3 Reasons Why Apple's 30% Rally Has Legs Since tagging that multi-year low at the start of the year Apple's shares have tacked on a full 30%, with higher highs pointing to further upside.

By Sam Quirke

This story originally appeared on MarketBeat

Despite equities having cooled somewhat this week following a strong end to Q1, Apple Inc's (NASDAQ: AAPL) 30% rally looks as strong as ever. Since tagging that multi-year low at the start of the year, their shares have tacked on a full 30%, with higher highs and higher lows ensuring a smooth ride.

But as the stock approaches what many might call a solid layer of resistance around the $175 mark, you'd be forgiven for taking a cautious stance right now. However, we see at least three good reasons to believe that Apple's shares are on track to test and breakthrough that zone in the coming weeks.

Bullish Comments

The first of these comes in the form of bullish analyst comments from the team at Evercore, who earlier this month reiterated their Outperform rating on Apple stock. Analyst Amit Daryanani and his team cited the company's solid performance in the first quarter of 2023. They're of the opinion that the current premium valuation is more than justified given the company's strong fundamentals, solid free cash flow and return on equity numbers.

In a note to clients, they wrote that "we think Apple deserves a premium to its peer group given its higher ROIC (AAPL at 39% 5-year average vs. peer group at 21%). The team's $190 price target points to Apple absolutely blowing past that resistance at $175, and indicates an upside of at least 20% from current levels.

It's a bullish stance that's since been reinforced by comments from Gene Munster of Deepwater Asset Management. He recently commented that Apple is likely to be the safest tech stock over the next six months, and also highlighted its strong position and outlook against its Big Tech peers. To be fair, Munster doesn't expect it to be all smooth sailing, especially in the near term given the ongoing economic uncertainty, but he expects Apple to crush through the back half of the year and into 2024.

Bullish Headlines

In addition to both of these positive outlooks, Apple's also been on a run of positive and bullish headlines. These have come mostly in the form of reports regarding its resilience in the face of challenges. For example, despite the ongoing tensions between China and the US, it's been reported that Apple has maintained increased market share there. This is due for the most part to its popularity among Chinese consumers, as well as Apple's proactive measures to navigate the changing regulatory environment.

Further good news on that side of things came this week, when we learned that Apple had won a UK antitrust-related appeal. The ruling effectively squashed a probe into mobile browser dominance, which was acting as a sneaky headwind but evolved into a significant victory for the company. The investigation could easily have resulted in fines or other sanctions, not to mention massive investor concern, but Apple successfully argued that it was not dominant in the relevant market and did so convincingly.

In addition, there have been rumors of a potential Apple-Disney merger, which would take the form of an acquisition by Apple of Disney. It's pie-in-the-sky stuff for now, but Needham analyst Laura Martin raised some interesting points last week when she suggested the two companies could be worth more together, given Apple's strength in hardware and Disney's strength in content. We're not expecting this to become a reality anytime soon, but can you imagine for a moment if it ever did?

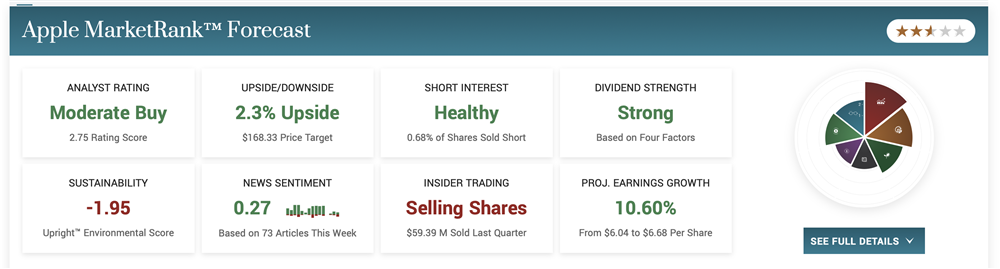

All in all, it's been pretty much clear sailing for Apple in terms of bullish notes and reports these past few weeks. Using the tools available on MarketBeat.com, we can see the stock overall is ranked as a Moderate Buy. While their shares take a breather heading into Easter, it's a good time for investors to consider getting involved before the next big push for the $200 level.