Peak Inflation Sets the Bottom for Brinker International Stock

Casual restaurant brand operator Brinker International (NYSE: BRK) stock is down (-31%) on the year. Brinker operates two popular casual restaurant brands

This story originally appeared on MarketBeat

Casual restaurant brand operator Brinker International (NYSE: BRK) stock is down (-31%) on the year. Brinker operates two popular casual restaurant brands Chili’s and Maggiano’s. Chili’s Bar & Grill is a casual diner with popular happy hour drink and appetizer specials. Maggiano’s Little Italy is a casual Italian restaurant chain known for its paper tablecloths complete with crayons that can be doodled on underscoring its family atmosphere. Inflationary pressures has caused consumers to tighten up their wallets, but surprisingly dining trends are still supporting growth in the recession. This can also be seen among its competitors like Darden Restaurants (NYSE: DRI) operator of brands like Olive Garden, Longhorn Steakhouse, Seasons 52, Capital Grille, Bahama, and Eddie V’s Prime Seafood restaurants.

Consumers Are Still Eating Out

Soaring food and freight costs are being passed onto customers, who normally rein in their dining out options during recessions but strangely haven’t yet done do. While sales are still keeping up, operating margins are getting hit significantly from rising commodity costs and operating expenses. This can be seen in the Company’s forward guidance for fiscal full-year 2023. This could be low balling if inflation actually starts to peak and drop as a result of the Fed’s interest rate hikes. With shares trading at just 10X forward earnings, Brinker can be considered a go to play when the CPI starts to fall.

Margins Getting Squeezed by Inflation

On Aug. 24, 2022, Brinker released its fourth-quarter fiscal 2022 results for the quarter ending June 2022. The Company reported a non-GAAP diluted earnings-per-share (EPS) of $1.15 versus $1.17 consensus analyst estimates, missing by (-$0.02). Revenues grew 1.3% year-over-year (YoY) to $1.02 billion, beating consensus analyst expectations for $1.2 billion. Comparable restaurant sales rose 3.1% in the quarter comprised of 0.03% at Chilli’s and 30.1% at Maggiano’s. Operating income fell to 4.4% from 10% year ago. Restaurant operating margin fell to 10.3% from 16.9% a year ago.

Sales Flat but Profits Slashed

While top line is not expected to fall too much, the real pain stems from the shrinking operating margins and profits. For the upcoming fiscal full-year 2023, Brink expects deeper pain with EPS falling to $2.45 to $2.85 versus $3.65 analyst expectations. Revenues are expected to come in between $3.9 billion to $4 billion.

Here’s What the Charts Say

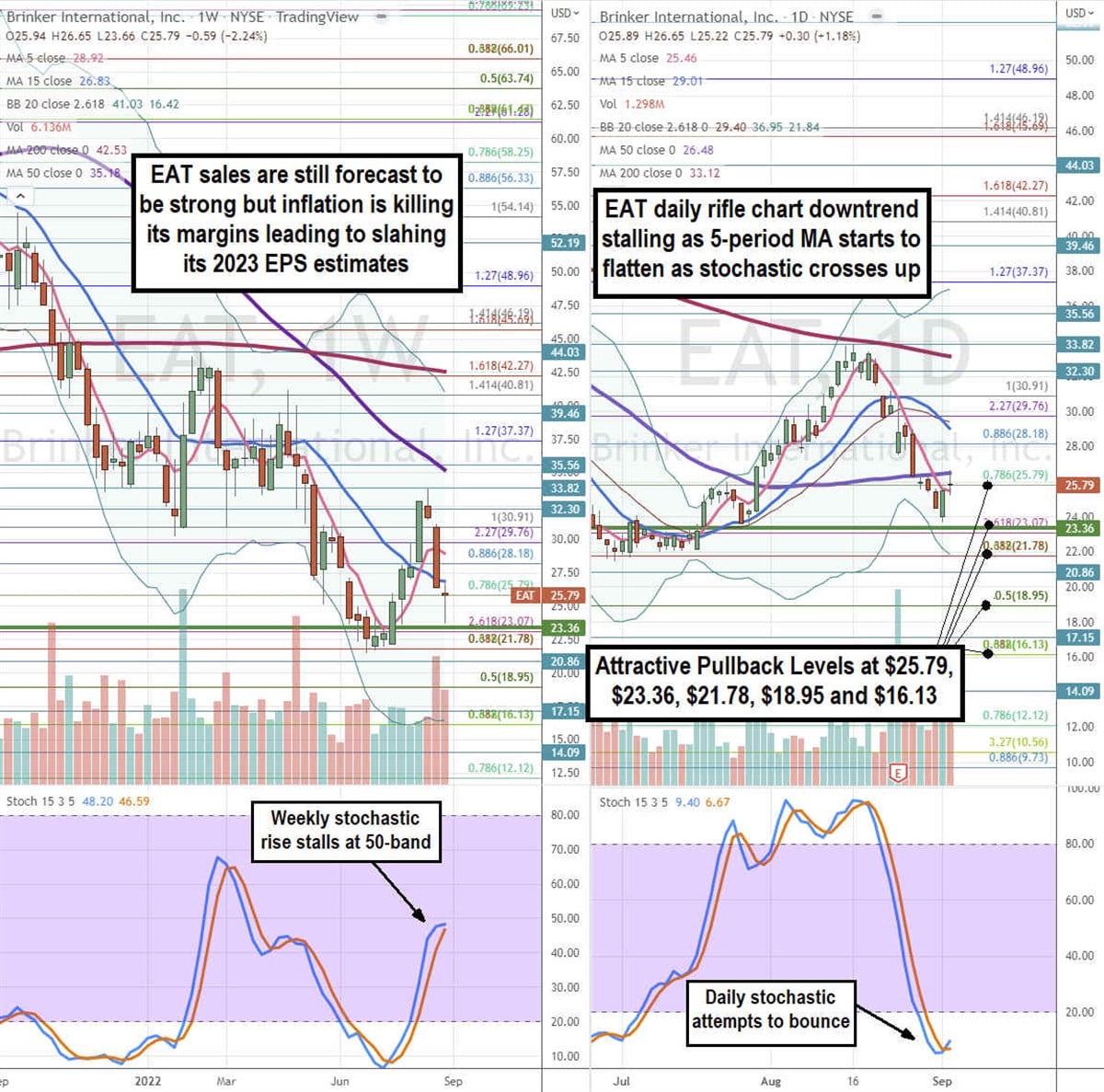

Using the rifle charts on the weekly and daily time frames provides a precision view of the landscape for EAT stock. The weekly rifle chart downtrend looks to have found support at the $21.78 Fibonacci (fib) level. Shares managed to stage a rally on the weekly market structure low (MSL) breakout triggered above $23.36. The weekly 5-period moving average (MA) support flattened at $28.92 followed by the 15-period MA at $26.83. The weekly 50-period MA resistance is falling at $35.18. The weekly stochastic is stalling at the 50-band as momentum slows on the sharp recent price drop. The daily rifle chartdowntrend is attempting to reverse as the daily 5-period MA flattens its descent at $25.46 just below the daily 50-period MA at $26.48 and falling 15-period MA at $29.01. The daily stochastic is bouncing at the 10-band after a full oscillation move down. The daily lower BBs are falling near the $21.78 fib level. Attractive pullback price levels sit at the $25.79 fib, $23.35 weekly MSL trigger, $21.78 fib, $18.95 fib, and the $16.13 fib level.

New CEO Comments

Newly installed Brinker CEO and President Kevin Hochman commented, “During my first sixty days I’ve spent considerable time in restaurants with our operators, exchanging ideas on how to make our operations more efficient, improve the guest experience, and grow the core business. We’re making quick interventions to better offset the tough inflationary headwinds and build sales momentum in the near term, as we work to meaningfully improve our four-wall economics and better position our business for long term sustainable and profitable growth.” Their evolved pricing strategy includes providing everyday value for guests and moving away from deep discounting with a focus on recovering expenses from inflated commodities prices. Maggiano’s is showing good trajectory as the brand emerged stronger after the pandemic. Chilli’s is the main focus in reducing friction, eliminating time consuming processes that don’t add value to its customer’s experiences.

Casual restaurant brand operator Brinker International (NYSE: BRK) stock is down (-31%) on the year. Brinker operates two popular casual restaurant brands Chili’s and Maggiano’s. Chili’s Bar & Grill is a casual diner with popular happy hour drink and appetizer specials. Maggiano’s Little Italy is a casual Italian restaurant chain known for its paper tablecloths complete with crayons that can be doodled on underscoring its family atmosphere. Inflationary pressures has caused consumers to tighten up their wallets, but surprisingly dining trends are still supporting growth in the recession. This can also be seen among its competitors like Darden Restaurants (NYSE: DRI) operator of brands like Olive Garden, Longhorn Steakhouse, Seasons 52, Capital Grille, Bahama, and Eddie V’s Prime Seafood restaurants.

Consumers Are Still Eating Out

Soaring food and freight costs are being passed onto customers, who normally rein in their dining out options during recessions but strangely haven’t yet done do. While sales are still keeping up, operating margins are getting hit significantly from rising commodity costs and operating expenses. This can be seen in the Company’s forward guidance for fiscal full-year 2023. This could be low balling if inflation actually starts to peak and drop as a result of the Fed’s interest rate hikes. With shares trading at just 10X forward earnings, Brinker can be considered a go to play when the CPI starts to fall.

Margins Getting Squeezed by Inflation

On Aug. 24, 2022, Brinker released its fourth-quarter fiscal 2022 results for the quarter ending June 2022. The Company reported a non-GAAP diluted earnings-per-share (EPS) of $1.15 versus $1.17 consensus analyst estimates, missing by (-$0.02). Revenues grew 1.3% year-over-year (YoY) to $1.02 billion, beating consensus analyst expectations for $1.2 billion. Comparable restaurant sales rose 3.1% in the quarter comprised of 0.03% at Chilli’s and 30.1% at Maggiano’s. Operating income fell to 4.4% from 10% year ago. Restaurant operating margin fell to 10.3% from 16.9% a year ago.