Enovix: A Rising Power in the Lithium-Ion Industry Impressive growth, turnaround in share price, strategic expansion, and a bullish outlook amongst analysts make ENVX a promising investment.

By Ryan Hasson

This story originally appeared on MarketBeat

Shares of the lithium-ion manufacturer, Enovix (NASDAQ: ENVX) have been on an impressive run recently, with the stock up close to 30% over the previous three months and up 13.5% YTD. Since making fresh lows at the beginning of the year, the stock has staged an impressive turnaround, up over 100% since the January low of $6.49. With a remarkable recovery, return to shareholders, and favorable technical setup, should ENVX be on your shopping list going forward?

Enovix is a leading manufacturer of advanced lithium-ion batteries in several applications, including vehicles, consumer electronics, and grid storage. Enovix's innovative battery design offers higher energy density, improved safety, and a longer life cycle than traditional lithium-ion batteries. The company's website says, "Enovix is on a mission to power the technologies of the future. Everything from IoT, mobile and computing devices, to the vehicle you drive, needs a batter." And Enovix plans on being the manufacturer of those batteries.

Enovix Expands Asia Presence

The company has been strategically increasing its presence in Asia to expand its reach and market share and position itself to support the demand of the global consumer electronics market.

Recently, Enovix announced agreements with Japanese distribution and manufacturing services company Elematec Corporation, and South Korean power management and IoT-focused distributor, Semicomtech. The deals support pan-Asian shipping, distribution, and market expansion.

Institutional Ownership of Enovix

Current institutional ownership in ENVX is 55.62% and has remained relatively unchanged over the previous twelve months, with a net inflow of $32 million.

In the first quarter, the stock experienced large inflows relative to the outflows. Institutional inflows for the first quarter were $108 million compared to just $17 million in outflows. With a 4.37% ownership in the company, BlackRock Inc is the largest institutional shareholder.

Insider transactions in Enovix

ENVX insiders purchased $1.82 million worth of stock in the first quarter of the year, compared to just $38,000 sold in the same period. Notably, the company director Thurman J Rodgers purchased 169,590 shares of ENVX in March. The company CEO Rajendra K Talluri purchased 5000 shares in March and made another purchase of 5000 shares in April.

What do analysts think about Enovix?

Analysts are bullish on the name. Enovix currently has a Buy rating based on twelve analyst ratings. The consensus price target of $31.08 predicts a possible 121% upside in the stock. All twelve analysts covering the name have a Buy rating.

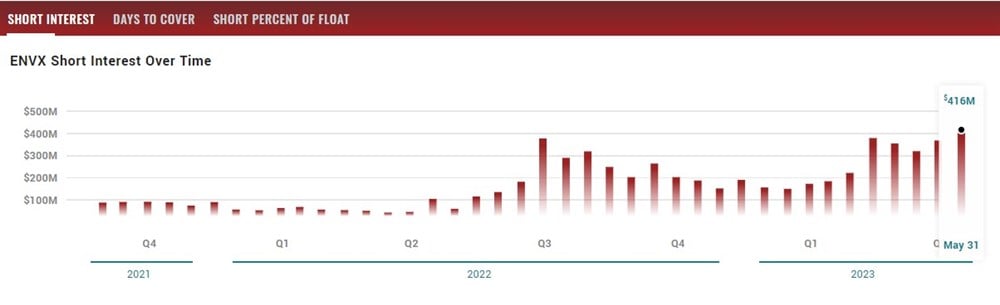

The Short Interest in ENVX

As of the end of May, the dollar volume sold short in ENVX is $415 million. The short interest is just over 26%, which is unusually high.

The stock's current dollar volume sold short has just reached a new record as short interest grows and the share price appreciates. This might be music to bulls' ears, as a further increase in share price and the potential for Enovix to release positive updates might spur a short squeeze.

However, investors will be less concerned with the stock appreciating via a short squeeze and more interested in continued growth and fundamental success.

Favorable Technical Setup

From a technical perspective, ENVX has set up favorably on the chart. The stock is consolidating in an ascending triangle near the year's high, $15.47, and critical resistance around $15. Suppose the stock can continue to base high and find price stability over the resistance of $15. In that case, momentum continuation to the upside is likely, with $16 being the next key level.