Investor Alert: We Have NOT Hit Bottom! Bears have been in charge for 2 months and likely going to take a rest for a while. So even though we have seen some mighty bounces this week...and could...

This story originally appeared on StockNews

Bears have been in charge for 2 months and likely going to take a rest for a while. So even though we have seen some mighty bounces this week...and could see more in coming days...do not be fooled. We still have a long way to go til bottom is found. Why is that the case? How much lower will the S&P 500 (SPY) go? How to profit in the weeks ahead? Read on below for the answers.

This was a very interesting week for stocks. Several times the premarket activity pointed one way...and then the script got flipped.

All in all, we have yet another week making new lows as inflation is not fading away, which means more vigilant Fed, which means greater likelihood of recession down the road, which means more downside for stocks.

Let's recap the week that was followed by what is likely in store for investors in the weeks ahead. This comes hand in hand with updates to our trading plan to stay on the right side of the action.

Market Commentary

Stocks tested the lows again on Tuesday. This got bulls anxious to enjoy a healthy pre-market bounce on Wednesday as it seemed like a good buying opportunity.

NOT SO FAST!

Next comes the Producer Price Index (PPI) report showing inflation way to hot. In fact, it was the month over month increase that was 2X expectations that alarmed investors since it was the first monthly increase in three months.

The report showed that inflation is showing up ALL OVER THE PLACE. It is no longer just a matter of high energy prices. Inflation has become sticky in just about every category you could imagine.

Remember that PPI is the leading indicator of where the more widely followed CPI will be in the future. Meaning that inflation is "not going quietly into that good night" any time soon. And why that healthy premarket bounce immediately evaporated with yet another test of the S&P 500 (SPY) lows in store Wednesday.

A near repeat of the Wednesday action took place on Thursday. Stocks were ready for a big bounce in the premarket only for another too hot inflation report (CPI) to rain on everyone's parade. This sparked another big sell off to new lows a tick under 3,500.

From there a big rally ensued to close the day at 3,669.91. Nothing about that bounce felt like it was built from sound logic and rationality. Everything about it felt like computers looking at 3,500 as a point of support and a place to have some fun for a few hours.

Also the groups that outperformed were some of the most defensive groups. The ones you cling to during a bear market and shed at the beginning of the next bull market.

Not surprisingly investors were splashed with cold water on Friday when they tried to rally once again only to discover a very weak Retail Sales report. Yes, it increased...but less than the rate of inflation meaning that consumer spending is slowing down.

All the above points to the fact that...THIS IS NOT BOTTOM

Let's remember that the average bear market sees a 34% decline. That would equate to 3,180 this time around.

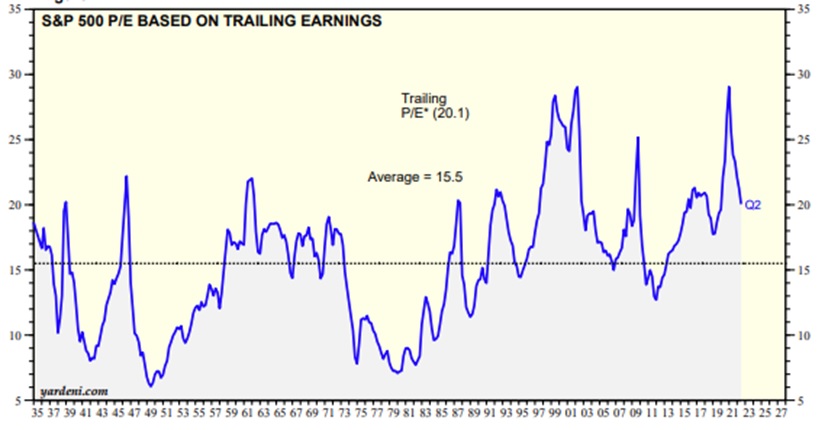

Now let's remember that the overall market valuations before this bear market began were a historic high. Yes, the overall PE for the S&P 500 (SPY) was actually a notch higher at the start of 2022 then it was at the peak of the 1999 tech bubble.

Now let's remember that one of the things to help find bottom is an accommodative Fed that is aggressively LOWERING rates to help restart the economy and restart investment. Yet right now the exact opposite is happening as the Fed has an aggressive rate hiking regime to tamp down the raging flames of inflation. (Read more about that in my recent article: Hidden Reason for Bloodier Bear Market).

Long story short, NOTHING about the Thursday bounce says the true and lasting bottom has been found. But yes, bear markets have some rip-roaring rallies along the way.

Some short...some long...but all NOT built to last.

When investors can finally appreciate the true virulence of the coming recession and approximate the full damage to the earnings outlook, then and only then can we start talking about a bottom forming.

Thus, at this stage we are still in wait and see mode to appreciate the outcome of high inflation + Hawkish Fed. That likely happens in the first half of 2023 because so far their rate hikes have not tamed inflation one damn bit. So they gotta keep pushing harder on higher rates to finally make the economy crack...thus reigning in inflation.

The outlook over the next 3-6 months is still quite bearish. However, in the short run it would not be surprising that 3,500 proves to be a point of support leading to a healthy bear market rally to unfold.

No...not the same kind of +18% "crazy train" rally we saw from mid June to mid August.

Perhaps more of a typical 5-10% rally could be in the offing as bears are getting a bit too comfortable having the upper hand for so long. Please consider using any of these ill-fated rallies to reinstate your bearish strategies.

Kind of like during a bull market we chant "buy the dip". Well during a bear market it's the opposite where we chant "fade the rally".

That will prove to be valuable advice as this bear market likely bottoms somewhere between 2,800 and 3,200. Trade accordingly.

What To Do Next?

Discover my special portfolio with 9 simple trades to help you generate gains as the market descends further into bear market territory.

This plan has been working wonders since it went into place mid August generating a +5.69% gain as the S&P 500 (SPY) tanked -16.62%.

If you have been successfully navigating the investment waters in 2022, then please feel free to ignore.

However, if the bearish argument shared above does make you curious as to what happens next...then do consider getting my updated "Bear Market Game Plan" that includes specifics on the 9 unique positions in my timely and profitable portfolio.

Wishing you a world of investment success!

Steve Reitmeister…but everyone calls me Reity (pronounced "Righty")

CEO, Stock News Network and Editor, Reitmeister Total Return

SPY shares fell $0.21 (-0.06%) in after-hours trading Friday. Year-to-date, SPY has declined -23.83%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Steve Reitmeister

Steve is better known to the StockNews audience as "Reity". Not only is he the CEO of the firm, but he also shares his 40 years of investment experience in the Reitmeister Total Return portfolio. Learn more about Reity's background, along with links to his most recent articles and stock picks.

The post Investor Alert: We Have NOT Hit Bottom! appeared first on StockNews.com