The Uptrend in Netflix Will Continue: Another 15% Upside Ahead Netflix's rally will continue because the company is growing and outpacing estimates, improving business quality, driving robust cash flow, and buying shares.

This story originally appeared on MarketBeat

Netflix's (NASDAQ: NFLX) uptrend will continue because the company is still growing and outpacing forecasts. In 2024 and 2025, the company's growth will be driven by the increasing user base and rising engagement, and in 2026, ad sales will drive it.

The critical takeaway from the report is that business quality is also improving, driving a sustainable increase in cash flow, margin, profits, and free cash flow available to investors. That means the tailwind of share repurchases significantly reduces the share count and will continue to blow. Based on the growth outlook, the technical targets, and analysts' sentiment, Netflix stock could easily gain another 15% by the end of the year and extend the rally to even higher highs in 2025.

Netflix Outperforms in Q3, Raises Estimate For Full-Year Earnings

Netflix's Q3 was strong and provided additional catalysts for the market. The 9.825 billion in net revenue is up 15% compared to last year, outpacing the consensus reported by MarketBeat.com by 65 basis points. The strength was driven by a 14.4% increase in global paid memberships, an acceleration from the previous year's 10% driven by password lockdown, tiered and ad-supported memberships.

The ad business is growing, driving a significant 50% of sign-ups in ad-supported territories. To attract advertisers, it is approaching what the company described as the "critical ad subscriber scale." Ads aren't expected to be a significant revenue driver in F2025 but should fuel growth in 2026.

Margin is another area of strength for this consumer tech company. The only bad news is that the 700 basis points improvement in operating margin is slightly below the consensus forecasts, leaving the top line at $5.40, only 20 basis points above target compared to the slightly more substantial top-line showing. The bottom line is that $5.40 in EPS is up 15% compared to last year, sufficient to lead management to raise guidance for the year.

Guidance is solid. The company expects another 15% in revenue growth, the high end of the previously announced range, with a wider-than-forecasted margin. The margin for the year is now forecasted at 27%, up 100 basis points, which is sufficient to improve the company's financial outlook. Netflix is a cash-burning machine because of its content slate, but it can improve its balance sheet and repurchase shares because of its cash flow strength. The Q3 repurchases reduced the count by 2.7% on average in Q3 and are expected to continue at a robust pace in Q4 and F2025 because of the $3.1 billion remaining authorization and cash flow outlook.

Analysts Forecast Another 15% Upside for Netflix: Possibly More

The analyst response to Netflix's results is overwhelmingly positive, with over a dozen revisions issued within the first 24 hours of the release. All include higher price targets, with 15 of 18 or nearly 85% above the consensus. The consensus target implies a slight decline in share price from $742, but it has been up 65% in the last 12 months, including a 5% overnight gain due to the revisions. The fresh revisions put the stock above $800 with a high end of $925, a range of 7.5% to 25% that may be reached before the year's end.

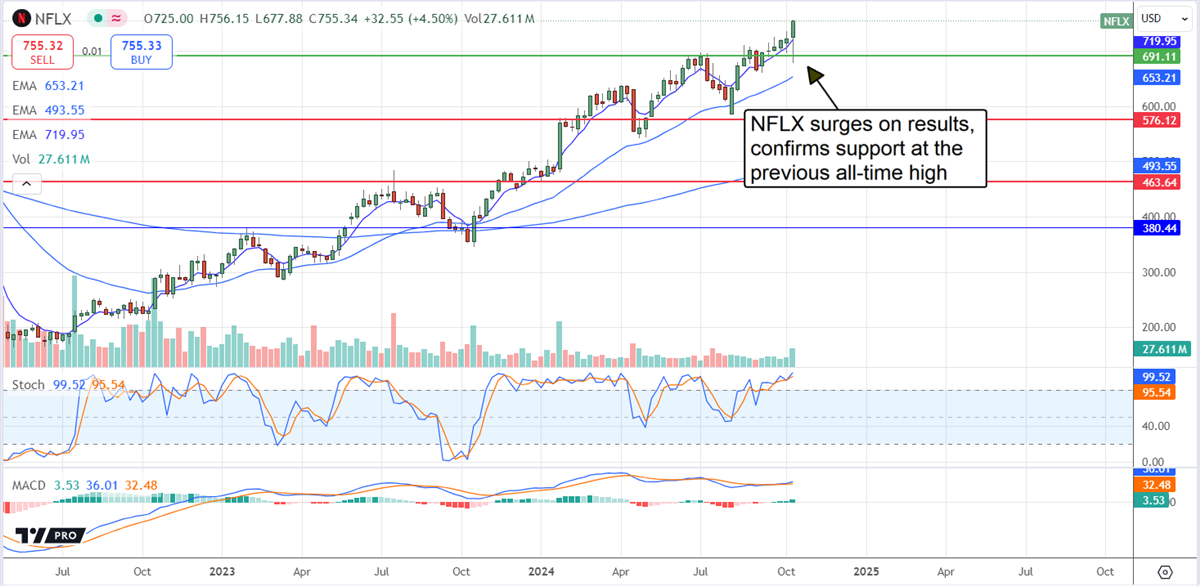

Netflix's price action surged nearly 10% following the earnings report, which set a new all-time high. The move confirms support at critical levels, including the 30-day moving average and the previous all-time high. The move suggests the uptrend will continue and brings a target of $825 into play. That target is derived from the magnitude of the summer price pullback projected to the critical resistance point, which is now confirmed as support.