All We Are Saying Is Give Puts A Chance Lower IV and higher rates make a put purchases more attractive on a richly valued S&P 500.

By Tim Biggam

This story originally appeared on StockNews

Lower IV and higher rates make a put purchases more attractive on a richly valued S&P 500.

VIX closed under 12 for the first time in nearly 5 years Friday, May 17. It is now at the lowest level since November 2019-right before Covid Crisis began in earnest.

Lower VIX signifies lower implied volatility. Lower implied volatility means lower option prices. Option prices now the cheapest they have been since Covid.

Interest rates are still hovering near recent highs. Fed Funds rate is currently at 5.25%-5.50%. 10-year Treasury yielding just under 4.5%. Higher interest rates make put prices cheaper as we will see shortly.

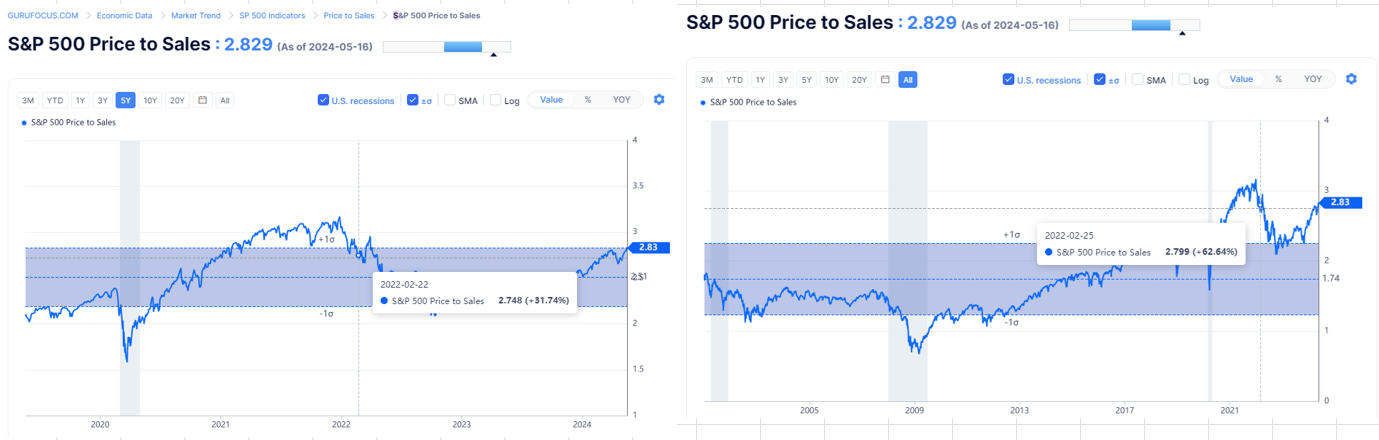

The S&P 500 just hit a fresh new high this week, trading above $5300 for the first time. The new highs are attributable to increased revenues to some degree, but also to an increase in valuation multiples. The current Price/Sales ratio for the S&P 500 now stands at 2.83 after starting 2024 at just 2.53.

Implied Volatility

The VIX is a measure of 30-day implied volatility (IV) on the S&P 500 (SPX) options. Lower implied volatility means option prices are lower. Higher IV means more expensive options.

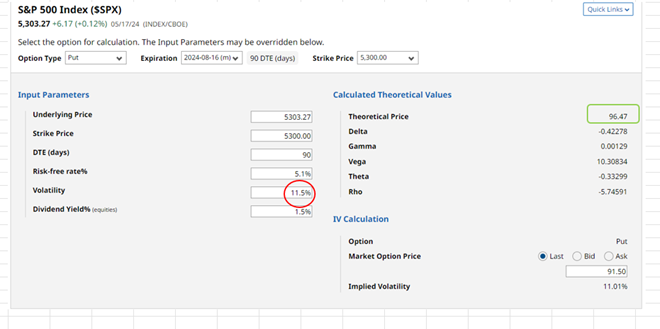

The calculator results above show the theoritical value of a 90 day at-the-money put on the SPX with IV at 11.5%. The put would be priced at just under $97.

Changed the IV input in the calculator results above from 11.5% to 25%. Keeping everything else constant. You can see how the put price expoded to over $235 simply by increasing the IV. Why we chose 25% will be evident later on in the article.

Interest Rates

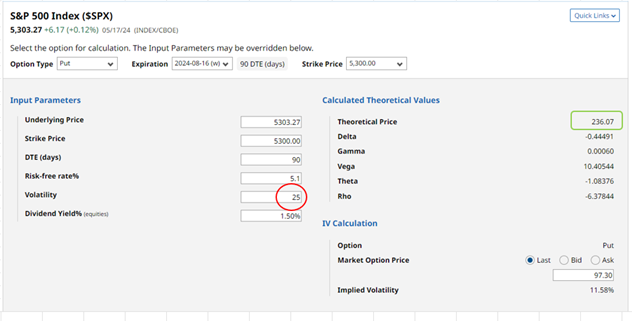

The Federal Reserve has hiked interest rates 11 times since March 2022. Fed Funds rate has risen 5% from 0.0% /0.25% to 5.25%/5.5%. The 10-year Treasury yield has followed suit, more than doubling in that same time frame.

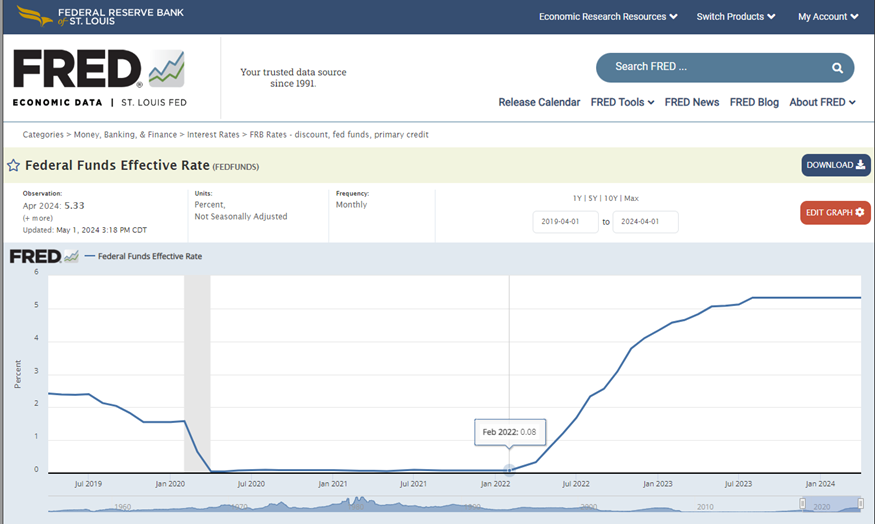

The side-by-side comparison below shows how an increase in interest rates from 1.5% to 5.1% drops the theoretical value of the 90-day ATM $5300 put from 119.53 to 97.30. This 22.23 point difference equates to the put price becoming cheaper by nearly 20% all else being equal

No doubt higher interest rates make put prices much less expensive.

Valuations

S&P 500 is just off the all-time high but valuations are just off the highs as well. Current P/S ratio of 2.83x is nearing the extremes of just over 3x seen in late 2021-which was by far the richest multiple seen this century.

Interesting to note that the over 3x multiple coincided with the S&P 500 peaking in late 2021. SPX subsequently fell nearly 25% before finding a bottom in October of 2022.

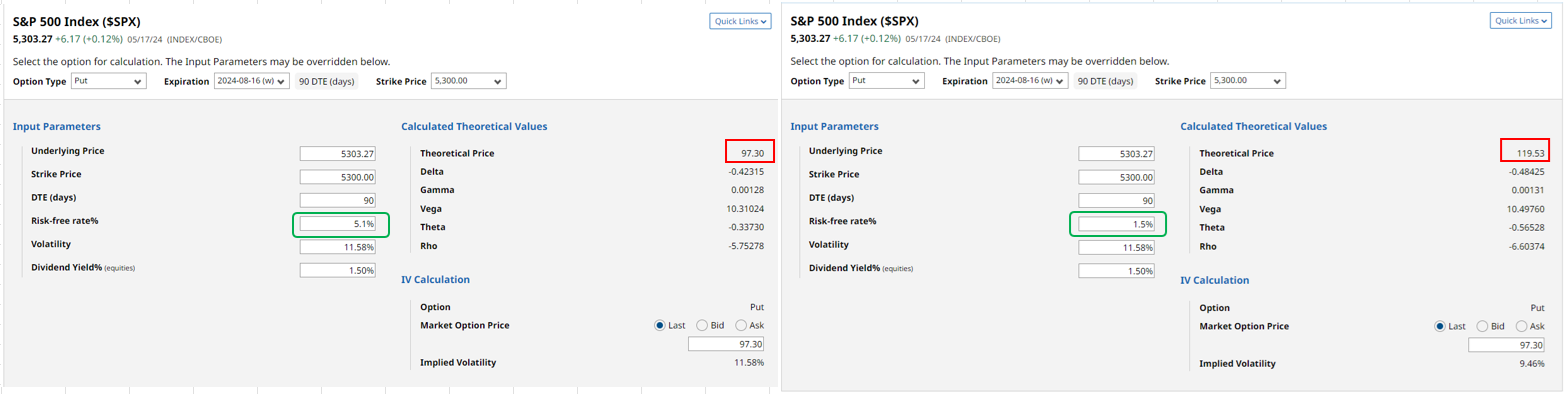

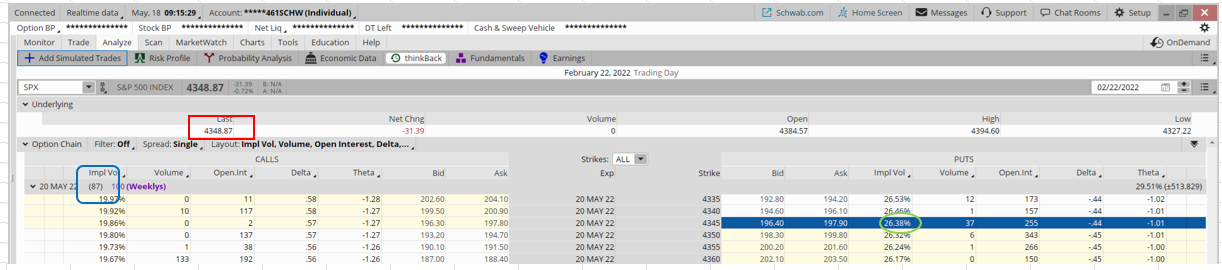

I looked back at option prices on the S&P 500 (SPX) on February 22, 2022 which was just before the Fed began the recent rate hikes. Compared them to the option prices from Friday.

Fed Funds rate was pretty much parked at zero back then and the 10-year Treasury was yielding just under 2%. We noted earlier just how much interest rates have shot higher since early 2022.

The S&P 500 was trading at a slightly lower P/S ratio of 2.75 on 2/22/22 compared to now. This multiple increase even occurred even though interest rates are dramatically higher now than back in February of 2022. Normally higher rates compress, not expand, valuation multiples.

The VIX was over 27 on February 22, 2022. It closed Friday at multi-year lows just under 12 at 11.99.

The option montage below is from February 22, 2022. It shows the closing price of the at-the money $4345 put. It closed at roughly $197 with the SPX closing at $4348.87 (3.87 points out-of-the money). 87 days until expiration and implied volatility (IV) was at 26.38%.

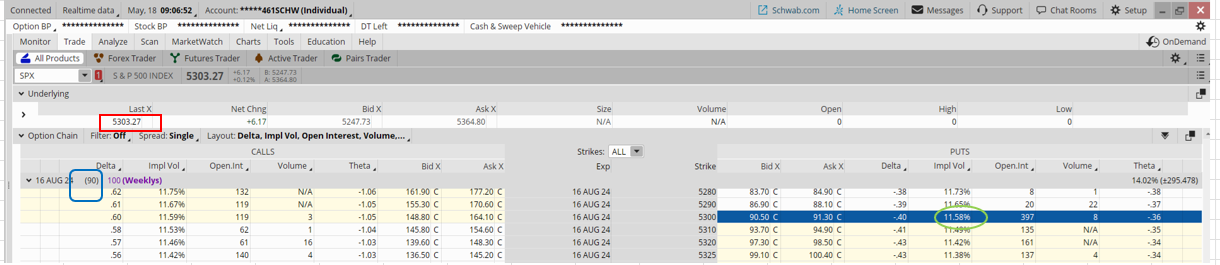

The following option montage shows the closing price of the $5300 put from Friday. Went out priced at right around $91 with the SPX priced at $5303.27 (3.27 points out-of-the money). 90 days to expiration, so a few more days than our comparison put from 2/22/2022. More time until expiration makes options more expensive. IV was just 11.58%.

So even though the 2/22/2022 put was a touch further out-of-the money and had a few more days until expiration, it closed at more than double the price of the current put.

All this despite the fact the S&P 500 (SPX) rose from just under $4350 to just over $5300- a gain of better than $950 points (nearly 22%) !

The reasons-higher interest rates and lower implied volatility had a combined one-two punch to push put prices dramatically lower.

To put it differently, full downside put protection now costs just 1.72% for 90 days versus 4.53% for 87 days back in February of 2022 for those looking to insure their portfolio against loss.

The speculators out there can be attracted to how much less risk a similarly bearish position has now, especially given that current valuations are even more extended.

Hasn't been a better time in quite a long time to put a put purchase on your trading radar.

This is the type of option and implied volatility research we do daily at POWR Options. Those intertested in putting the probabilities in their favor should check it out.

POWR Options

What To Do Next?

If you're looking for the best options trades for today's market, you should check out our latest presentation How to Trade Options with the POWR Ratings. Here we show you how to consistently find the top options trades, while minimizing risk.

If that appeals to you, and you want to learn more about this powerful new options strategy, then click below to get access to this timely investment presentation now:

How to Trade Options with the POWR Ratings

All the Best!

Tim Biggam

Editor, POWR Options Newsletter

SPY shares closed at $529.45 on Friday, up $0.76 (+0.14%). Year-to-date, SPY has gained 11.74%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Tim Biggam

Tim spent 13 years as Chief Options Strategist at Man Securities in Chicago, 4 years as Lead Options Strategist at ThinkorSwim and 3 years as a Market Maker for First Options in Chicago. He makes regular appearances on Bloomberg TV and is a weekly contributor to the TD Ameritrade Network "Morning Trade Live". His overriding passion is to make the complex world of options more understandable and therefore more useful to the everyday trader. Tim is the editor of the POWR Options newsletter. Learn more about Tim's background, along with links to his most recent articles.

The post All We Are Saying Is Give Puts A Chance appeared first on StockNews.com