Chegg Faces a New Threat With the Rise of ChatGPT Chegg (NYSE:CHGG) finds its status threatened by AI chatbots like ChatGPT. Can Chegg marry their human touch with smart use of AI and get back on top?

By Pat Crawley

This story originally appeared on MarketBeat

Chegg (NYSE: CHGG) has helped college students ace their courses for several years, often with little to no actual work. Chegg's massive homework and exam answers database has become indispensable for many students who have grown accustomed to doing little homework.

But the hype around ChatGPT and other AI chatbots is leading some students to consider if they can replace Chegg with ChatGPT and save the $20 per month they pay Chegg.

OpenAI's revolutionary AI chatbot, ChatGPT, is intelligent enough to pass law school exams, MBA exams, and even the US Medical Licensing Exam.

The sheer capabilities of ChatGPT are forcing the market to reflect on whether Chegg has a place in the long-term post-AI world. On Chegg's recent earnings call, "AI" was mentioned 22 times, and analysts asked multiple questions about how the company will adapt to the new technological landscape.

How Growth Expectations Plagued Chegg's Stock Price

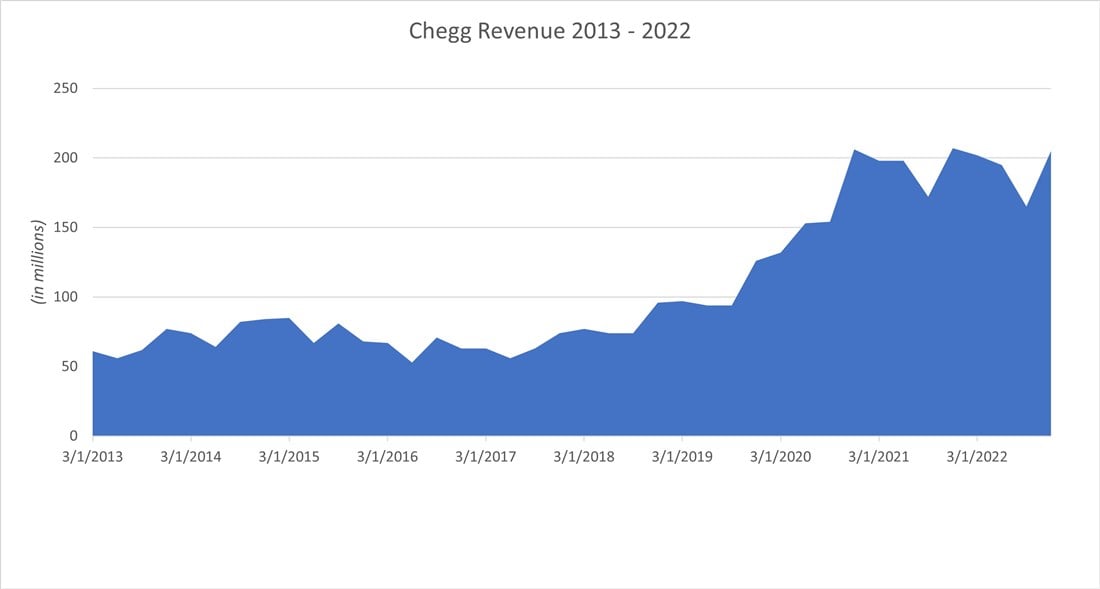

The value proposition of no homework and improved grades for merely $20 is a good bargain. Chegg has had little problem growing their business on the back of this over the last decade. For instance, here's a chart of their revenue since their IPO:

The stock became a Wall Street darling and one of the biggest growth stories in the educational technology world. Investors were happy to pay high valuation multiples to participate in the potentially huge upside.

And their stock price followed suit, going on a years-long trend starting in 2016.

But Chegg hit its biggest home run when the pandemic came around and sent students home for virtual learning.

While Chegg was always great for homework, once students could take exams in the comfort and privacy of their homes, the tool's value skyrocketed. Suddenly, a Chegg membership had the potential to help students ace their classes with almost no work.

As a result, subscriptions skyrocketed, and revenues increased 56% from 2019 to 2020.

However, as schools started to shift back to in-person learning and fewer new students enrolled in university, the growth began to flatten just as the stock market entered bear market territory. This period was vicious to even growth stocks that could maintain their growth trajectory, unlike Chegg.

A growth stock with no growth is poison to stock prices. Investors expected the growth story to continue forever and dumped the stock indiscriminately when it didn't.

This leads us to where Chegg finds itself: down about 85% from 2021 highs with no near-term catalysts to give investors hope for a return to their glory days during the pandemic. On top of that, Chegg was dealt a gut punch recently when they issued weak forward guidance for 2023. Impossibly high bull market expectations leave Chegg a forgotten "busted growth story" as things stand today.

Enter a technological disruptor, and the picture has the potential to sour even further.

How ChatGPT and AI Threaten Chegg

Chegg suffers because its target market is college students, who, by and large, have very little disposable income. When Chegg is the only "homework helper" in town, it's easy to justify paying $20 per month to save hours on homework while improving your grades.

But students are increasingly turning to ChatGPT for help. The chatbot can critique essays, debug coding homework, or even be a study buddy, all free.

With such powerful technology freely available at students' fingertips, Chegg can seem limited in comparison. After all, it can't help students with questions not in its database as ChatGPT can, nor respond to open-ended inquiries.

With this in mind, some are accusing the company of failing to adapt to what is the next forefront of edtech, generative AI. The company's most recent AI-related acquisition was 2018's WriteLab, a grammar and sentence structure assistant.

Furthermore, some accused Chegg CEO Dan Rosensweig of downplaying the risks AI poses to the business. On Chegg's most recent earnings conference call, he was asked about the potential impacts of the chatbot's adoption by students and said, "obviously, we're going to track it, but we've seen nothing. We've seen continued really powerful renewals and reduction in cancellations, we've seen continued high take rates of Chegg Study Pack."

The Counter Point

Chatbots are highly imperfect. Even the lauded ChatGPT confidently gives incorrect answers to simple, straightforward questions regularly, expected behavior of AI known as "hallucinations." While the model seems very smart, it doesn't actually know anything the way a human does, and instead, to crudely describe AI models, collects lots of information and uses it to connect complex patterns.

Furthermore, ChatGPT struggles with more complex questions in physics or engineering.

Physics YouTuber "Physics Explained" recently posted "Physics Solution: ChatGPT vs. Chegg vs. Me," in which he solved a Chegg physics question himself and then asked ChatGPT to answer the same. ChatGPT responded to the question and even showed its work, but it was incorrect.

One of Chegg's saving graces is its heavy human approach. The service has a system for voting on the accuracy of solutions, giving students confidence that they're using the correct answer. On the other hand, it's challenging to verify ChatGPT's accuracy, making it possible for any solution students get from the chatbot to be another hallucination.

When students turn in graded work, the stakes are high, and they might not want to risk a potentially unverifiable AI hallucination.

Bottom Line

Despite the hype around AI and chatbots, Chegg is far from dead. While students might experiment with chatbots when Chegg can't do the trick, Chegg's database of verified-correct answers is hard to beat, shiny bells and all.

Still, there's no denying that AI will continue to advance and eventually rule companies like Chegg, who essentially charge for access to a database, obsolete. There are already significant questions about Chegg's growth story, and this angle casts doubt on the long-term picture.

Chegg is at a crossroads, and much of its survival in a post-AI world hinges on its ability to adapt to the new technological landscape.