my weekly commentary from the POWR Growth newsletter).

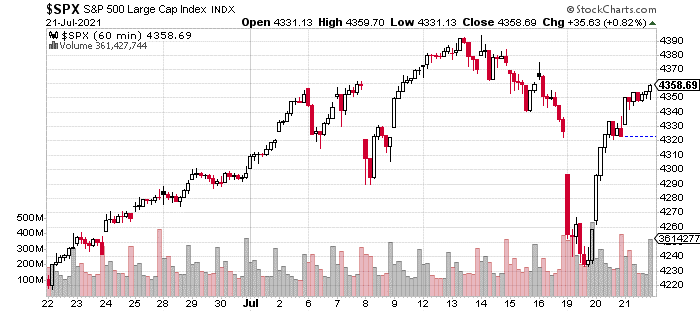

Let's start off by looking at an hourly chart of the S&P 500 over the past month. Clearly, the market has been putting in a strong bounce off the Monday lows and has recovered about 2/3 of its losses.

During our webinar and previous commentaries, we talked about how this could take the shape of a correction or another garden-variety dip.

Corrections tend to last for weeks, turning sentiment from bullish to bearish and result in pullbacks between 7 and 15%. On average, we get about one a year. Dips are quick pullbacks that are furiously bought.

Despite my belief that conditions were ripe for a correction, this price action is not consistent with that hypothesis. Given this development, I believe it is appropriate to gradually ramp up our risk exposure in our portfolio.

I'm particularly keen on opportunities in technology as the sector has been largely flat over the past six to nine months, while many names have posted impressive earnings growth over that period.

Earnings Season

We've talked often about the two biggest drivers of stock prices – earnings and interest rates.

In normal times, these offset each other. If earnings are rapidly growing, then the Fed is likely to have a hawkish bias. Conversely, if corporations are earning less profits, the Fed is likely to alleviate the pain by cutting rates assuming that they are not constrained by high inflation.

We are in a unique moment as these are not offsetting each other at the moment. In fact, the interest rate picture has gotten more bullish based on the decline in longer-term yields, Powell's dovish pushback at his Congressional testimony, and the market's belief that the inflation spike is transitory.

Based on the few companies that have reported and analysts' expectations for this quarter, earnings growth is going to continue at an impressive pace.

Analysts are expecting that Q2 earnings will be 61.9% higher than last year. Of course, last year's earnings were adversely impacted by the pandemic. Compared to 2019's Q2, 2021 Q2 EPS for the S&P 500 should come in 41% higher.

So far about 20% of companies in the S&P 500 have reported. Among this group, 37 companies issued negative EPS guidance, while 66 issued positive EPS guidance. If this ratio holds, then it would be the highest percent of companies with positive EPS revisions since 2003.

One concern for many investors has been the S&P 500's elevated price to earnings (P/E) ratio of 35.1 which is the highest level since the dot-com bubble. The bullish argument would be that this high P/E is justified given the pace of earnings growth. Certainly, the market's forward P/E is much more reasonable at 22.1 which is above its long-term average of 18.5 but not as egregious as the trailing P/E.

Here are some more specific topics that I'm following this earnings season:

- Impact of Higher Inflation: So far, companies have been complaining about higher inflation, but there has been no impact in terms of margins or on forward outlook. If margins start to compress because of inflation, then that would certainly be a negative development.

- Buyback Announcements: Earlier, we talked about how many tech stocks have continued to compound earnings even with their stock prices flat.

The combination of lower long-term yields and cheaper valuation may lead to an increase in buybacks.

- Energy/Material Stocks: On one hand, these sectors have had impressive performance. However, it's been in-line with apprecation in the underlying commoditiy.

This means there has been no multiple expansion. For example, VALE's forward P/E is 5.2. One possibility is that the market believes that the rise in iron ore prices is transitory. So far, the producers have been behaving as if this is the case as there has been no material increase in capex.

Lower CAPEX is part of my bullish thesis for the sector. So until CAPEX rises, then I am looking for energy and material stocks to use their profits to buy back shares as this could serve as a catalyst and make them more attractive to investors.

Summary

Writing is helpful for me to clarify and organize my thoughts. Sometimes, I come to new realizations. Or I gain or lose conviction in an idea.

The market's strong bounce and relentless price action are leading me to conclude that the underlying bullish forces are overwhelming the bearish factors discussed in the past.

Earnings season is historically strong. The rate situation has improved for stocks with the drop in long-term rates and inflation expectations.

The next question is whether this will be a thinner advance like we had in the last few weeks or a more broad-based rally like we had for much of 2020 and earlier this year.

Since mid-February, growth stocks have underperformed. However, this is changing as I noticed that many growth stocks actually made higher lows compared to other stocks and sectors. This change in behavior is making me eager to add some high-quality, growth names.

SPY shares rose $1.85 (+0.42%) in premarket trading Friday. Year-to-date, SPY has gained 17.77%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Jaimini Desai

Jaimini Desai has been a financial writer and reporter for nearly a decade. His goal is to help readers identify risks and opportunities in the markets. He is the Chief Growth Strategist for StockNews.com and the editor of POWR Growth newsletter. Learn more about Jaimini's background, along with links to his most recent articles.

The post Who Wins the Stock Market Tug of War? appeared first on StockNews.com