A Peek Into the Top 25 Emerging Scale-ups in Portugal: Report The new report details the state of the Portuguese entrepreneurial and innovation ecosystem.

This story originally appeared on Portugal Startups

You're reading Entrepreneur Europe, an international franchise of Entrepreneur Media.

The Scale-Up Portugal 2018 report reveals the top 25 Portuguese scale-ups, gender gap, the top five industries and provides the current state of investments in Portuguese startups.

Related: Report Details the Current State of Artificial Intelligence in Portuguese Companies

The report by EIT Digital, Building Global Innovators and their partners takes a data-driven approach at understanding key elements within the Portuguese entrepreneurial and innovation (E&I) ecosystem. Some of these elements include funding structure, investor profiles, economic impact and startup business models, among several others.

Its starting sample size consists of 480 Portuguese technology companies founded between 2012 and 2017 across four major verticals:

- Information and communication technology (ICT)

- Cleantech and industry

- Consumer and web

- Medical devices and health IT

Top 25 Portuguese scale-ups

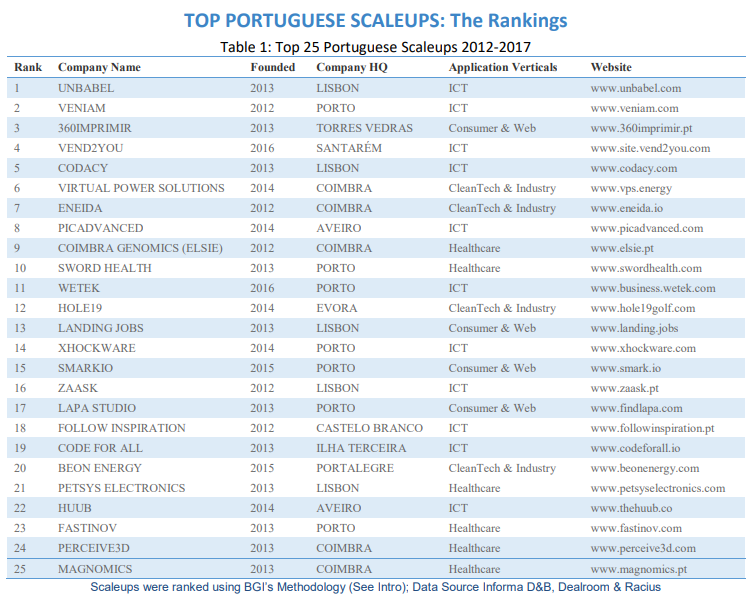

Researchers arrived at the top 25 by considering the total funding received, total revenues, capital to revenue ratio and jobs created of candidates with Portuguese origin, with less than five years of operation (i.e. between 2012 and 2017).

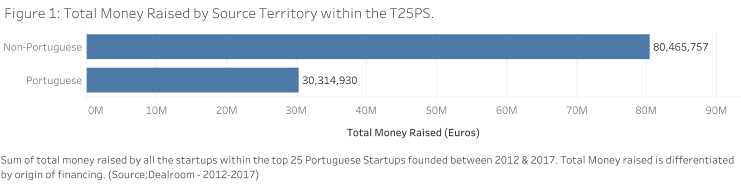

The Portuguese entrepreneurial and innovation ecosystem relies significantly on venture capital financing from outside Portugal with 72.6 percent of total funding in the Top 25 coming from non-Portuguese sources, mainly from the U.K. and the U.S.

There is a big dependence on external sources of venture financing, making the Portuguese Entrepreneurial and Innovation ecosystem very susceptible to the international context.

Related: Portugal Among Top 25 Countries for Government Startup Initiatives

Top five startup scaleiup industries in Portugal

The five top industries in Portugal based on shares of total investments are:

- IoT (30 percent)

- Health (18.8 percent)

- Enterprise software (14.6 percent)

- Marketing (13.6 percent)

- Fintech (9.8 percent)

Gender gap

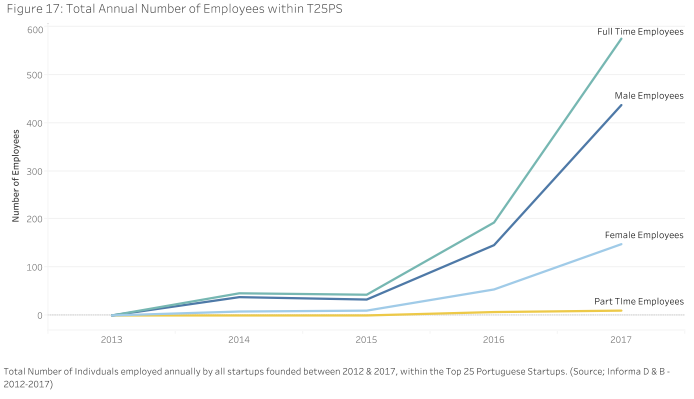

There is a steady increase in the number of employees within the top 25 with a cumulative value of 850 employees. Even though number of female employees is growing steadily there is a significant gap (30 percent) between male and female employees.

Part-time employee figures are almost ignorable and significantly low (just over 1 percent). ICT is by far the largest contributor to employment generation, followed by consumer a web within the top 25. Similarly, female representation is greatest within the ICT vertical followed by consumer and web.

Related: Over 24,000 Companies Created in Portugal in First 6 Months of 2018: Report

Scale-Up Portugal key findings

A breakdown of investment sources within the top 25 and the ecosystem as a whole show that the U.S., United Kingdom, Belgium and France are the largest contributors of VC financing from abroad, with a combined investment of €92 million in the Portuguese Venture Ecosystem (PVE).

Investment sources at a country level indicate that Portuguese investors are leaders in terms of frequency of investments and total sum of investments (€30 million in top 25 and €41 milllion in PVE).

However, their average financing size per investment within the PVE is approximately €1.5 million, which is 121% lesser than the average in USA, UK and Sweden.

ICT received most funding, contributed to most revenue growth and job creation

ICT received the most funding within the top 25 at €73 million and within the Portuguese Ecosystem as a whole at 59.3 percent. ICT also appears to be the largest contributor to revenue growth within the top 25 with €24 million, and it is the largest contributor to job creation.

The second largest contributor to revenue growth and job creation is consumer and web.

Medical devices and health IT receive the second largest share of financing within the top 25 and PVE (16.7 percent).

Research organizers

EIT Digital is a leading European open innovation organization that brings together a partnership of over 150 top European corporations, small businesses, startups, universities and research institutes.

Building Global Innovators (BGI) is a deep innovation global accelerator based in Lisbon (Portugal) with operations in Cambridge (U.S.). BGI was born from the MIT Portugal Innovation and Entrepreneurship Initiative (IEI) -- launched to support Portugal's goal to strengthen its capacity in business education, technological innovation and entrepreneurship.

(By Tim Hinchliffe)