Political Journey of Muhammad Yunus, Bangladesh's Interim Chief His several economic policies and social initiatives inspired several governments across the world but in recent years he's faced several legal charges.

Opinions expressed by Entrepreneur contributors are their own.

You're reading Entrepreneur India, an international franchise of Entrepreneur Media.

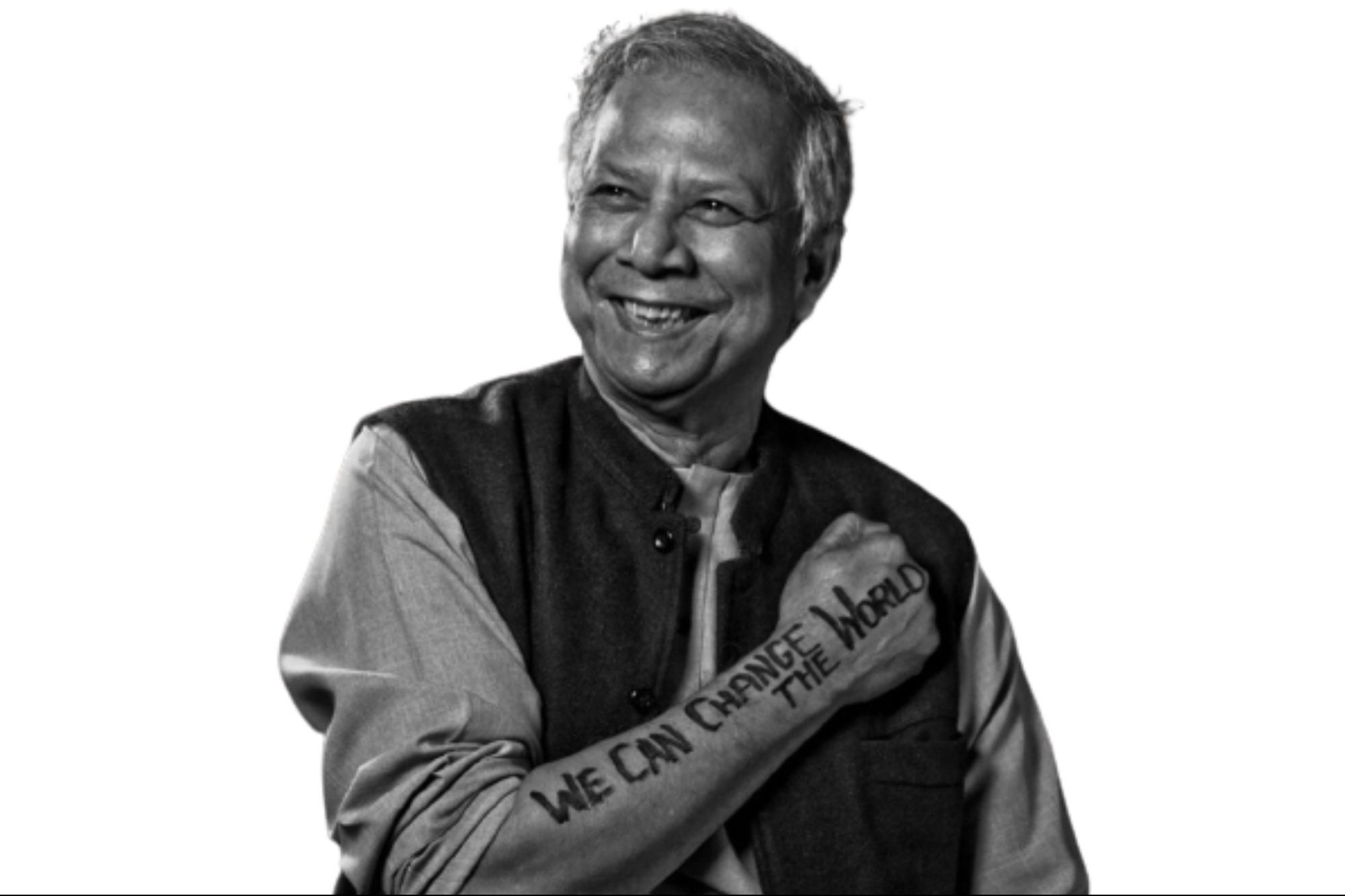

Nobel laureate Muhammad Yunus is known for his social economic initiatives around the world and renowned for his work to uplift the poor, especially women in Bangladesh.

After political unrest led to the ousting of Sheikh Hasina, who had governed for 15 years, Yunus was sworn in as the Chief Advisor of the new interim government of Bangladesh on August 8, 2024. His spokesperson confirmed that Yunus accepted the students' request to serve as an advisor during this transitional period.

"Yunus has agreed to request of students to be adviser for interim government," confirmed his spokesperson.

Known as the "banker to the poor", Yunus was born on 28 June 1940 to a Bengali family in Bathua village of Chittagong district of the Bengal Presidency, (present-day Bangladesh). His several economic policies and social initiatives inspired several governments across the world but in recent years he's faced several legal charges.

Scout Boy to Economic Professor

Yonus was an active Scout boy during his school years, traveled to West Pakistan and India in 1952, and to Canada in 1955. Later, he completed his BA and MA in economics in 1961 from Dhaka University and joined the Bureau of Economics as a research assistant. Then in the same year, he was appointed as a lecturer in economics at Chittagong College. Side by side he also set up a profitable packaging factory. Later, he was awarded a Fulbright scholarship to study in the USA and obtained his PhD from Vanderbilt University in 1971. From 1969 to 1972, he also held the position of assistant professor of economics at Middle Tennessee State University in Murfreesboro.

During the Liberation 1971

When Bangladesh was fighting a liberation war, Yunus also participated in the effort to liberate the nation, founded a citizen's committee, and ran the Bangladesh Information Center in the USA with other Bangladeshis. In this effort, he also published a Bangladesh Newsletter from his home in Nashville.

Becoming a Member of the Planning Commission

When Bangladesh became an independent nation, he returned to his nation and was appointed to the government's Planning Commission headed by Nurul Islam. However, he felt he was not made for this work and joined Chittagong University as head of the Economics department.

From Famine To Nabajug, Tebhaga Khamar, and Gram Sarkar

After the hard period the nation went through, he became active in poverty reduction and formed a rural economic program as a research project. Later, in 1975, he came up with a series of initiatives such as Nabajug (New Era), and Tebhaga Khamar (three share farm) which the government adopted as the packaged input program.

He didn't stop there, to make these policies more efficient and effective, Yunus with his other members proposed the Gram Sarkar (the village government) program to the government. However, after coming into effect in 2003, it was declared illegal in 2005.

Microcredit Policy To Infolady Social Entrepreneurship Programme

When Yunus visited the poorest households in the village of Jobra near Chittagong University in 1976, he noticed that small loans could make a big difference for poor people in Jobra village. Traditional banks wouldn't lend tiny amounts because they thought the risk of not getting paid back was too high. As a result, poor people had to take expensive loans from moneylenders.

However, he believed that if the poor were given reasonable loans, they could repay them and keep their profits. To test this, he lent USD 27 of his own money to 42 women, who each made a small profit. It proved that his microcredit plan could work. In December 1976, he got a loan from Janata Bank to help more poor people. This effort grew, and in 1983, he founded Grameen Bank to provide microloans. Grameen Bank used "solidarity groups," where members supported each other and guaranteed repayments. By 2007, Grameen Bank had lent USD 6.38 billion to 7.4 million borrowers.

"They explained to me that the bank cannot lend money to poor people because these people are not creditworthy," Yunus noted.

His concept of Microcredit worked well, especially for women, 93 per cent of the loan was given to women. Later, the policy was adopted by 100 nations including the USA. He was also rewarded with the Nobel Peace Prize in 2006. He also inspired programs such as the Infolady Social Entrepreneurship Programme around developing countries.

Political Participation

In 2006, Yunus participated in a civil campaign with other members to fight against dishonest political candidates in national elections. Later, in 2007, he considered launching his political party named Nagorik Shakti (Citizen's Power) and wrote an open letter in the newspaper Daily Star to obtain opinions from the general public regarding the same. There were speculations that the army was backing Yunus in politics. However, after meeting the head of the interim government, Fakhruddin Ahmed on the 3rd of May, he abandoned his political plans.

However, in 2011, Hasina's government announced his removal from Grameen Bank's managing director post. The government believed that the bank was "sucking blood of the poor" and Yunus treated the bank as his "personal property." In 2013, he was tried for violating foreign currency rules and prosecuted in relation to the companies he founded.

In January 2024, he was sentenced to six months for violating labor laws, although he was released on bail in March. However, he is facing over 100 additional charges regarding violation of labor law and corruption.