Business Angels Have Invested €1.2 Billion in Spanish Startups in 2018, According to New Report Investments into Spanish startups by business angels are up 44 percent over last year in terms of euros.

By Novobrief

This story originally appeared on Novobrief

You're reading Entrepreneur Europe, an international franchise of Entrepreneur Media.

Business angels' investments into Spanish startups reaches €1.217 billion as of October, 2018, according to the latest report by Startupxplore.

Related: Spanish Association of Startups 'Requests More Ambition' From Spain's Prime Minister

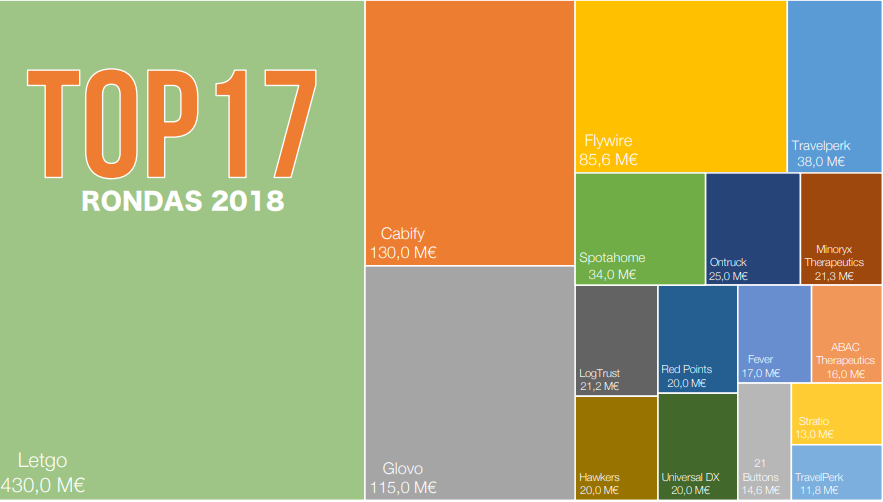

Investments into Spanish startups by business angels are up 44 percent over last year in terms of euros, and this year investments were dominated by 17 rounds among 16 startups (Travelperk had two major funding rounds).

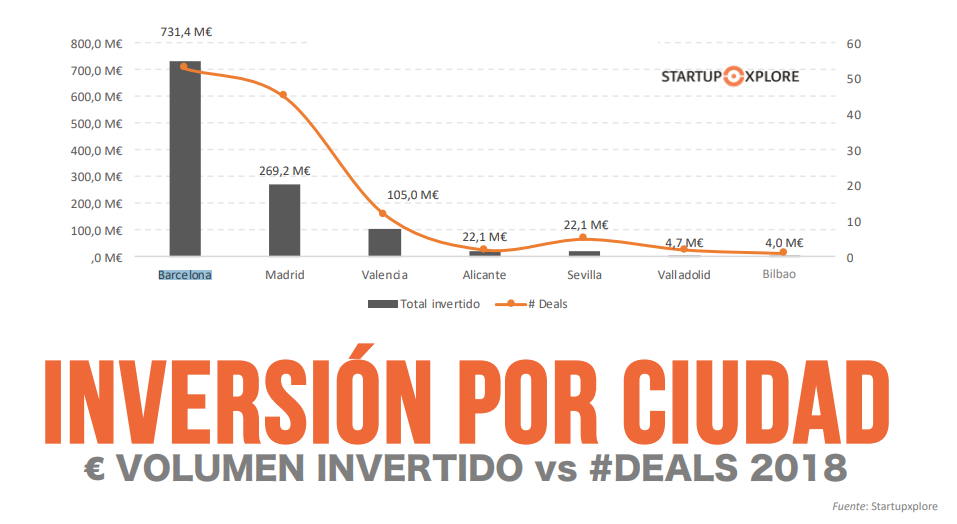

Barcelona is the city with the highest percentage of investment, with 57 percent, thanks, in part, to the fact that it was the pioneering center of operations in the market, with 17 years of seniority.

Source: Startupxplore

Source: Startupxplore

The top investment rounds in 2018 were:

- Letgo: €430 million

- Cabify: €130 million

- Glovo: €115 million

- Flywire: €85.6 million

- Travelperk: €38 million

- Spotahome: €34 million

- Ontruck: €25 million

- Minoryx Therapeutics: €21.3 million

- LogTrust (Devo): €21.2 million

- Red Points: €20 million

- Hawkers: €20 million

- Universal DX: €20 million

- Fever: €17 million

- ABAC Therapeutics: €16 million

- 21 Buttons: €14.6 million

- Stratio: €13 million

- Travelperk: €11.8 million

Related: New Report Finds 22 Percent of Spanish Startup Founders Are Women

Source: Startupxplore

Source: Startupxplore

The volume of operations last year has been reduced by 27.1 percent, with 142 operations, however, the size of these has gone from €4.3 million in 2017 to €8.56 million this year.

The CEO and co-founder of Startupxplore, Javier Megias, highlighted this fact of the report, since "it has considerably exceeded all the investment of last year in 10 months" and that "there are fewer operations but they are larger."

The weight of the investment has fallen in four rounds of financing, which have exceeded €50 million and accounted for 62 percent of the total investment.

Megias has stated that this phenomenon, together with the increase in operations, creates "a future market in which there will be more opportunities and perhaps better valuations in the initial phases of startups."

Related: Boom or Bubble? The 3 Issues That Block Spain's Startup Sector From Sustainable Growth.

The sectors that have stood out most by percentage of number of operations in the investment in startups were

- Web consumers (14 percent)

- Health (11 percent)

- Mobility and logistics (8 percent)

- Fintech, software and ecommerce (8 percent)

In terms of the amount invested, the sectors that have received the most funding were

- Directories (35 percent)

- Travel and leisure (15 percent)

- Mobility and logistics (4 percent)

The Startupxplore report clarifies the number of startups potentially on the radar of investors in Spain, which reaches 3,415 companies, 4 percent more than in 2017.

Startupxplore is an investment platform that operates with first class companies, approved by the CNMV, with more than 13,000 investors and gateway to an ecosystem with 30,000 entrepreneurs, investors, startups and accelerators.

(By Tim Hinchliffe)