Is There a Red Light for the Stock Market?

The S&P 500 (SPY) is up over 20% this year and all seems right with the world. However, you should be aware of one major red light for the market…

This story originally appeared on StockNews

The S&P 500 (SPY) is up over 20% this year and all seems right with the world. However, you should be aware of one major red light for the market that may prevent further gains. Steve Reitmeister spells it out in his latest commentary below.

Most of what lies before us as stock investors are green lights to race ahead.

However…and it’s a big HOWEVER, there is one flashing red light that we need to appreciate in order to invest more successfully in the months ahead.

We will talk about that red light in detail leading to an investment plan that should help us handily top the market going forward.

Market Outlook

Let’s start by reviewing the bright green lights for investors at this time:

- Just a few weeks shy of 24 months into new bull market that started October 2022. History shows the average bull market to last 63 months so good reason to believe there is plenty of time left on the clock.

- “Don’t Fight the Fed” This is the famed investor battle cry when the Fed is lowering rates because it is a catalyst for future economic growth that begets higher corporate earnings…and most importantly…higher share prices. This party officially got started at the September 18th Fed meeting as they announced the first cut of 50 basis points with expectations for another 150 basis point worth of cuts by the end of 2025. Hard not to be bullish with the Fed finally on our side.

- Typically, the Fed is cutting rates to bolster a flagging economy…often in the midst of a recession. Amazingly GDP is growing at a healthy pace with the GDPNow model from the Atlanta Fed pointing to above trend +2.9% growth in Q3. Or to put it another way, there is no recession in sight and little reason to fear meaningful stock downside besides the occasional pullback or correction that happens quite often during a long term bull market cycle.

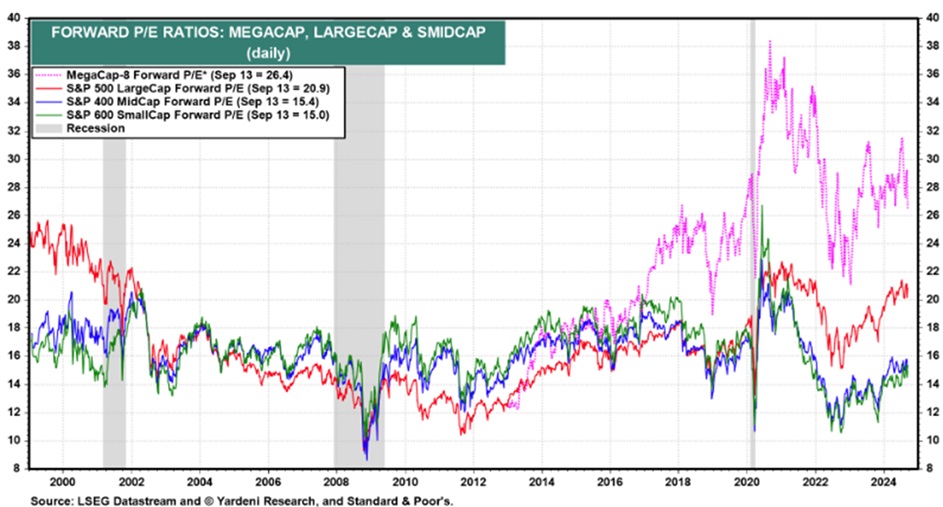

No doubt you are finding it hard to be worried about your stock investments with the above green lights in place. So that is why I now need to share the most important red light at this time. That being the current valuation of stocks based upon market cap in the chart below:

The valuation of mega caps (pink line) is MORBIDLY OBESE compared to historical norms. No…its not quite 1999 internet bubble valuations…but it is a level of valuation that should not hold up and would fully expect those stocks (like the Magnificent 7) to underperform going forward to get their valuations down to size.

Large caps as a whole (red line) are what I would call fully valued at this stage. The key ingredient to move substantially higher would be for earnings growth to rev up after 2 lackluster years. Gladly Wall Street analysts do see that happening later in 2025 as the benefits of lower rates takes hold. So, at best this group of larger stocks will see modest returns in the year ahead. But breakeven wouldn’t surprise me either.

This leads us to a focus on small (green line) and mid caps (blue line) as the place to find value and future outperformance. Going back 100 years these stocks have a firm lead over their large cap peers in terms of annual gains. But that has not been the case for the better part of the last 4 years.

In September you could see the tide turning as the surety of rate cuts were on the way, investors made a massive rotation to smaller stocks which have outperformed this month. This Risk On shift is logical and should continue given the much better value proposition.

I will go on record now saying that I don’t think the S&P 500 (SPY) makes it much higher than 6,000 in 2025. In fact, we may touch that level before we close out 2024 with the benefit of the typical post election rally followed by a touch of Santa Claus rally.

This means that 2025 is likely a flat year for large caps. So those who want outperformance should concentrate in small and mid cap stocks with the right blend of earnings growth and attractive valuation.

Gladly that job is made all the easier for you by concentrating on the top picks from our POWR Ratings model where we explore 13 measures of Growth as well as 31 measures of Value.

Going back to 1999 the POWR Ratings model has narrowed in on these best in class stocks leading to an average annual return of +28.56% since 1999.

Some of my personal favorites are shared in the next section. Read on for more…

What To Do Next?

Discover my current portfolio of 11 stocks packed to the brim with the outperforming benefits found in our exclusive POWR Ratings model. (Nearly 4X better than the S&P 500 going back to 1999).

All of these hand selected picks are all based on my 44 years of investing experience seeing bull markets…bear markets…and everything between.

And right now this portfolio is beating the stuffing out of the market.

If you are curious to learn more, and want to see my 11 timely stock recommendations, then please click the link below to get started now.

Steve Reitmeister’s Trading Plan & Top 11 Stocks >

Wishing you a world of investment success!

Steve Reitmeister…but everyone calls me Reity (pronounced “Righty”)

CEO, StockNews.com and Editor, Reitmeister Total Return

SPY shares rose $0.38 (+0.07%) in premarket trading Friday. Year-to-date, SPY has gained 21.54%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Steve Reitmeister

Steve is better known to the StockNews audience as “Reity”. Not only is he the CEO of the firm, but he also shares his 40 years of investment experience in the Reitmeister Total Return portfolio. Learn more about Reity’s background, along with links to his most recent articles and stock picks.

The post Is There a Red Light for the Stock Market? appeared first on StockNews.com

The S&P 500 (SPY) is up over 20% this year and all seems right with the world. However, you should be aware of one major red light for the market that may prevent further gains. Steve Reitmeister spells it out in his latest commentary below.

Most of what lies before us as stock investors are green lights to race ahead.

However…and it’s a big HOWEVER, there is one flashing red light that we need to appreciate in order to invest more successfully in the months ahead.