How to Profit Picking the Worst Stocks… Stock markets suffered through a rough year in 2022. Major indices like the S&P 500 (SPY) and NASDAQ 100 were down double digits across the board. Yet this simple strategy...

By Tim Biggam

This story originally appeared on StockNews

Stock markets suffered through a rough year in 2022. Major indices like the S&P 500 (SPY) and NASDAQ 100 were down double digits across the board. Yet this simple strategy showed a solid double-digit gain by taking profitable positions in both good AND bad stocks. This type of balanced approach will likely continue to outperform in what looks like to be a tough 2023. Read on below to find out more.

2022 is shaping up to end as one of the worst years for stocks in quite a while. Currently the S&P 500 is down about 15% so far this year. The NASDAQ has suffered a worse fate while the Dow Jones Industrial Average has fared a little better.

Regardless, stocks are generally down across the board.

What happens in 2023 is anyone's guess. The recent rise in interest rates along with slowing earnings growth will likely be a headwind for equity prices, especially in the first part of next year.

The average annual return for stocks (S&P 500) over the past 150 years is roughly 9%, including dividends. Without dividends it drops to just over 4.5%. Inflation shaves about half off those returns.

A return back towards more historic returns may look pretty good in the coming 12 months. Stock selection will be critical to performing well in 2023, rather than just buying any stock -which was seemingly the way to easy gains up until 2022.

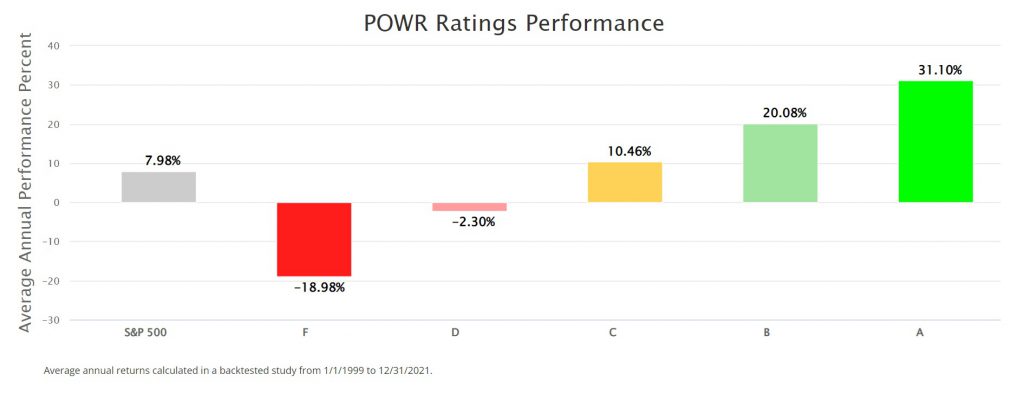

The POWR Ratings can certainly provide investors and traders with a clear edge when selecting stocks. Over the past 20 plus years, the A rated Strong Buys names in the POWR Ratings have outperformed the S&P 500 by over 23% annually.

While this level of outperformance is truly eye-opening, selling the F rated Strong Sell names would have beaten the overall market by an even greater degree.

These lowest rated stocks actually fell almost 19% per year while the S&P 500 gained nearly 8% annually. This equates to an underperformance of roughly 27%! This means the bad stocks fell a little bit worse than the good stocks rose in comparison to the S&P 500.

Many investors and traders are not comfortable shorting stocks. Unlimited potential loss increases the fear factor even more. Luckily, the options market provides a defined risk solution to profit from a pullback in stocks. Puts.

Owning a put option gives you the ability to sell a stock at a specific price before a certain time. The put buyer pays money upfront - called the option premium.

For instance, buying the Apple March $125 put at $5.20 gives the buyer the right to sell AAPL stock at $125 until expiration on 3/17/2023 (the third Friday in March).

The price of these bearish put options will increase as the stock goes down and decrease if the stock rises. The most at risk is $520 ($5.20 premium x 100)

Buying put options is a simple, but very effective way, to take a bearish stance on bad stocks.

It is a strategy we use successfully day in and day out in the POWR Options Portfolio to take a more balanced approach by combining bearish puts with bullish calls. It worked very well in 2022 and will certainly be part of our trading toolbox in 2023.

A recent example of using the power of the POWR ratings for bearish put plays may help shed some light on things. Below is a recent trade done in the POWR Options Portfolio on Lithium Americas (LAC) stock.

LAC was an F rated -Strong Sell – stock in an F rated industry. Ranked almost at the bottom in the industry group as well, so pretty much the worst of the worst.

Shares, however, had rallied sharply (over 30%) off the lows near $21 in mid-October before running into serious resistance at the $29 area. The stock was getting overbought on a technical basis.

LAC also had a key reversal day, trading up to new recent highs only to reverse and close back near the lows of the day.

This set up ideally for a bearish put purchase. It also helped that implied volatility (IV) was only at the 19Th percentile-meaning option prices were well below average. The POWR Options Portfolio bought the February $30 puts for $5.00, or $500 per put option purchased.

That proved to be the top for LAC stock as it fell back 25% from the $8 area to just under $21. Shares, however, were now oversold and nearing the support area around $21. POWR Options closed out the put play at $8.50 for a gain of 70%. Trade took just about a month from start to finish.

Note how while the stock dropped 25%, the options gained almost three times that amount. Highlights the power of leverage that options have. Plus, the loss is always limited at maximum to the total premium paid—in this case $500.

This marked the third consecutive time that POWR Options was able to realize a gain on LAC puts based on a loss in LAC stock price.

The ability to say nimble and be more neutral served the POWR Options Portfolio well in 2022. Our trading showed solid gains over the past 12 months versus deep losses for stocks in that same time frame.

Using the POWR ratings to help us select the best of the best stocks to be bullish on with call buys, along with the worst of the worst stocks to be bearish on with put purchases, will likely continue to prove profitable in 2023.

What To Do Next?

While the concepts behind options trading and put buying are simpler than most people realize, applying those concepts at the right time to consistently make winning trades is no easy task.

The solution is to let me do the hard work for you…by starting a no-obligation 30 day trial to my POWR Options newsletter.

With the quantitative muscle of the POWR Ratings as my starting point, I've uncovered some of the best options trades in the tough markets we've experienced this year.

That's because I take advantage of both call and put options trades to generate big gains in ALL market conditions.

In fact, since launching the service in November 2021 I have delivered a market beating +65.44% return for my subscribers.

The good news is that you can become a subscriber today for just $1.

During your $1 trial you'll get full access to the current portfolio, my weekly market insights and every trade alert by text & email.

Plus, I'll be adding the next 2 exciting options trades when the market opens this Tuesday morning (closed Monday for Holiday), so start your trial today so you don't miss out!

About POWR Options & $1 Trial >>

Here's to good trading!

Tim Biggam

Editor, POWR Options Newsletter

SPY shares were trading at $375.38 per share on Thursday afternoon, down $10.85 (-2.81%). Year-to-date, SPY has declined -19.68%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Tim Biggam

Tim spent 13 years as Chief Options Strategist at Man Securities in Chicago, 4 years as Lead Options Strategist at ThinkorSwim and 3 years as a Market Maker for First Options in Chicago. He makes regular appearances on Bloomberg TV and is a weekly contributor to the TD Ameritrade Network "Morning Trade Live". His overriding passion is to make the complex world of options more understandable and therefore more useful to the everyday trader. Tim is the editor of the POWR Options newsletter. Learn more about Tim's background, along with links to his most recent articles.

The post How to Profit Picking the Worst Stocks… appeared first on StockNews.com