Investor Alert: Join the Stock Rally Now Before It's Over Overthinking and procrastination rob investors of better results. That is especially true for those that don't appreciate that the S&P 500 (SPY) moves 4-6 months ahead of actual events. Simply...

This story originally appeared on StockNews

Overthinking and procrastination rob investors of better results. That is especially true for those that don't appreciate that the S&P 500 (SPY) moves 4-6 months ahead of actual events. Simply stated, the time to join the bull rally is now as waiting longer will lead to subpar results. Get the full story in the article below….

Investors see the stars lining up for the first Fed rate cut. It could come as early as the July 31st meeting...but most signs point to the next meeting on September 18th as being the true starting line.

Those investors waiting for the Fed to make that first move are missing out on tremendous gains. In fact, they may be greatly disappointed by results after the rate cut announcement.

That last part is a head scratcher for some...so that will be the focus of my article today.

Market Commentary

Investors have always been forward looking. Meaning that they are making decisions now based upon what they see happening down the road.

It is widely believed that investors act 4-6 months ahead of events. That explains why the bear market starts before the recession bell has been officially sounded. And why the next bull market begins in the midst of horrible economic conditions knowing that around the corner is the next economic expansion.

Using that backdrop we now appreciate that the bull run, especially for Risk On stocks this past week, is based on this same forward looking process. Meaning that once the pieces of the puzzle fell into place after the lower than expected CPI report on Thursday 7/11...investors were off to the races buying more aggressive stocks in anticipation of rate cuts being served up starting in September and beyond.

Those still clinging to their Magnificent 7 stocks...or even worse, buying more shares on this modest dip, are clearly not getting the memo that other investors have already moved on from these safe haven selections. Now it is time for gains to broaden out to corners of the market that previously were not getting much sun light.

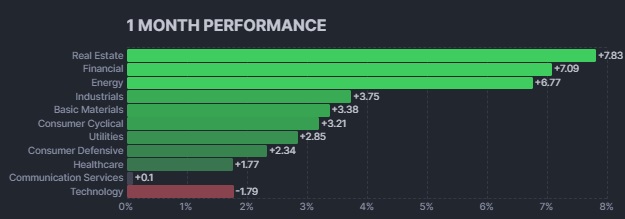

Yes, small caps for sure. But also more economically sensitive groups that were seeing underwhelming results year to date. This 1 month performance chart by sector tells you what is now leading the way:

The first 2 industries benefit the most from lower rates. Housing is obvious given the benefit of lower mortgage rates to increase demand. As for financials, lower rates equates to higher demand for loans which bolsters the bottom line.

The next 4 industries are all economically sensitive. Meaning that lower rates will lead to higher economic growth and those 4 sectors will benefit greatly from that rising tide: Energy, Industrials, Basic Materials, Consumer Cyclical.

At the bottom are the 2 groups that were leading the way in 2024...and 2023 for that matter. And that is where the Magnificent 7 stocks reside.

Don't get me wrong, most of the Magnificent 7 stocks will be fine long term investments. But at this moment they are TERRIBLY overpriced. Even another 10-20% haircut would still leave them above reasonable valuations. That is why buying the dip at this moment is too early given how much they will likely shed in the months ahead.

Back to the main point of today's commentary...those waiting for the Fed to cut rates will miss the profit train taking place now. In fact, it is very possible that the actual lowering of rates provides a "buy the rumor, sell the news" event.

This happens, once again, because investors act in anticipation of future events. Thus, when the event arrives, it often serves as the signal to take those profits off the table.

No...I am not saying that a bear market follows the first rate cut. Rather, I am saying that the Risk On investing party is taking place now and you would be wise to switch your game plan to benefit.

After the announcement, yes, I expect a modest sell off. After that I think investors will be more selective about what they want to own.

Meaning at that stage the easy money will have been made with many stocks reaching full or excess valuations. That typically ushers in a 6-12 month period of little to no gains for the main market indices. However, the cream will rise to the top. And those are the stocks you want to own.

What constitutes "cream" in that environment?

Companies that beat earnings expectations leading to rising estimates for the future. Couple that attractive growth with reasonable valuations and those will be the stocks that outperform whereas now just about any stock below the Magnificent 7 will have some time in the sun.

Long time readers know what I am going to say next. The best way to find the stocks that will outperform in that environment is by using our POWR Ratings quant system which analyzes 118 factors for each stock. Growth and Value are at the heart of that analysis.

Meaning top POWR Ratings stocks are more likely to enjoy beat and raise earnings reports. Plus trade for more reasonable valuations. That is the combo package that should lead to their future outperformance. That certainly has been the case historically as the POWR Ratings enjoys a 4 to 1 advantage over the S&P 500 (SPY) dating back to 1999.

What are my favorite POWR Ratings stocks now? Read on below for the answer...

What To Do Next?

Discover my current portfolio of 12 stocks packed to the brim with the outperforming benefits found in our exclusive POWR Ratings model. (Nearly 4X better than the S&P 500 going back to 1999)

These hand selected picks are all based on my 44 years of investing experience seeing bull markets...bear markets...and everything between.

And right now this portfolio is beating the stuffing out of the market.

If you are curious to learn more, and want to see these timely 12 trades, then please click the link below to get started now.

Steve Reitmeister's Trading Plan & Top 12 Stocks >

Wishing you a world of investment success!

Steve Reitmeister…but everyone calls me Reity (pronounced "Righty")

CEO, StockNews.com and Editor, Reitmeister Total Return

SPY shares were trading at $552.04 per share on Friday morning, down $0.62 (-0.11%). Year-to-date, SPY has gained 16.88%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Steve Reitmeister

Steve is better known to the StockNews audience as "Reity". Not only is he the CEO of the firm, but he also shares his 40 years of investment experience in the Reitmeister Total Return portfolio. Learn more about Reity's background, along with links to his most recent articles and stock picks.

The post Investor Alert: Join the Stock Rally Now Before It's Over appeared first on StockNews.com