2 Concerns for Investors in October The S&P 500 (SPY) may be touching all time highs...but recent action points to concerns on 2 fronts: inflation and earnings. Investment veteran Steve Reitmeister shares his views on these...

This story originally appeared on StockNews

The S&P 500 (SPY) may be touching all time highs...but recent action points to concerns on 2 fronts: inflation and earnings. Investment veteran Steve Reitmeister shares his views on these 2 timely topics along with a preview of his top stocks to buy now.

The S&P 500 (SPY) is consolidating just under the recent highs. With that investors are focused on 2 main things:

- Earnings season

- ..and what that means for future rate cuts

There is a lot to dig into on these fronts and we will tackle them both in today's Reitmeister Total Return commentary.

Market Outlook

Some of you may think there are 3 things on investors' minds these days. That 3rd being the Presidential election. Unfortunately right now it is a forgone conclusion that Trump will win.

(This is not meant to be a political conversation. And has nothing to do with my personal views. Just objective observations about the facts in hand).

I know some of you will say that Harris is still slightly ahead in the national polls. Yes, by about 1% and that lead is slipping by the day. But do remember that Hillary Clinton was ahead by 6% and lost. And Biden was ahead by nearly 10% and he barely won.

What we have learned over the past few election cycles is that Republican votes are undercounted in the polls. Second, is that National data is nearly irrelevant because of the electoral college system which brings it down to about 7 swing states. And in most of those key states. Trump is leading.

Add that altogether and you understand why investors are already betting on a Trump victory. Note that if Harris did win the market would still rally afterwards. There would just be a bit of sector rotation to some groups considered more favorable under her administration.

So that brings us back around to a discussion of earnings and inflation. We will start with the latter.

The most recent inflation data has not been favorable leading to a surprising increase in treasury rates. I covered this topic in detail in my recent commentary: Are Rising Bond Rates Bad News for Stocks?

There are only 2 more pieces of inflation data for the Fed to digest before their next meeting on 11/7. That would be their favored inflation report in PCE on 10/31 (trick or treat?). Then you have the Average Hourly Earnings component of the monthly jobs report on 11/1.

Right now, the CME measures investor activity to say that there is a 91% probability of a 25 basis point cut at the 11/7 Fed meeting. I think that too many people are huffing paint.

Given the stickiness of inflation data coupled with the patience of Fed officials, then I would say 50% or higher odds of no cut on the way at this meeting. Please remember that investors have been wrong about Fed intentions for a long time thinking the first rate cuts would be the end of 2023. So, this would not be the first time they have gotten it very wrong.

Please don't read the above as my warning of a serious problem with inflation. Or a reason to be bearish.

Just simply, the Fed will likely keep rates "higher for longer" to ensure inflation is properly disposed of before making more moves. This doesn't change the likelihood of future rate cuts...just changes the path and timing of those moves.

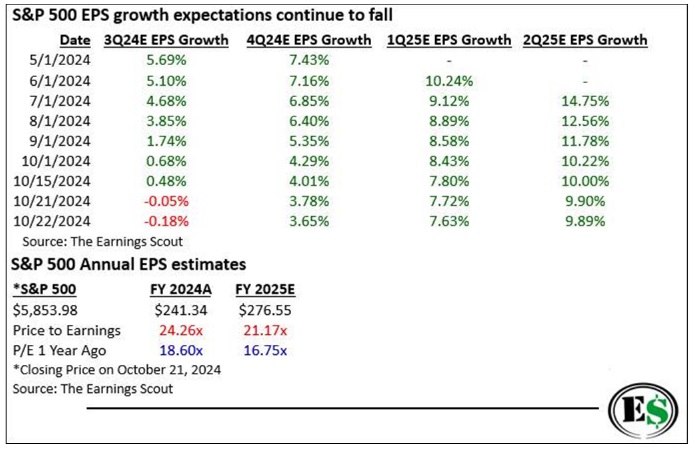

Now let's peruse the early earnings season data as compiled by Nick Raich Tuesday morning @ EarningsScout.com:

- So far, 97 S&P 500 companies have reported their 3Q 2024 results.

- Of those, 81% exceeded their EPS estimates, averaging a +2.92% beat, with EPS growth of +7.02% over 3Q 2023.

- Additionally, 65% beat their 3Q 2024 sales estimates, reflecting +5.09% growth compared to 3Q 2023.

- While the current 3Q 2024 results are solid, they are slightly below the levels seen three months ago.

- For reference, in 2Q 2024, these same 97 companies had an 86% EPS beat rate, with an average beat of +6.28% and growth of +10.36% over 2Q 2023.

- 4Q 2024 EPS expectations and beyond matter more than current 3Q 2024 results.

I think the most valuable data was shared in the chart above. What is says is that even as earnings beats roll in for the current quarter, that estimates are being cut for the future.

When you couple this with the great expansion of PE this year vs. 1 year ago, then it will become harder to substantiate those valuations unless we see more earnings growth.

Again, that complaint is mostly about the S&P 500 which has a well above average PE at this time. Whereas the forward PE for small and mid cap stocks as a group is about 15.5. That is under historical norms and well below large caps. Meaning that value seekers should continue to focus on smaller stocks to generate outperformance in the months ahead.

Gladly our POWR Ratings model is very beneficial in finding those lesser followed stocks leading to a nearly 4 to 1 performance advantage over the S&P 500.

My favorite POWR stocks are discussed below...

What To Do Next?

Discover my current portfolio of 11 stocks packed to the brim with the outperforming benefits found in our exclusive POWR Ratings model. (Nearly 4X better than the S&P 500 going back to 1999).

All of these hand selected picks are all based on my 44 years of investing experience seeing bull markets...bear markets...and everything between.

And right now this portfolio is beating the stuffing out of the market.

If you are curious to learn more, and want to see my 11 timely stock recommendations, then please click the link below to get started now.

Steve Reitmeister's Trading Plan & Top 11 Stocks >

Wishing you a world of investment success!

Steve Reitmeister…but everyone calls me Reity (pronounced "Righty")

CEO, StockNews.com and Editor, Reitmeister Total Return

SPY shares were unchanged in after-hours trading Tuesday. Year-to-date, SPY has gained 23.88%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Steve Reitmeister

Steve is better known to the StockNews audience as "Reity". Not only is he the CEO of the firm, but he also shares his 40 years of investment experience in the Reitmeister Total Return portfolio. Learn more about Reity's background, along with links to his most recent articles and stock picks.

The post 2 Concerns for Investors in October appeared first on StockNews.com